Wilmington Savings Fund Society FSB boosted its stake in Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 193.4% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 1,810 shares of the biopharmaceutical company's stock after buying an additional 1,193 shares during the period. Wilmington Savings Fund Society FSB's holdings in Regeneron Pharmaceuticals were worth $1,903,000 at the end of the most recent reporting period.

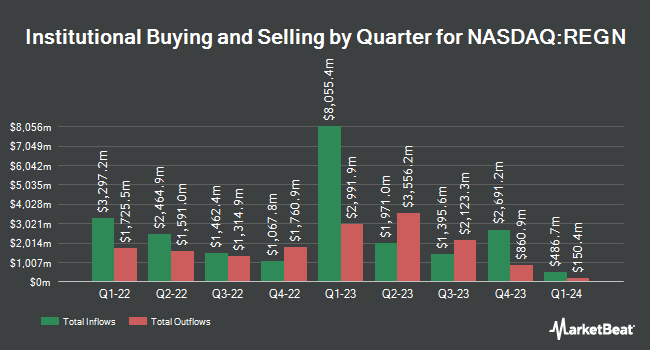

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Envestnet Portfolio Solutions Inc. increased its stake in shares of Regeneron Pharmaceuticals by 6.5% in the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 1,692 shares of the biopharmaceutical company's stock worth $1,778,000 after acquiring an additional 104 shares in the last quarter. Blue Trust Inc. increased its stake in shares of Regeneron Pharmaceuticals by 316.2% during the second quarter. Blue Trust Inc. now owns 283 shares of the biopharmaceutical company's stock valued at $272,000 after purchasing an additional 215 shares in the last quarter. Hoylecohen LLC purchased a new position in shares of Regeneron Pharmaceuticals during the second quarter valued at approximately $222,000. OFI Invest Asset Management boosted its position in shares of Regeneron Pharmaceuticals by 2.2% in the 2nd quarter. OFI Invest Asset Management now owns 1,226 shares of the biopharmaceutical company's stock worth $1,202,000 after purchasing an additional 26 shares in the last quarter. Finally, Raymond James & Associates grew its stake in shares of Regeneron Pharmaceuticals by 4.0% in the 2nd quarter. Raymond James & Associates now owns 74,228 shares of the biopharmaceutical company's stock worth $78,016,000 after buying an additional 2,887 shares during the last quarter. Hedge funds and other institutional investors own 83.31% of the company's stock.

Regeneron Pharmaceuticals Stock Performance

REGN stock traded down $9.67 during midday trading on Friday, reaching $731.30. 696,989 shares of the company's stock traded hands, compared to its average volume of 556,147. The company has a current ratio of 5.28, a quick ratio of 4.46 and a debt-to-equity ratio of 0.09. Regeneron Pharmaceuticals, Inc. has a 52-week low of $728.68 and a 52-week high of $1,211.20. The stock has a market cap of $80.36 billion, a P/E ratio of 18.10, a PEG ratio of 2.32 and a beta of 0.08. The stock's 50-day moving average is $849.77 and its 200 day moving average is $1,003.80.

Wall Street Analyst Weigh In

A number of research analysts have issued reports on the company. Wells Fargo & Company lowered their price objective on Regeneron Pharmaceuticals from $1,200.00 to $1,050.00 and set an "overweight" rating for the company in a research note on Tuesday, October 22nd. Cantor Fitzgerald reaffirmed a "neutral" rating and issued a $1,015.00 price target on shares of Regeneron Pharmaceuticals in a research report on Wednesday, October 23rd. Wolfe Research started coverage on shares of Regeneron Pharmaceuticals in a research report on Friday, November 15th. They set an "outperform" rating and a $1,150.00 price objective on the stock. Truist Financial reduced their price objective on shares of Regeneron Pharmaceuticals from $1,137.00 to $1,126.00 and set a "buy" rating for the company in a research note on Friday, November 1st. Finally, Morgan Stanley dropped their target price on shares of Regeneron Pharmaceuticals from $1,235.00 to $1,184.00 and set an "overweight" rating on the stock in a research note on Friday, November 1st. One research analyst has rated the stock with a sell rating, four have issued a hold rating, seventeen have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $1,099.90.

Read Our Latest Research Report on Regeneron Pharmaceuticals

Regeneron Pharmaceuticals Profile

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

Featured Articles

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.