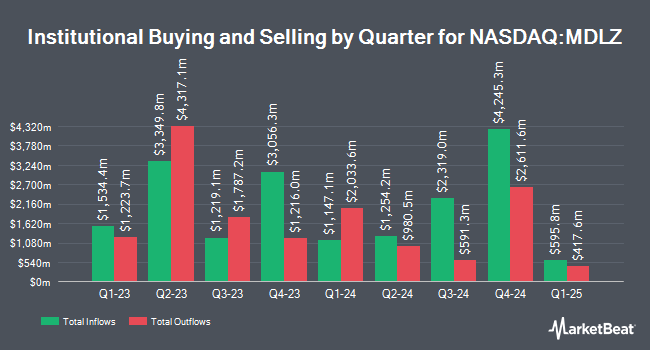

Wilmington Savings Fund Society FSB grew its stake in shares of Mondelez International, Inc. (NASDAQ:MDLZ - Free Report) by 489.1% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 104,764 shares of the company's stock after buying an additional 86,981 shares during the period. Wilmington Savings Fund Society FSB's holdings in Mondelez International were worth $7,718,000 at the end of the most recent reporting period.

Several other institutional investors also recently modified their holdings of the stock. Arvest Bank Trust Division purchased a new stake in Mondelez International in the third quarter worth approximately $14,578,000. Sanctuary Advisors LLC boosted its stake in Mondelez International by 18.5% in the third quarter. Sanctuary Advisors LLC now owns 319,819 shares of the company's stock worth $23,561,000 after buying an additional 49,871 shares in the last quarter. Pine Valley Investments Ltd Liability Co boosted its stake in Mondelez International by 13.6% in the third quarter. Pine Valley Investments Ltd Liability Co now owns 14,088 shares of the company's stock worth $1,042,000 after buying an additional 1,686 shares in the last quarter. Diamant Asset Management Inc. boosted its stake in shares of Mondelez International by 27.6% during the third quarter. Diamant Asset Management Inc. now owns 3,978 shares of the company's stock valued at $293,000 after purchasing an additional 860 shares during the period. Finally, Unigestion Holding SA boosted its stake in shares of Mondelez International by 2,625.2% during the third quarter. Unigestion Holding SA now owns 102,112 shares of the company's stock valued at $7,523,000 after purchasing an additional 98,365 shares during the period. 78.32% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of research firms have recently weighed in on MDLZ. Stifel Nicolaus increased their price objective on Mondelez International from $75.00 to $82.00 and gave the company a "buy" rating in a research note on Friday, October 25th. Piper Sandler raised their price target on Mondelez International from $74.00 to $84.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 30th. Bank of America raised their price target on Mondelez International from $80.00 to $84.00 and gave the stock a "buy" rating in a research note on Tuesday, October 15th. Deutsche Bank Aktiengesellschaft lowered Mondelez International from a "buy" rating to a "hold" rating and dropped their price target for the stock from $78.00 to $67.00 in a research note on Thursday. Finally, Evercore ISI raised their price target on Mondelez International from $79.00 to $85.00 and gave the stock an "outperform" rating in a research note on Thursday, September 26th. Two research analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the stock. According to MarketBeat.com, Mondelez International currently has a consensus rating of "Moderate Buy" and an average target price of $79.07.

Check Out Our Latest Stock Analysis on Mondelez International

Mondelez International Stock Performance

NASDAQ:MDLZ traded down $0.33 during mid-day trading on Friday, reaching $62.30. The company's stock had a trading volume of 3,316,684 shares, compared to its average volume of 6,894,590. Mondelez International, Inc. has a 12-month low of $60.33 and a 12-month high of $77.20. The firm's fifty day moving average price is $67.18 and its two-hundred day moving average price is $68.68. The company has a current ratio of 0.63, a quick ratio of 0.42 and a debt-to-equity ratio of 0.59. The stock has a market cap of $83.31 billion, a P/E ratio of 22.21, a PEG ratio of 2.85 and a beta of 0.53.

Mondelez International (NASDAQ:MDLZ - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The company reported $0.99 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.85 by $0.14. The business had revenue of $9.20 billion during the quarter, compared to the consensus estimate of $9.11 billion. Mondelez International had a return on equity of 17.53% and a net margin of 10.58%. The business's quarterly revenue was up 1.9% compared to the same quarter last year. During the same period in the previous year, the company posted $0.82 EPS. On average, equities analysts forecast that Mondelez International, Inc. will post 3.48 EPS for the current fiscal year.

Mondelez International declared that its Board of Directors has initiated a share buyback plan on Wednesday, December 11th that authorizes the company to buyback $9.00 billion in shares. This buyback authorization authorizes the company to purchase up to 10.7% of its stock through open market purchases. Stock buyback plans are often an indication that the company's management believes its stock is undervalued.

Mondelez International Company Profile

(

Free Report)

Mondelez International, Inc, through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe. It provides biscuits and baked snacks, including cookies, crackers, salted snacks, snack bars, and cakes and pastries; chocolates; and gums and candies, as well as various cheese and grocery, and powdered beverage products.

Further Reading

Before you consider Mondelez International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mondelez International wasn't on the list.

While Mondelez International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.