Wilmington Savings Fund Society FSB purchased a new position in Monolithic Power Systems, Inc. (NASDAQ:MPWR - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund purchased 25,130 shares of the semiconductor company's stock, valued at approximately $23,233,000. Wilmington Savings Fund Society FSB owned about 0.05% of Monolithic Power Systems at the end of the most recent reporting period.

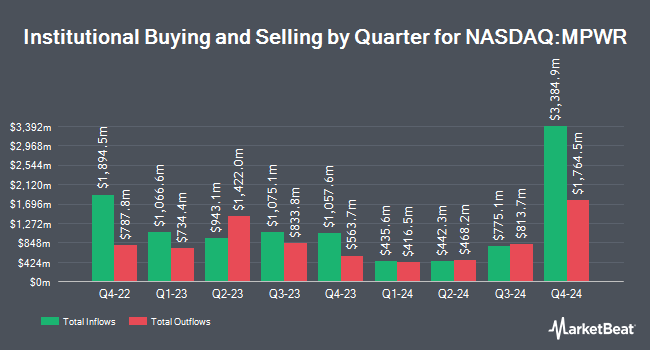

A number of other hedge funds also recently bought and sold shares of the company. Dynamic Advisor Solutions LLC lifted its stake in shares of Monolithic Power Systems by 3.8% in the second quarter. Dynamic Advisor Solutions LLC now owns 326 shares of the semiconductor company's stock worth $268,000 after buying an additional 12 shares in the last quarter. Sequoia Financial Advisors LLC lifted its position in Monolithic Power Systems by 59.5% in the 2nd quarter. Sequoia Financial Advisors LLC now owns 603 shares of the semiconductor company's stock valued at $496,000 after acquiring an additional 225 shares in the last quarter. Wealth Enhancement Advisory Services LLC boosted its stake in Monolithic Power Systems by 22.1% during the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 3,273 shares of the semiconductor company's stock valued at $2,690,000 after purchasing an additional 592 shares during the last quarter. 180 Wealth Advisors LLC bought a new stake in shares of Monolithic Power Systems in the 2nd quarter worth $248,000. Finally, Swedbank AB raised its stake in shares of Monolithic Power Systems by 39.2% in the second quarter. Swedbank AB now owns 6,961 shares of the semiconductor company's stock worth $5,720,000 after purchasing an additional 1,961 shares during the last quarter. Institutional investors own 93.46% of the company's stock.

Monolithic Power Systems Stock Performance

Shares of MPWR stock traded down $18.37 during mid-day trading on Thursday, reaching $605.45. 862,063 shares of the company's stock traded hands, compared to its average volume of 622,563. The firm has a market capitalization of $29.53 billion, a PE ratio of 68.26, a price-to-earnings-growth ratio of 2.81 and a beta of 1.05. Monolithic Power Systems, Inc. has a 12 month low of $546.71 and a 12 month high of $959.64. The firm has a 50 day moving average price of $737.10 and a two-hundred day moving average price of $807.89.

Monolithic Power Systems (NASDAQ:MPWR - Get Free Report) last released its earnings results on Wednesday, October 30th. The semiconductor company reported $2.99 earnings per share for the quarter, missing the consensus estimate of $3.04 by ($0.05). The company had revenue of $620.12 million for the quarter, compared to analysts' expectations of $600.10 million. Monolithic Power Systems had a net margin of 21.29% and a return on equity of 20.44%. As a group, equities analysts expect that Monolithic Power Systems, Inc. will post 10.46 earnings per share for the current fiscal year.

Monolithic Power Systems Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were issued a $1.25 dividend. This represents a $5.00 annualized dividend and a yield of 0.83%. The ex-dividend date was Monday, September 30th. Monolithic Power Systems's dividend payout ratio is 56.37%.

Insiders Place Their Bets

In other news, EVP Maurice Sciammas sold 11,000 shares of the company's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $929.59, for a total value of $10,225,490.00. Following the completion of the transaction, the executive vice president now owns 103,829 shares of the company's stock, valued at $96,518,400.11. This represents a 9.58 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, CFO Theodore Blegen sold 2,500 shares of Monolithic Power Systems stock in a transaction that occurred on Monday, December 9th. The shares were sold at an average price of $600.00, for a total value of $1,500,000.00. Following the sale, the chief financial officer now directly owns 53,444 shares in the company, valued at $32,066,400. This trade represents a 4.47 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 20,100 shares of company stock worth $17,153,021. Company insiders own 3.70% of the company's stock.

Analyst Ratings Changes

Several research firms recently commented on MPWR. Wells Fargo & Company assumed coverage on Monolithic Power Systems in a research report on Friday, November 22nd. They set an "equal weight" rating and a $610.00 price objective on the stock. Truist Financial reaffirmed a "buy" rating and set a $994.00 price target (up previously from $918.00) on shares of Monolithic Power Systems in a report on Wednesday, October 2nd. KeyCorp decreased their price objective on shares of Monolithic Power Systems from $1,075.00 to $700.00 and set an "overweight" rating for the company in a report on Monday, November 18th. Oppenheimer restated an "outperform" rating and issued a $900.00 target price on shares of Monolithic Power Systems in a report on Monday, November 11th. Finally, Needham & Company LLC cut their target price on shares of Monolithic Power Systems from $950.00 to $600.00 and set a "buy" rating for the company in a research report on Friday, November 22nd. Two research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $828.67.

View Our Latest Stock Analysis on MPWR

Monolithic Power Systems Company Profile

(

Free Report)

Monolithic Power Systems, Inc engages in the design, development, marketing, and sale of semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets. The company provides direct current (DC) to DC integrated circuits (ICs) that are used to convert and control voltages of various electronic systems, such as cloud-based CPU servers, server artificial intelligence applications, storage applications, commercial notebooks, digital cockpit, power sources, home appliances, 4G and 5G infrastructure, and satellite communications applications.

Featured Stories

Before you consider Monolithic Power Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monolithic Power Systems wasn't on the list.

While Monolithic Power Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.