Wilmington Savings Fund Society FSB acquired a new position in shares of Equitable Holdings, Inc. (NYSE:EQH - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the SEC. The firm acquired 11,331 shares of the company's stock, valued at approximately $534,000.

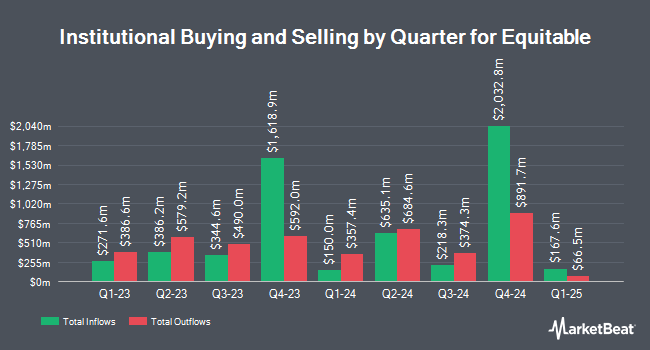

Several other hedge funds also recently added to or reduced their stakes in EQH. Versant Capital Management Inc lifted its position in shares of Equitable by 195.6% in the 4th quarter. Versant Capital Management Inc now owns 532 shares of the company's stock worth $25,000 after buying an additional 352 shares during the last quarter. Covestor Ltd lifted its position in Equitable by 61.5% in the 3rd quarter. Covestor Ltd now owns 646 shares of the company's stock valued at $27,000 after purchasing an additional 246 shares during the last quarter. Carolina Wealth Advisors LLC bought a new stake in Equitable in the 3rd quarter valued at about $48,000. MassMutual Private Wealth & Trust FSB lifted its position in Equitable by 298.3% in the 4th quarter. MassMutual Private Wealth & Trust FSB now owns 1,689 shares of the company's stock valued at $80,000 after purchasing an additional 1,265 shares during the last quarter. Finally, UMB Bank n.a. lifted its position in Equitable by 26.1% in the 4th quarter. UMB Bank n.a. now owns 1,954 shares of the company's stock valued at $92,000 after purchasing an additional 404 shares during the last quarter. 92.70% of the stock is owned by institutional investors and hedge funds.

Equitable Trading Up 3.0 %

Shares of Equitable stock traded up $1.62 during trading on Friday, hitting $55.36. The stock had a trading volume of 4,530,037 shares, compared to its average volume of 2,889,528. The stock has a 50 day simple moving average of $50.16 and a 200 day simple moving average of $45.81. The company has a market capitalization of $17.35 billion, a PE ratio of 14.49 and a beta of 1.39. The company has a quick ratio of 0.12, a current ratio of 0.07 and a debt-to-equity ratio of 3.07. Equitable Holdings, Inc. has a 1 year low of $32.96 and a 1 year high of $55.78.

Equitable (NYSE:EQH - Get Free Report) last released its earnings results on Wednesday, February 5th. The company reported $1.57 earnings per share for the quarter, missing the consensus estimate of $1.65 by ($0.08). Equitable had a return on equity of 85.70% and a net margin of 10.51%. On average, research analysts expect that Equitable Holdings, Inc. will post 7.24 EPS for the current fiscal year.

Equitable Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, March 12th. Investors of record on Wednesday, March 5th will be given a dividend of $0.24 per share. This represents a $0.96 dividend on an annualized basis and a yield of 1.73%. The ex-dividend date is Wednesday, March 5th. Equitable's payout ratio is presently 25.13%.

Analyst Upgrades and Downgrades

Several brokerages recently weighed in on EQH. Deutsche Bank Aktiengesellschaft upgraded shares of Equitable from a "hold" rating to a "buy" rating and lifted their price objective for the company from $47.00 to $58.00 in a research report on Friday, January 10th. Morgan Stanley lifted their price objective on shares of Equitable from $60.00 to $61.00 and gave the company an "overweight" rating in a research report on Friday. JPMorgan Chase & Co. lifted their price objective on shares of Equitable from $45.00 to $53.00 and gave the company a "neutral" rating in a research report on Tuesday, January 7th. Wells Fargo & Company cut their price objective on shares of Equitable from $54.00 to $53.00 and set an "overweight" rating on the stock in a research report on Tuesday, January 14th. Finally, Keefe, Bruyette & Woods boosted their price target on shares of Equitable from $58.00 to $62.00 and gave the stock an "outperform" rating in a research report on Wednesday. Two analysts have rated the stock with a hold rating and ten have given a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $55.92.

Get Our Latest Stock Report on EQH

Insider Activity at Equitable

In other Equitable news, CAO William James Iv Eckert sold 1,700 shares of Equitable stock in a transaction that occurred on Monday, December 23rd. The shares were sold at an average price of $46.68, for a total value of $79,356.00. Following the completion of the sale, the chief accounting officer now directly owns 17,677 shares in the company, valued at $825,162.36. The trade was a 8.77 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Jeffrey J. Hurd sold 6,666 shares of Equitable stock in a transaction that occurred on Wednesday, January 15th. The shares were sold at an average price of $54.65, for a total transaction of $364,296.90. Following the completion of the sale, the chief operating officer now owns 92,209 shares of the company's stock, valued at $5,039,221.85. This trade represents a 6.74 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 125,032 shares of company stock valued at $6,165,071. Corporate insiders own 1.10% of the company's stock.

Equitable Company Profile

(

Free Report)

Equitable Holdings, Inc, together with its consolidated subsidiaries, operates as a diversified financial services company worldwide. The company operates through six segments: Individual Retirement, Group Retirement, Investment Management and Research, Protection Solutions, Wealth Management, and Legacy.

Further Reading

Before you consider Equitable, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equitable wasn't on the list.

While Equitable currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.