Wilmington Savings Fund Society FSB bought a new stake in shares of Warner Bros. Discovery, Inc. (NASDAQ:WBD - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 187,301 shares of the company's stock, valued at approximately $1,545,000.

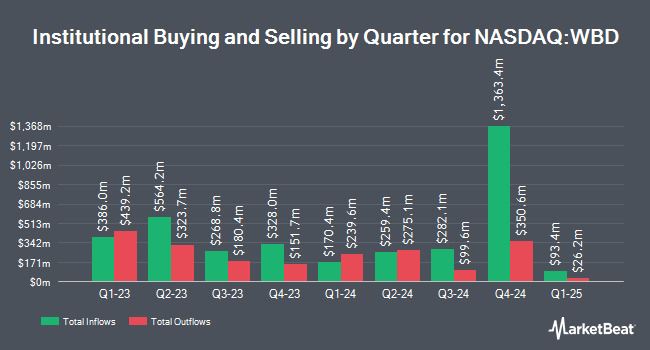

A number of other institutional investors also recently modified their holdings of WBD. Family Firm Inc. purchased a new position in Warner Bros. Discovery during the second quarter valued at $26,000. OFI Invest Asset Management raised its stake in Warner Bros. Discovery by 45.9% during the second quarter. OFI Invest Asset Management now owns 3,879 shares of the company's stock valued at $27,000 after buying an additional 1,221 shares during the last quarter. Future Financial Wealth Managment LLC purchased a new position in Warner Bros. Discovery during the third quarter valued at $41,000. Larson Financial Group LLC raised its stake in Warner Bros. Discovery by 54.1% during the third quarter. Larson Financial Group LLC now owns 4,998 shares of the company's stock valued at $41,000 after buying an additional 1,754 shares during the last quarter. Finally, Quarry LP raised its stake in Warner Bros. Discovery by 2,185.1% during the second quarter. Quarry LP now owns 6,307 shares of the company's stock valued at $47,000 after buying an additional 6,031 shares during the last quarter. 59.95% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of equities analysts recently weighed in on WBD shares. Wolfe Research upgraded shares of Warner Bros. Discovery from an "underperform" rating to a "peer perform" rating in a report on Monday, November 11th. KeyCorp lifted their price objective on Warner Bros. Discovery from $11.00 to $14.00 and gave the stock an "overweight" rating in a report on Tuesday, December 10th. Needham & Company LLC reissued a "hold" rating on shares of Warner Bros. Discovery in a research report on Thursday, October 10th. Rosenblatt Securities raised their price objective on shares of Warner Bros. Discovery from $9.00 to $13.00 and gave the company a "neutral" rating in a research report on Friday. Finally, Bank of America restated a "buy" rating and set a $14.00 target price on shares of Warner Bros. Discovery in a research report on Thursday. Twelve equities research analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $11.33.

Get Our Latest Stock Analysis on Warner Bros. Discovery

Warner Bros. Discovery Stock Down 3.4 %

WBD stock traded down $0.42 during mid-day trading on Friday, hitting $12.07. 36,581,051 shares of the company were exchanged, compared to its average volume of 29,640,697. The company has a market capitalization of $29.61 billion, a PE ratio of -2.64 and a beta of 1.52. The firm has a fifty day simple moving average of $9.11 and a 200 day simple moving average of $8.24. The company has a current ratio of 0.80, a quick ratio of 0.80 and a debt-to-equity ratio of 1.03. Warner Bros. Discovery, Inc. has a twelve month low of $6.64 and a twelve month high of $12.70.

Warner Bros. Discovery (NASDAQ:WBD - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The company reported $0.05 earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.07) by $0.12. Warner Bros. Discovery had a negative return on equity of 27.56% and a negative net margin of 28.34%. The business had revenue of $9.62 billion during the quarter, compared to the consensus estimate of $9.79 billion. During the same period in the previous year, the firm posted ($0.17) earnings per share. The business's revenue was down 3.6% on a year-over-year basis. On average, research analysts forecast that Warner Bros. Discovery, Inc. will post -4.37 earnings per share for the current fiscal year.

Warner Bros. Discovery Company Profile

(

Free Report)

Warner Bros. Discovery, Inc operates as a media and entertainment company worldwide. It operates through three segments: Studios, Network, and DTC. The Studios segment produces and releases feature films for initial exhibition in theaters; produces and licenses television programs to its networks and third parties and direct-to-consumer services; distributes films and television programs to various third parties and internal television; and offers streaming services and distribution through the home entertainment market, themed experience licensing, and interactive gaming.

See Also

Before you consider Warner Bros. Discovery, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warner Bros. Discovery wasn't on the list.

While Warner Bros. Discovery currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.