Wilmington Savings Fund Society FSB purchased a new stake in Liberty Global Ltd. (NASDAQ:LBTYA - Free Report) in the 3rd quarter, according to its most recent disclosure with the SEC. The fund purchased 291,588 shares of the company's stock, valued at approximately $6,155,000. Wilmington Savings Fund Society FSB owned 0.08% of Liberty Global as of its most recent filing with the SEC.

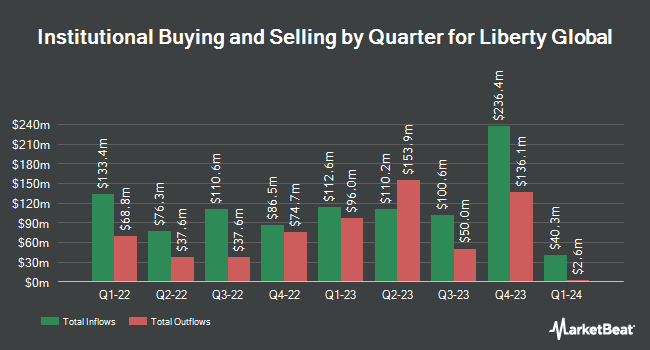

Several other hedge funds and other institutional investors have also modified their holdings of the business. EverSource Wealth Advisors LLC raised its holdings in shares of Liberty Global by 63.7% in the 2nd quarter. EverSource Wealth Advisors LLC now owns 1,545 shares of the company's stock worth $27,000 after purchasing an additional 601 shares in the last quarter. Wealth Enhancement Advisory Services LLC increased its stake in shares of Liberty Global by 2.2% during the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 28,188 shares of the company's stock worth $595,000 after purchasing an additional 606 shares during the last quarter. Private Advisor Group LLC boosted its holdings in shares of Liberty Global by 8.1% during the 3rd quarter. Private Advisor Group LLC now owns 11,113 shares of the company's stock worth $235,000 after buying an additional 835 shares during the period. Stifel Financial Corp boosted its holdings in shares of Liberty Global by 8.2% during the 3rd quarter. Stifel Financial Corp now owns 12,717 shares of the company's stock worth $268,000 after buying an additional 968 shares during the period. Finally, Blue Trust Inc. boosted its holdings in shares of Liberty Global by 110.3% during the 3rd quarter. Blue Trust Inc. now owns 1,859 shares of the company's stock worth $39,000 after buying an additional 975 shares during the period. 37.20% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling at Liberty Global

In other Liberty Global news, CFO Charles H. R. Bracken sold 84,103 shares of the stock in a transaction that occurred on Monday, December 2nd. The stock was sold at an average price of $14.56, for a total transaction of $1,224,539.68. Following the transaction, the chief financial officer now directly owns 53,312 shares in the company, valued at approximately $776,222.72. This represents a 61.20 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Insiders own 11.51% of the company's stock.

Analysts Set New Price Targets

A number of research firms have recently commented on LBTYA. Benchmark reaffirmed a "buy" rating and set a $27.00 price objective on shares of Liberty Global in a report on Tuesday, October 29th. Barclays dropped their target price on shares of Liberty Global from $20.00 to $12.00 and set an "equal weight" rating for the company in a research report on Monday, November 25th. UBS Group cut shares of Liberty Global from a "buy" rating to a "neutral" rating and lowered their price objective for the company from $23.00 to $13.00 in a research report on Monday, November 18th. Deutsche Bank Aktiengesellschaft lowered their price target on shares of Liberty Global from $38.00 to $23.00 and set a "buy" rating for the company in a research report on Thursday, December 5th. Finally, Bank of America lowered shares of Liberty Global from a "neutral" rating to an "underperform" rating and cut their price target for the company from $13.10 to $12.60 in a research note on Friday, December 6th. One analyst has rated the stock with a sell rating, four have issued a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat, Liberty Global has a consensus rating of "Hold" and an average price target of $18.94.

View Our Latest Report on Liberty Global

Liberty Global Price Performance

LBTYA traded down $0.08 on Friday, hitting $12.98. 958,208 shares of the stock were exchanged, compared to its average volume of 1,884,439. Liberty Global Ltd. has a 12 month low of $10.93 and a 12 month high of $21.56. The business has a 50-day moving average of $17.35 and a two-hundred day moving average of $18.29. The company has a debt-to-equity ratio of 0.80, a current ratio of 1.19 and a quick ratio of 1.19. The firm has a market capitalization of $4.64 billion, a price-to-earnings ratio of -1.29 and a beta of 1.24.

Liberty Global Company Profile

(

Free Report)

Liberty Global Ltd., together with its subsidiaries, provides broadband internet, video, fixed-line telephony, and mobile communications services to residential and business customers. It offers value-added broadband services, such as WiFi features, security, anti-virus, firewall, spam protection, smart home services, online storage solutions, and web spaces; and Connect Box that delivers in-home Wi-Fi service.

Further Reading

Before you consider Liberty Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liberty Global wasn't on the list.

While Liberty Global currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.