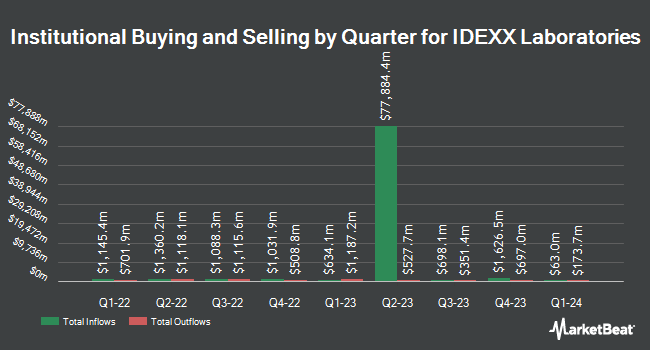

Wilmington Savings Fund Society FSB lessened its holdings in shares of IDEXX Laboratories, Inc. (NASDAQ:IDXX - Free Report) by 82.1% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,978 shares of the company's stock after selling 9,089 shares during the period. Wilmington Savings Fund Society FSB's holdings in IDEXX Laboratories were worth $999,000 at the end of the most recent quarter.

A number of other institutional investors and hedge funds have also recently made changes to their positions in the business. Sanctuary Advisors LLC increased its stake in IDEXX Laboratories by 20.4% in the third quarter. Sanctuary Advisors LLC now owns 3,288 shares of the company's stock valued at $1,661,000 after acquiring an additional 558 shares during the last quarter. Toronto Dominion Bank lifted its holdings in IDEXX Laboratories by 1.9% in the third quarter. Toronto Dominion Bank now owns 42,283 shares of the company's stock valued at $21,362,000 after buying an additional 808 shares during the period. Coldstream Capital Management Inc. lifted its holdings in IDEXX Laboratories by 7.9% in the third quarter. Coldstream Capital Management Inc. now owns 1,579 shares of the company's stock valued at $787,000 after buying an additional 115 shares during the period. Geode Capital Management LLC increased its stake in IDEXX Laboratories by 1.8% in the third quarter. Geode Capital Management LLC now owns 2,259,537 shares of the company's stock valued at $1,138,732,000 after purchasing an additional 40,349 shares in the last quarter. Finally, M&T Bank Corp increased its stake in IDEXX Laboratories by 1.6% in the third quarter. M&T Bank Corp now owns 5,693 shares of the company's stock valued at $2,876,000 after purchasing an additional 92 shares in the last quarter. Institutional investors and hedge funds own 87.84% of the company's stock.

Insider Activity at IDEXX Laboratories

In other news, Director Sophie V. Vandebroek sold 344 shares of the company's stock in a transaction that occurred on Wednesday, November 27th. The shares were sold at an average price of $420.44, for a total value of $144,631.36. Following the completion of the sale, the director now directly owns 905 shares of the company's stock, valued at approximately $380,498.20. This represents a 27.54 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 2.11% of the company's stock.

IDEXX Laboratories Trading Down 1.2 %

Shares of IDXX stock traded down $5.08 during trading on Friday, hitting $432.10. 353,727 shares of the stock traded hands, compared to its average volume of 512,194. The firm has a market capitalization of $35.38 billion, a P/E ratio of 41.67, a price-to-earnings-growth ratio of 3.99 and a beta of 1.37. The company has a debt-to-equity ratio of 0.32, a current ratio of 1.42 and a quick ratio of 1.03. IDEXX Laboratories, Inc. has a 52-week low of $398.50 and a 52-week high of $583.39. The firm's fifty day moving average price is $439.55 and its 200-day moving average price is $471.57.

IDEXX Laboratories (NASDAQ:IDXX - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The company reported $2.80 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.69 by $0.11. IDEXX Laboratories had a return on equity of 55.42% and a net margin of 22.53%. The firm had revenue of $975.50 million for the quarter, compared to analyst estimates of $980.32 million. During the same quarter last year, the company posted $2.53 earnings per share. The business's revenue was up 6.6% on a year-over-year basis. As a group, research analysts forecast that IDEXX Laboratories, Inc. will post 10.44 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of brokerages have issued reports on IDXX. Leerink Partners began coverage on shares of IDEXX Laboratories in a research report on Monday, December 2nd. They issued an "outperform" rating and a $500.00 price objective for the company. Piper Sandler restated a "neutral" rating and set a $435.00 price target (down from $520.00) on shares of IDEXX Laboratories in a research note on Monday, November 4th. StockNews.com raised shares of IDEXX Laboratories from a "hold" rating to a "buy" rating in a report on Thursday, November 28th. JPMorgan Chase & Co. decreased their price target on shares of IDEXX Laboratories from $630.00 to $575.00 and set an "overweight" rating on the stock in a report on Friday, October 11th. Finally, Leerink Partnrs raised shares of IDEXX Laboratories to a "strong-buy" rating in a report on Monday, December 2nd. Two research analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $539.63.

Read Our Latest Stock Report on IDXX

IDEXX Laboratories Profile

(

Free Report)

IDEXX Laboratories, Inc develops, manufactures, and distributes products primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets in Africa, the Asia Pacific, Canada, Europe, Latin America, and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy.

Further Reading

Before you consider IDEXX Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEXX Laboratories wasn't on the list.

While IDEXX Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.