Blueshift Asset Management LLC increased its position in shares of Wingstop Inc. (NASDAQ:WING - Free Report) by 416.9% during the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 17,637 shares of the restaurant operator's stock after buying an additional 14,225 shares during the quarter. Wingstop comprises about 1.8% of Blueshift Asset Management LLC's portfolio, making the stock its 3rd biggest position. Blueshift Asset Management LLC owned approximately 0.06% of Wingstop worth $7,338,000 at the end of the most recent reporting period.

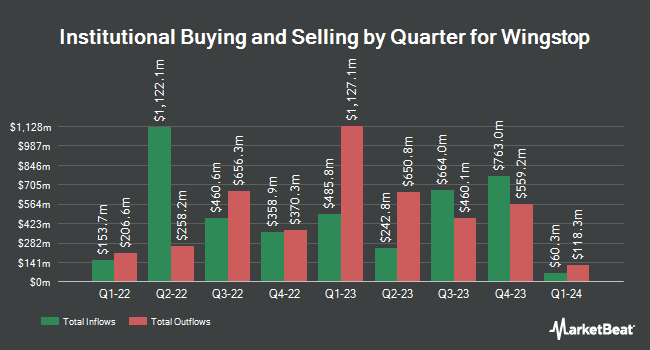

A number of other hedge funds have also recently added to or reduced their stakes in the company. Freedom Investment Management Inc. bought a new position in Wingstop in the 3rd quarter valued at about $351,000. BNP Paribas Financial Markets lifted its holdings in shares of Wingstop by 364.5% in the third quarter. BNP Paribas Financial Markets now owns 13,330 shares of the restaurant operator's stock valued at $5,546,000 after purchasing an additional 10,460 shares in the last quarter. Quantbot Technologies LP boosted its position in shares of Wingstop by 209.7% during the third quarter. Quantbot Technologies LP now owns 21,394 shares of the restaurant operator's stock valued at $8,902,000 after buying an additional 14,485 shares during the last quarter. FMR LLC grew its holdings in Wingstop by 984.7% during the third quarter. FMR LLC now owns 217,946 shares of the restaurant operator's stock worth $90,683,000 after buying an additional 197,853 shares in the last quarter. Finally, Dynamic Technology Lab Private Ltd raised its position in Wingstop by 21.6% in the 3rd quarter. Dynamic Technology Lab Private Ltd now owns 8,192 shares of the restaurant operator's stock valued at $3,408,000 after buying an additional 1,456 shares during the last quarter.

Analysts Set New Price Targets

WING has been the topic of a number of analyst reports. Northcoast Research upgraded shares of Wingstop from a "neutral" rating to a "buy" rating and set a $350.00 target price for the company in a research note on Friday, November 1st. Truist Financial upped their price objective on shares of Wingstop from $407.00 to $423.00 and gave the stock a "hold" rating in a research report on Thursday, August 1st. Citigroup lifted their target price on shares of Wingstop from $417.00 to $440.00 and gave the stock a "neutral" rating in a research report on Friday, October 4th. Stephens cut their target price on Wingstop from $490.00 to $468.00 and set an "overweight" rating on the stock in a research note on Thursday, October 31st. Finally, The Goldman Sachs Group raised Wingstop from a "neutral" rating to a "buy" rating and decreased their price target for the company from $458.00 to $377.00 in a research report on Friday, November 8th. Six analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the company. According to data from MarketBeat, Wingstop currently has a consensus rating of "Moderate Buy" and a consensus target price of $368.74.

Get Our Latest Report on Wingstop

Wingstop Trading Up 0.5 %

WING opened at $338.79 on Wednesday. Wingstop Inc. has a 12 month low of $229.27 and a 12 month high of $433.86. The company has a market cap of $9.90 billion, a PE ratio of 98.77, a price-to-earnings-growth ratio of 3.14 and a beta of 1.76. The company has a 50 day moving average of $369.86 and a 200 day moving average of $381.97.

Wingstop (NASDAQ:WING - Get Free Report) last posted its earnings results on Wednesday, October 30th. The restaurant operator reported $0.88 earnings per share for the quarter, missing analysts' consensus estimates of $0.97 by ($0.09). Wingstop had a net margin of 17.05% and a negative return on equity of 22.69%. The company had revenue of $162.50 million for the quarter, compared to analysts' expectations of $160.24 million. During the same period in the previous year, the firm earned $0.69 EPS. The firm's quarterly revenue was up 38.8% compared to the same quarter last year. Research analysts forecast that Wingstop Inc. will post 3.68 earnings per share for the current fiscal year.

Wingstop Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Stockholders of record on Friday, November 15th will be given a dividend of $0.27 per share. The ex-dividend date is Friday, November 15th. This represents a $1.08 dividend on an annualized basis and a dividend yield of 0.32%. Wingstop's dividend payout ratio (DPR) is currently 31.49%.

About Wingstop

(

Free Report)

Wingstop Inc, together with its subsidiaries, franchises and operates restaurants under the Wingstop brand. Its restaurants offer classic wings, boneless wings, tenders, and hand-sauced-and-tossed in various flavors, as well as chicken sandwiches with fries and hand-cut carrots and celery that are cooked-to-order.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Wingstop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wingstop wasn't on the list.

While Wingstop currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.