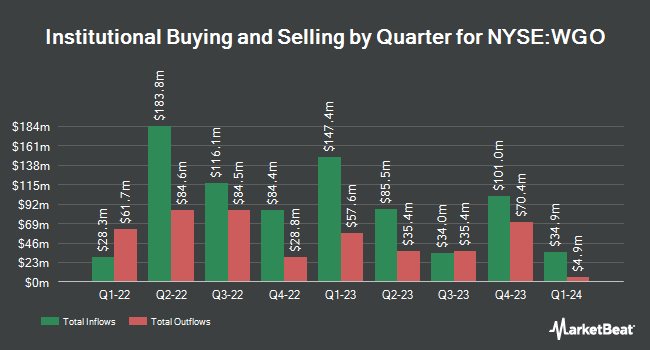

Quantbot Technologies LP lifted its holdings in shares of Winnebago Industries, Inc. (NYSE:WGO - Free Report) by 94.5% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 64,291 shares of the construction company's stock after buying an additional 31,242 shares during the period. Quantbot Technologies LP owned about 0.22% of Winnebago Industries worth $3,736,000 as of its most recent filing with the SEC.

A number of other institutional investors also recently modified their holdings of the business. Louisiana State Employees Retirement System raised its stake in Winnebago Industries by 1.4% during the second quarter. Louisiana State Employees Retirement System now owns 14,700 shares of the construction company's stock worth $797,000 after acquiring an additional 200 shares in the last quarter. Sound Income Strategies LLC grew its holdings in shares of Winnebago Industries by 69.1% during the 3rd quarter. Sound Income Strategies LLC now owns 700 shares of the construction company's stock valued at $41,000 after purchasing an additional 286 shares during the last quarter. Commonwealth Equity Services LLC increased its position in Winnebago Industries by 5.0% during the 2nd quarter. Commonwealth Equity Services LLC now owns 6,143 shares of the construction company's stock worth $333,000 after purchasing an additional 294 shares in the last quarter. GAMMA Investing LLC lifted its stake in Winnebago Industries by 222.5% in the 3rd quarter. GAMMA Investing LLC now owns 458 shares of the construction company's stock valued at $27,000 after purchasing an additional 316 shares during the last quarter. Finally, Linden Thomas Advisory Services LLC boosted its position in Winnebago Industries by 1.6% in the second quarter. Linden Thomas Advisory Services LLC now owns 21,988 shares of the construction company's stock valued at $1,192,000 after buying an additional 350 shares in the last quarter.

Insider Activity at Winnebago Industries

In related news, Director William C. Fisher acquired 2,000 shares of the stock in a transaction dated Monday, October 28th. The stock was bought at an average price of $54.81 per share, for a total transaction of $109,620.00. Following the purchase, the director now directly owns 32,267 shares of the company's stock, valued at $1,768,554.27. The trade was a 6.61 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, SVP Bret A. Woodson sold 12,187 shares of the business's stock in a transaction on Friday, November 1st. The shares were sold at an average price of $56.64, for a total transaction of $690,271.68. Following the transaction, the senior vice president now owns 23,728 shares in the company, valued at $1,343,953.92. The trade was a 33.93 % decrease in their position. The disclosure for this sale can be found here. 4.63% of the stock is owned by company insiders.

Wall Street Analysts Forecast Growth

Several brokerages have recently issued reports on WGO. Truist Financial lowered their price target on shares of Winnebago Industries from $68.00 to $64.00 and set a "buy" rating for the company in a report on Thursday, October 24th. BMO Capital Markets lowered their target price on Winnebago Industries from $75.00 to $70.00 and set an "outperform" rating for the company in a report on Thursday, October 24th. Northcoast Research raised Winnebago Industries from a "neutral" rating to a "buy" rating and set a $75.00 price target on the stock in a research note on Monday, November 11th. Robert W. Baird reduced their price target on Winnebago Industries from $70.00 to $64.00 and set an "outperform" rating on the stock in a report on Thursday, October 24th. Finally, StockNews.com lowered shares of Winnebago Industries from a "hold" rating to a "sell" rating in a report on Tuesday, October 29th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating and six have given a buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $68.13.

Check Out Our Latest Stock Analysis on WGO

Winnebago Industries Trading Down 1.0 %

Shares of Winnebago Industries stock traded down $0.56 during midday trading on Wednesday, reaching $58.37. The company had a trading volume of 551,305 shares, compared to its average volume of 588,546. The stock has a fifty day moving average price of $58.31 and a 200 day moving average price of $57.91. Winnebago Industries, Inc. has a fifty-two week low of $49.68 and a fifty-two week high of $75.42. The firm has a market cap of $1.69 billion, a PE ratio of 200.04 and a beta of 1.60. The company has a debt-to-equity ratio of 0.50, a current ratio of 2.44 and a quick ratio of 1.36.

Winnebago Industries (NYSE:WGO - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The construction company reported $0.28 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.89 by ($0.61). Winnebago Industries had a return on equity of 7.97% and a net margin of 0.44%. The firm had revenue of $720.90 million during the quarter, compared to analyst estimates of $718.72 million. During the same quarter last year, the firm posted $1.59 EPS. The firm's revenue for the quarter was down 6.5% on a year-over-year basis. On average, equities analysts anticipate that Winnebago Industries, Inc. will post 3.54 earnings per share for the current year.

About Winnebago Industries

(

Free Report)

Winnebago Industries, Inc manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities. The company operates through three segments: Towable RV, Motorhome RV, and Marine. It provides towable products that are non-motorized vehicles to be towed by automobiles, pickup trucks, SUVs, or vans for use as temporary living quarters for recreational travel, such as conventional travel trailers, fifth wheels, folding camper trailers, and truck campers under the Winnebago and Grand Design brand names.

See Also

Before you consider Winnebago Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Winnebago Industries wasn't on the list.

While Winnebago Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.