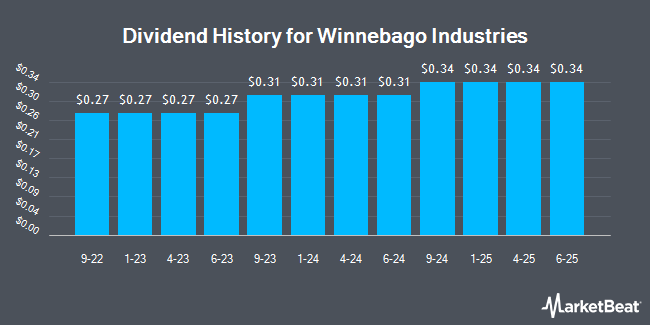

Winnebago Industries, Inc. (NYSE:WGO - Get Free Report) declared a quarterly dividend on Wednesday, December 18th,RTT News reports. Shareholders of record on Wednesday, January 15th will be paid a dividend of 0.34 per share by the construction company on Wednesday, January 29th. This represents a $1.36 dividend on an annualized basis and a yield of 2.63%.

Winnebago Industries has increased its dividend payment by an average of 35.5% per year over the last three years. Winnebago Industries has a payout ratio of 40.0% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Winnebago Industries to earn $4.88 per share next year, which means the company should continue to be able to cover its $1.36 annual dividend with an expected future payout ratio of 27.9%.

Winnebago Industries Stock Down 5.6 %

NYSE:WGO traded down $3.04 during mid-day trading on Wednesday, hitting $51.70. The stock had a trading volume of 1,024,269 shares, compared to its average volume of 583,356. Winnebago Industries has a twelve month low of $49.68 and a twelve month high of $75.42. The stock has a 50-day simple moving average of $58.05 and a two-hundred day simple moving average of $57.46. The company has a current ratio of 2.44, a quick ratio of 1.36 and a debt-to-equity ratio of 0.50. The company has a market capitalization of $1.50 billion, a PE ratio of 172.34 and a beta of 1.60.

Winnebago Industries (NYSE:WGO - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The construction company reported $0.28 earnings per share for the quarter, missing analysts' consensus estimates of $0.89 by ($0.61). The company had revenue of $720.90 million for the quarter, compared to analyst estimates of $718.72 million. Winnebago Industries had a return on equity of 7.97% and a net margin of 0.44%. The firm's revenue for the quarter was down 6.5% compared to the same quarter last year. During the same period in the previous year, the business posted $1.59 EPS. On average, equities research analysts anticipate that Winnebago Industries will post 3.52 EPS for the current year.

Insider Transactions at Winnebago Industries

In other news, CEO Michael J. Happe purchased 2,500 shares of the company's stock in a transaction on Tuesday, October 29th. The shares were purchased at an average price of $55.52 per share, with a total value of $138,800.00. Following the purchase, the chief executive officer now directly owns 285,953 shares of the company's stock, valued at $15,876,110.56. This trade represents a 0.88 % increase in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director William C. Fisher purchased 2,000 shares of the stock in a transaction on Monday, October 28th. The shares were bought at an average cost of $54.81 per share, for a total transaction of $109,620.00. Following the transaction, the director now directly owns 32,267 shares in the company, valued at approximately $1,768,554.27. The trade was a 6.61 % increase in their ownership of the stock. The disclosure for this purchase can be found here. 4.63% of the stock is owned by insiders.

Wall Street Analyst Weigh In

A number of research analysts have issued reports on the stock. StockNews.com lowered shares of Winnebago Industries from a "hold" rating to a "sell" rating in a report on Tuesday, October 29th. Truist Financial decreased their price target on Winnebago Industries from $68.00 to $64.00 and set a "buy" rating for the company in a report on Thursday, October 24th. Robert W. Baird cut their target price on shares of Winnebago Industries from $70.00 to $64.00 and set an "outperform" rating on the stock in a research note on Thursday, October 24th. Benchmark reduced their price target on shares of Winnebago Industries from $75.00 to $70.00 and set a "buy" rating for the company in a report on Tuesday, October 22nd. Finally, BMO Capital Markets dropped their price target on shares of Winnebago Industries from $75.00 to $70.00 and set an "outperform" rating on the stock in a research report on Thursday, October 24th. One analyst has rated the stock with a sell rating, two have assigned a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, Winnebago Industries has an average rating of "Moderate Buy" and an average price target of $68.13.

Read Our Latest Stock Report on WGO

About Winnebago Industries

(

Get Free Report)

Winnebago Industries, Inc manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities. The company operates through three segments: Towable RV, Motorhome RV, and Marine. It provides towable products that are non-motorized vehicles to be towed by automobiles, pickup trucks, SUVs, or vans for use as temporary living quarters for recreational travel, such as conventional travel trailers, fifth wheels, folding camper trailers, and truck campers under the Winnebago and Grand Design brand names.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Winnebago Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Winnebago Industries wasn't on the list.

While Winnebago Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.