WINTON GROUP Ltd cut its position in WEX Inc. (NYSE:WEX - Free Report) by 53.3% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 13,376 shares of the business services provider's stock after selling 15,297 shares during the quarter. WINTON GROUP Ltd's holdings in WEX were worth $2,345,000 at the end of the most recent reporting period.

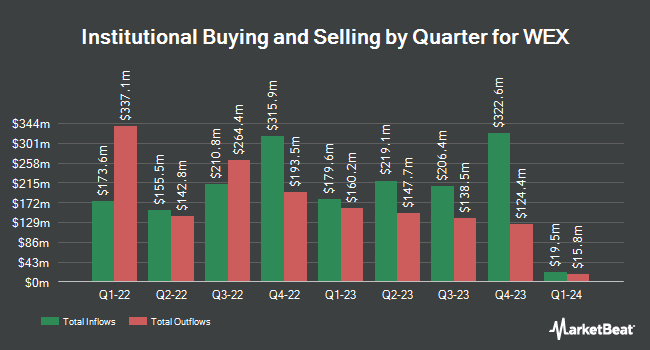

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Wealthfront Advisers LLC bought a new stake in shares of WEX in the fourth quarter valued at about $28,689,000. FMR LLC raised its stake in WEX by 8.8% in the 3rd quarter. FMR LLC now owns 1,555,507 shares of the business services provider's stock worth $326,237,000 after purchasing an additional 125,262 shares in the last quarter. Hotchkis & Wiley Capital Management LLC boosted its holdings in WEX by 82.2% in the 3rd quarter. Hotchkis & Wiley Capital Management LLC now owns 175,690 shares of the business services provider's stock valued at $36,847,000 after purchasing an additional 79,252 shares during the period. Raymond James Financial Inc. acquired a new position in shares of WEX during the 4th quarter worth approximately $12,444,000. Finally, Fisher Asset Management LLC increased its holdings in shares of WEX by 168.8% during the fourth quarter. Fisher Asset Management LLC now owns 82,896 shares of the business services provider's stock worth $14,533,000 after purchasing an additional 52,056 shares during the period. 97.47% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several equities research analysts recently issued reports on the company. Keefe, Bruyette & Woods cut their price target on WEX from $220.00 to $200.00 and set an "outperform" rating for the company in a research note on Friday, February 7th. Wells Fargo & Company cut their target price on WEX from $180.00 to $160.00 and set an "equal weight" rating for the company in a research report on Friday, February 7th. Bank of America cut WEX from a "buy" rating to a "neutral" rating in a research report on Thursday, February 6th. William Blair reaffirmed a "market perform" rating on shares of WEX in a research report on Thursday, February 6th. Finally, Jefferies Financial Group raised their target price on shares of WEX from $180.00 to $190.00 and gave the company a "hold" rating in a report on Wednesday, January 22nd. Nine research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat, the stock has an average rating of "Hold" and an average target price of $187.80.

View Our Latest Research Report on WEX

WEX Price Performance

Shares of WEX stock traded up $2.19 during midday trading on Monday, hitting $156.75. 248,922 shares of the company traded hands, compared to its average volume of 492,099. The stock has a market cap of $6.08 billion, a price-to-earnings ratio of 20.95, a PEG ratio of 2.06 and a beta of 1.61. The company has a debt-to-equity ratio of 2.07, a quick ratio of 1.04 and a current ratio of 1.02. The firm's fifty day moving average price is $162.27 and its 200-day moving average price is $179.13. WEX Inc. has a 12 month low of $146.03 and a 12 month high of $244.04.

WEX (NYSE:WEX - Get Free Report) last posted its earnings results on Wednesday, February 5th. The business services provider reported $3.13 earnings per share for the quarter, topping analysts' consensus estimates of $2.97 by $0.16. WEX had a net margin of 11.78% and a return on equity of 32.35%. As a group, sell-side analysts forecast that WEX Inc. will post 14.09 earnings per share for the current year.

WEX Company Profile

(

Free Report)

WEX Inc operates a commerce platform in the United States and internationally. The Mobility segment offers fleet vehicle payment solutions, transaction processing, and information management services; and provides account activation and account retention services; authorization and billing inquiries, and account maintenance services; account management; credit and collections services; merchant services; analytics solutions; and ancillary services and offerings.

See Also

Before you consider WEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WEX wasn't on the list.

While WEX currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.