Wintrust Investments LLC decreased its holdings in shares of Core Laboratories Inc. (NYSE:CLB - Free Report) by 73.8% in the 4th quarter, according to its most recent 13F filing with the SEC. The fund owned 10,142 shares of the oil and gas company's stock after selling 28,549 shares during the period. Wintrust Investments LLC's holdings in Core Laboratories were worth $175,000 at the end of the most recent reporting period.

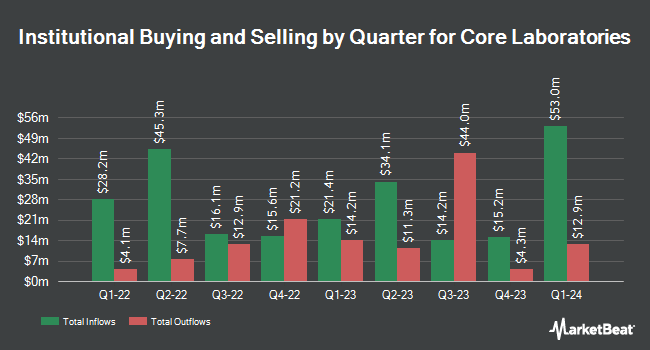

A number of other large investors also recently made changes to their positions in the stock. State Street Corp increased its holdings in Core Laboratories by 2.9% in the third quarter. State Street Corp now owns 1,975,016 shares of the oil and gas company's stock valued at $36,597,000 after purchasing an additional 56,187 shares during the last quarter. Geode Capital Management LLC increased its stake in shares of Core Laboratories by 0.7% in the 3rd quarter. Geode Capital Management LLC now owns 1,053,204 shares of the oil and gas company's stock valued at $19,521,000 after acquiring an additional 7,721 shares during the last quarter. Boston Trust Walden Corp increased its stake in shares of Core Laboratories by 2.7% in the 4th quarter. Boston Trust Walden Corp now owns 617,336 shares of the oil and gas company's stock valued at $10,686,000 after acquiring an additional 16,503 shares during the last quarter. Barclays PLC raised its position in shares of Core Laboratories by 288.2% in the 3rd quarter. Barclays PLC now owns 83,570 shares of the oil and gas company's stock valued at $1,549,000 after acquiring an additional 62,042 shares during the period. Finally, Principal Financial Group Inc. boosted its stake in Core Laboratories by 3.1% during the 4th quarter. Principal Financial Group Inc. now owns 229,096 shares of the oil and gas company's stock worth $3,966,000 after acquiring an additional 6,827 shares during the last quarter. Institutional investors and hedge funds own 97.81% of the company's stock.

Analysts Set New Price Targets

Separately, Citigroup upgraded shares of Core Laboratories from a "sell" rating to a "neutral" rating and increased their target price for the stock from $15.00 to $16.00 in a report on Wednesday. One research analyst has rated the stock with a sell rating and four have assigned a hold rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $17.50.

View Our Latest Stock Report on Core Laboratories

Core Laboratories Trading Up 3.3 %

CLB opened at $15.10 on Thursday. The stock has a market capitalization of $706.90 million, a P/E ratio of 22.87, a P/E/G ratio of 0.99 and a beta of 2.38. The company has a current ratio of 2.32, a quick ratio of 1.71 and a debt-to-equity ratio of 0.49. Core Laboratories Inc. has a 12 month low of $12.95 and a 12 month high of $25.13. The firm's fifty day simple moving average is $17.24 and its 200 day simple moving average is $18.37.

Core Laboratories (NYSE:CLB - Get Free Report) last issued its quarterly earnings results on Wednesday, January 29th. The oil and gas company reported $0.23 EPS for the quarter, meeting analysts' consensus estimates of $0.23. Core Laboratories had a return on equity of 16.24% and a net margin of 5.99%. As a group, research analysts anticipate that Core Laboratories Inc. will post 0.96 EPS for the current fiscal year.

Core Laboratories Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Monday, March 3rd. Stockholders of record on Monday, February 10th were issued a $0.01 dividend. The ex-dividend date of this dividend was Monday, February 10th. This represents a $0.04 dividend on an annualized basis and a dividend yield of 0.26%. Core Laboratories's dividend payout ratio (DPR) is presently 6.06%.

Core Laboratories Company Profile

(

Free Report)

Core Laboratories Inc provides reservoir description and production enhancement services and products to the oil and gas industry in the United States, and internationally. It operates through Reservoir Description and Production Enhancement segments. The Reservoir Description segment includes the characterization of petroleum reservoir rock and reservoir fluid samples to enhance production and improve recovery of crude oil and gas from its clients' reservoirs.

Featured Stories

Want to see what other hedge funds are holding CLB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Core Laboratories Inc. (NYSE:CLB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Core Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core Laboratories wasn't on the list.

While Core Laboratories currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.