Wisconsin Capital Management LLC cut its stake in shares of VSE Co. (NASDAQ:VSEC - Free Report) by 14.4% in the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 49,819 shares of the construction company's stock after selling 8,353 shares during the quarter. VSE accounts for 2.6% of Wisconsin Capital Management LLC's portfolio, making the stock its 17th largest holding. Wisconsin Capital Management LLC owned 0.24% of VSE worth $4,738,000 as of its most recent filing with the Securities & Exchange Commission.

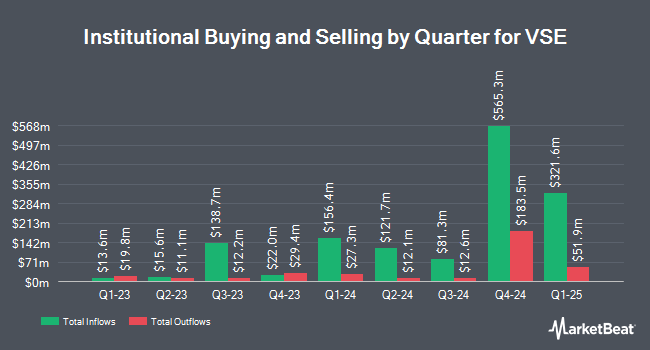

Other hedge funds have also modified their holdings of the company. Quantbot Technologies LP acquired a new position in shares of VSE in the 4th quarter valued at $47,000. Sanctuary Advisors LLC acquired a new stake in shares of VSE during the third quarter valued at approximately $155,000. KFA Private Wealth Group LLC purchased a new stake in shares of VSE in the 4th quarter valued at approximately $209,000. M&T Bank Corp acquired a new position in VSE in the 4th quarter worth approximately $239,000. Finally, US Bancorp DE grew its position in VSE by 16.8% during the 4th quarter. US Bancorp DE now owns 3,021 shares of the construction company's stock worth $287,000 after purchasing an additional 435 shares in the last quarter. 91.54% of the stock is currently owned by institutional investors and hedge funds.

VSE Stock Performance

VSEC traded down $10.83 during midday trading on Friday, reaching $105.93. The company's stock had a trading volume of 377,985 shares, compared to its average volume of 199,042. VSE Co. has a twelve month low of $73.36 and a twelve month high of $128.72. The company has a fifty day simple moving average of $110.53 and a 200 day simple moving average of $104.95. The stock has a market cap of $2.19 billion, a P/E ratio of 127.63 and a beta of 1.32. The company has a current ratio of 3.69, a quick ratio of 1.15 and a debt-to-equity ratio of 0.53.

VSE (NASDAQ:VSEC - Get Free Report) last released its earnings results on Wednesday, February 26th. The construction company reported $0.90 earnings per share for the quarter, beating the consensus estimate of $0.73 by $0.17. VSE had a net margin of 1.36% and a return on equity of 7.26%. The business had revenue of $299.02 million during the quarter, compared to analysts' expectations of $289.97 million. Research analysts expect that VSE Co. will post 2.96 earnings per share for the current year.

VSE Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, May 15th. Stockholders of record on Thursday, May 1st will be given a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a dividend yield of 0.38%. The ex-dividend date of this dividend is Thursday, May 1st. VSE's dividend payout ratio is presently 48.19%.

Wall Street Analyst Weigh In

Several brokerages recently issued reports on VSEC. StockNews.com raised VSE to a "sell" rating in a research note on Thursday, March 6th. Truist Financial boosted their price objective on shares of VSE from $129.00 to $134.00 and gave the company a "buy" rating in a research report on Tuesday, March 4th. One analyst has rated the stock with a sell rating and six have given a buy rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $118.67.

Read Our Latest Research Report on VSE

VSE Company Profile

(

Free Report)

VSE Corporation operates as a diversified aftermarket products and services company in the United States. The company operates through two segments, Aviation and Fleet. The Aviation segment provides aftermarket parts supply and distribution; maintenance, repair, and overhaul services for components and engine accessories supporting commercial, business, and general aviation operators.

See Also

Before you consider VSE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VSE wasn't on the list.

While VSE currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.