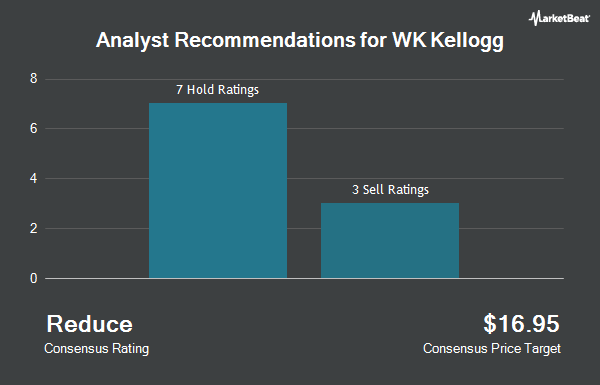

Shares of WK Kellogg Co (NYSE:KLG - Get Free Report) have received an average recommendation of "Reduce" from the eight ratings firms that are covering the firm, MarketBeat reports. Three research analysts have rated the stock with a sell rating and five have given a hold rating to the company. The average 12-month price objective among brokerages that have issued ratings on the stock in the last year is $18.88.

KLG has been the subject of several recent analyst reports. Barclays upped their target price on WK Kellogg from $16.00 to $19.00 and gave the stock an "underweight" rating in a research note on Monday, November 11th. JPMorgan Chase & Co. reduced their price objective on WK Kellogg from $22.00 to $17.00 and set a "neutral" rating on the stock in a research note on Wednesday, August 7th.

Check Out Our Latest Report on WK Kellogg

WK Kellogg Stock Down 0.7 %

Shares of NYSE KLG opened at $17.08 on Thursday. WK Kellogg has a 52 week low of $10.99 and a 52 week high of $24.63. The stock's fifty day moving average is $17.48 and its 200 day moving average is $17.79. The company has a debt-to-equity ratio of 1.49, a quick ratio of 0.34 and a current ratio of 0.78. The stock has a market capitalization of $1.47 billion and a P/E ratio of 21.90.

WK Kellogg (NYSE:KLG - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported $0.31 EPS for the quarter, beating the consensus estimate of $0.26 by $0.05. WK Kellogg had a net margin of 2.50% and a return on equity of 33.41%. The firm had revenue of $689.00 million for the quarter, compared to analyst estimates of $674.10 million. During the same period last year, the firm earned $0.49 EPS. The business's quarterly revenue was down .4% compared to the same quarter last year. Sell-side analysts forecast that WK Kellogg will post 1.49 earnings per share for the current fiscal year.

WK Kellogg Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 29th will be paid a $0.16 dividend. This represents a $0.64 annualized dividend and a dividend yield of 3.75%. The ex-dividend date is Friday, November 29th. WK Kellogg's dividend payout ratio is currently 82.05%.

Insider Buying and Selling

In other news, Director G Zachary Gund purchased 65,000 shares of the company's stock in a transaction dated Thursday, November 14th. The shares were purchased at an average price of $17.76 per share, for a total transaction of $1,154,400.00. Following the transaction, the director now owns 195,000 shares of the company's stock, valued at approximately $3,463,200. This trade represents a 50.00 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. 0.90% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On WK Kellogg

A number of institutional investors and hedge funds have recently modified their holdings of the business. GAMMA Investing LLC raised its stake in WK Kellogg by 88.6% during the 3rd quarter. GAMMA Investing LLC now owns 1,890 shares of the company's stock worth $32,000 after buying an additional 888 shares during the period. EntryPoint Capital LLC acquired a new position in shares of WK Kellogg during the first quarter worth approximately $42,000. Rothschild Investment LLC bought a new position in shares of WK Kellogg in the 2nd quarter worth $46,000. Abich Financial Wealth Management LLC grew its position in WK Kellogg by 3,575.4% in the 3rd quarter. Abich Financial Wealth Management LLC now owns 4,484 shares of the company's stock valued at $77,000 after purchasing an additional 4,362 shares during the period. Finally, International Assets Investment Management LLC grew its position in WK Kellogg by 1,724.1% in the 3rd quarter. International Assets Investment Management LLC now owns 4,688 shares of the company's stock valued at $80,000 after purchasing an additional 4,431 shares during the period. 95.74% of the stock is currently owned by institutional investors.

WK Kellogg Company Profile

(

Get Free ReportWK Kellogg Co operates as a food company in the United States, Canada, and the Caribbean. It manufactures, markets, and distributes ready-to-eat cereal products primarily under the Frosted Flakes, Special K, Froot Loops, Raisin Bran, Frosted Mini-Wheats, and Kashi brands. The company was formerly known as North America Cereal Co and changed its name to WK Kellogg Co in March 2023.

Recommended Stories

Before you consider WK Kellogg, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WK Kellogg wasn't on the list.

While WK Kellogg currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.