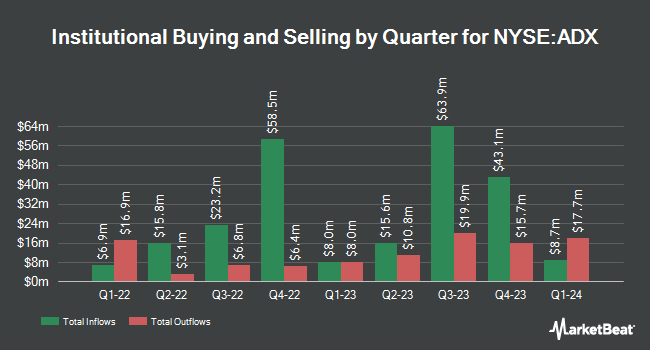

Wolverine Asset Management LLC purchased a new stake in shares of Adams Diversified Equity Fund, Inc. (NYSE:ADX - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund purchased 30,367 shares of the closed-end fund's stock, valued at approximately $655,000.

Several other hedge funds and other institutional investors also recently bought and sold shares of the company. Farther Finance Advisors LLC acquired a new stake in Adams Diversified Equity Fund during the 3rd quarter valued at approximately $30,000. Rothschild Investment LLC acquired a new position in Adams Diversified Equity Fund in the second quarter valued at approximately $45,000. Sunbelt Securities Inc. grew its stake in shares of Adams Diversified Equity Fund by 23,200.0% during the 2nd quarter. Sunbelt Securities Inc. now owns 2,563 shares of the closed-end fund's stock worth $55,000 after purchasing an additional 2,552 shares during the period. Covestor Ltd purchased a new position in shares of Adams Diversified Equity Fund during the 1st quarter valued at approximately $203,000. Finally, Great Valley Advisor Group Inc. purchased a new position in Adams Diversified Equity Fund during the second quarter worth approximately $206,000. Institutional investors own 28.41% of the company's stock.

Adams Diversified Equity Fund Trading Down 0.8 %

ADX stock traded down $0.18 during trading on Thursday, hitting $22.27. The stock had a trading volume of 166,090 shares, compared to its average volume of 193,170. Adams Diversified Equity Fund, Inc. has a twelve month low of $16.47 and a twelve month high of $22.58. The company's 50-day moving average price is $21.58 and its two-hundred day moving average price is $21.13.

Insider Transactions at Adams Diversified Equity Fund

In related news, Director Jane Musser Nelson acquired 1,155 shares of the stock in a transaction that occurred on Thursday, October 31st. The stock was purchased at an average price of $21.69 per share, with a total value of $25,051.95. Following the transaction, the director now owns 4,982 shares of the company's stock, valued at approximately $108,059.58. This trade represents a 30.18 % increase in their position. The acquisition was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Frederic A. Escherich sold 4,833 shares of the firm's stock in a transaction dated Friday, October 25th. The shares were sold at an average price of $21.90, for a total value of $105,842.70. Following the transaction, the director now owns 59,408 shares of the company's stock, valued at $1,301,035.20. This trade represents a 7.52 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.11% of the company's stock.

About Adams Diversified Equity Fund

(

Free Report)

Adams Diversified Equity Fund, Inc is a publicly owned investment manager. It primarily provides its services to investment companies. The firm is a large advisory firm The firm is actively engaged in businesses, including commodity pool operator or commodity trading advisor. The firm launches equity.

See Also

Before you consider Adams Diversified Equity Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adams Diversified Equity Fund wasn't on the list.

While Adams Diversified Equity Fund currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.