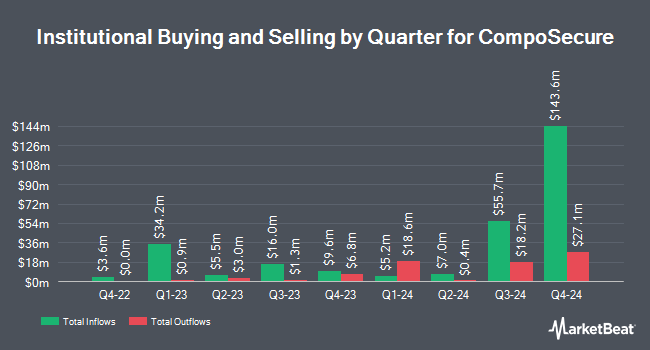

Woodson Capital Management LP bought a new stake in CompoSecure, Inc. (NASDAQ:CMPO - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor bought 770,000 shares of the company's stock, valued at approximately $10,795,000. CompoSecure comprises approximately 2.1% of Woodson Capital Management LP's holdings, making the stock its 20th biggest holding. Woodson Capital Management LP owned approximately 0.87% of CompoSecure at the end of the most recent quarter.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Vanguard Group Inc. lifted its stake in CompoSecure by 1.6% in the first quarter. Vanguard Group Inc. now owns 843,476 shares of the company's stock valued at $6,098,000 after buying an additional 13,081 shares during the last quarter. Boston Partners boosted its stake in CompoSecure by 40.8% during the 1st quarter. Boston Partners now owns 557,136 shares of the company's stock worth $4,028,000 after purchasing an additional 161,333 shares during the period. Pacific Ridge Capital Partners LLC grew its position in CompoSecure by 146.9% during the 2nd quarter. Pacific Ridge Capital Partners LLC now owns 486,462 shares of the company's stock worth $3,308,000 after purchasing an additional 289,451 shares during the last quarter. Bard Associates Inc. increased its stake in CompoSecure by 0.6% in the third quarter. Bard Associates Inc. now owns 305,247 shares of the company's stock valued at $4,280,000 after purchasing an additional 1,957 shares during the period. Finally, Rice Hall James & Associates LLC purchased a new stake in shares of CompoSecure in the third quarter valued at about $3,766,000. 37.56% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities analysts recently issued reports on the company. JPMorgan Chase & Co. boosted their price target on CompoSecure from $8.00 to $12.00 and gave the company a "neutral" rating in a research report on Tuesday, August 20th. B. Riley lifted their price objective on CompoSecure from $18.00 to $23.00 and gave the company a "buy" rating in a report on Monday, November 11th. Benchmark reiterated a "buy" rating and issued a $17.00 price objective on shares of CompoSecure in a research report on Tuesday, November 12th. Bank of America lifted their price target on shares of CompoSecure from $9.00 to $10.00 and gave the company a "buy" rating in a research report on Thursday, August 8th. Finally, Compass Point lifted their price objective on CompoSecure from $11.50 to $14.50 and gave the stock a "buy" rating in a research report on Tuesday, August 20th. One research analyst has rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $15.79.

Read Our Latest Analysis on CompoSecure

Insider Buying and Selling

In related news, Director Michele Logan sold 10,017,983 shares of the company's stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $7.55, for a total value of $75,635,771.65. Following the sale, the director now directly owns 2,043,320 shares of the company's stock, valued at $15,427,066. This represents a 83.06 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, insider Adam Joseph Lowe sold 5,730 shares of the business's stock in a transaction dated Wednesday, September 11th. The stock was sold at an average price of $12.05, for a total transaction of $69,046.50. Following the completion of the sale, the insider now directly owns 1,292,219 shares of the company's stock, valued at $15,571,238.95. The trade was a 0.44 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 10,641,727 shares of company stock valued at $80,370,824 in the last quarter. Company insiders own 74.99% of the company's stock.

CompoSecure Price Performance

NASDAQ CMPO traded down $0.22 during trading hours on Friday, hitting $15.95. The company had a trading volume of 216,588 shares, compared to its average volume of 532,260. The firm's 50 day moving average is $14.69 and its 200 day moving average is $10.67. CompoSecure, Inc. has a fifty-two week low of $4.61 and a fifty-two week high of $16.38. The company has a market capitalization of $1.41 billion, a price-to-earnings ratio of -36.75, a P/E/G ratio of 1.28 and a beta of 0.76.

CompoSecure (NASDAQ:CMPO - Get Free Report) last released its quarterly earnings results on Friday, November 8th. The company reported $0.27 EPS for the quarter, missing the consensus estimate of $0.29 by ($0.02). CompoSecure had a negative return on equity of 14.87% and a negative net margin of 5.63%. The company had revenue of $107.14 million for the quarter, compared to analyst estimates of $105.11 million. During the same period last year, the firm posted $0.24 earnings per share. On average, equities analysts anticipate that CompoSecure, Inc. will post 1.02 EPS for the current year.

CompoSecure Profile

(

Free Report)

CompoSecure, Inc manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally. Its primary metal form factors include embedded, metal veneer lite, metal veneer, and full metal products. The company also offers Arculus Cold Storage Wallet, a three-factor authentication solution, which supports specific digital assets, including Bitcoin, Ethereum, non-fungible tokens and others.

Read More

Before you consider CompoSecure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CompoSecure wasn't on the list.

While CompoSecure currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.