Workiva (NYSE:WK - Get Free Report) had its price objective boosted by stock analysts at Citigroup from $116.00 to $128.00 in a report issued on Monday,Benzinga reports. The firm presently has a "buy" rating on the software maker's stock. Citigroup's price objective would suggest a potential upside of 21.30% from the company's previous close.

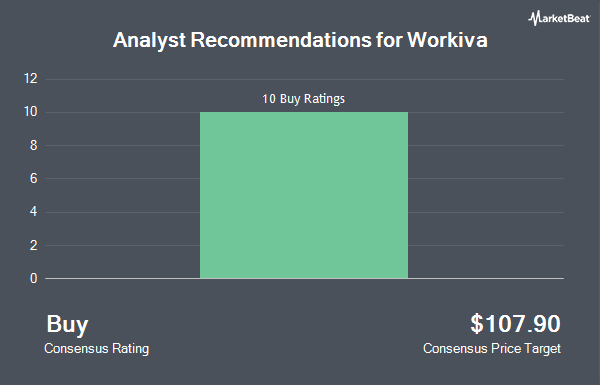

A number of other research analysts also recently commented on WK. Stifel Nicolaus boosted their target price on Workiva from $85.00 to $102.00 and gave the company a "hold" rating in a research note on Thursday, November 7th. BMO Capital Markets raised their price objective on shares of Workiva from $96.00 to $104.00 and gave the company an "outperform" rating in a research report on Thursday, November 7th. Finally, Robert W. Baird boosted their target price on shares of Workiva from $110.00 to $130.00 and gave the stock an "outperform" rating in a research report on Friday. Two analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to MarketBeat.com, Workiva currently has a consensus rating of "Moderate Buy" and an average target price of $111.80.

View Our Latest Report on Workiva

Workiva Stock Performance

Shares of NYSE WK traded up $1.65 during mid-day trading on Monday, reaching $105.52. The company had a trading volume of 543,891 shares, compared to its average volume of 378,035. The company has a market capitalization of $5.84 billion, a price-to-earnings ratio of -114.70 and a beta of 1.09. The stock has a fifty day moving average of $89.86 and a two-hundred day moving average of $80.21. Workiva has a 12-month low of $65.47 and a 12-month high of $106.41.

Hedge Funds Weigh In On Workiva

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Versor Investments LP bought a new stake in shares of Workiva during the 3rd quarter worth $1,217,000. TimesSquare Capital Management LLC lifted its position in Workiva by 4.3% during the 3rd quarter. TimesSquare Capital Management LLC now owns 467,769 shares of the software maker's stock worth $37,010,000 after acquiring an additional 19,095 shares during the last quarter. Mutual of America Capital Management LLC boosted its holdings in Workiva by 138.8% during the third quarter. Mutual of America Capital Management LLC now owns 54,059 shares of the software maker's stock valued at $4,277,000 after acquiring an additional 31,421 shares during the period. GSA Capital Partners LLP bought a new stake in Workiva during the third quarter valued at about $641,000. Finally, Impax Asset Management Group plc grew its position in shares of Workiva by 16.5% in the third quarter. Impax Asset Management Group plc now owns 158,586 shares of the software maker's stock valued at $12,547,000 after purchasing an additional 22,500 shares during the last quarter. Institutional investors and hedge funds own 92.21% of the company's stock.

About Workiva

(

Get Free Report)

Workiva Inc, together with its subsidiaries, provides cloud-based reporting solutions in the United States and internationally. The company offers Workiva platform, a multi-tenant cloud software that provides data linking capabilities; audit trail services; administrators access management; and allows customers to connect data from multiple enterprise resource planning, human capital management, and customer relationship management systems, as well as other third-party cloud and on-premise applications.

Featured Stories

Before you consider Workiva, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workiva wasn't on the list.

While Workiva currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.