World Investment Advisors LLC purchased a new stake in Celestica Inc. (NYSE:CLS - Free Report) TSE: CLS during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 78,300 shares of the technology company's stock, valued at approximately $4,003,000. World Investment Advisors LLC owned approximately 0.07% of Celestica at the end of the most recent reporting period.

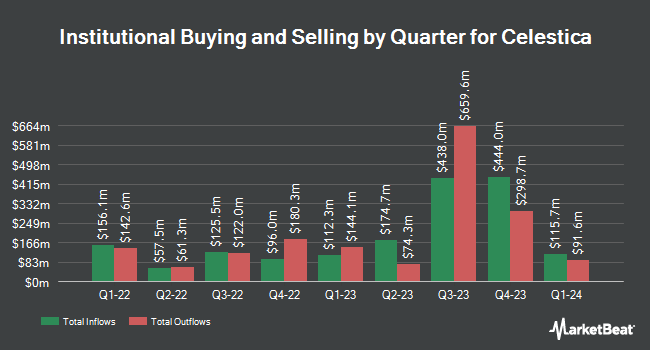

A number of other institutional investors and hedge funds have also recently bought and sold shares of the business. Optimum Investment Advisors lifted its position in shares of Celestica by 66.7% during the 3rd quarter. Optimum Investment Advisors now owns 500 shares of the technology company's stock valued at $26,000 after acquiring an additional 200 shares during the period. Truist Financial Corp increased its stake in Celestica by 2.0% in the 2nd quarter. Truist Financial Corp now owns 11,008 shares of the technology company's stock valued at $631,000 after purchasing an additional 214 shares in the last quarter. Whittier Trust Co. of Nevada Inc. raised its holdings in Celestica by 26.6% during the third quarter. Whittier Trust Co. of Nevada Inc. now owns 1,307 shares of the technology company's stock worth $67,000 after purchasing an additional 275 shares during the last quarter. Pier Capital LLC boosted its position in Celestica by 0.4% during the third quarter. Pier Capital LLC now owns 93,055 shares of the technology company's stock worth $4,757,000 after purchasing an additional 335 shares in the last quarter. Finally, Creative Planning boosted its position in Celestica by 4.7% during the second quarter. Creative Planning now owns 7,526 shares of the technology company's stock worth $431,000 after purchasing an additional 336 shares in the last quarter. Institutional investors and hedge funds own 67.38% of the company's stock.

Celestica Trading Up 9.0 %

Shares of NYSE:CLS traded up $8.19 during midday trading on Friday, reaching $99.20. The company's stock had a trading volume of 4,118,795 shares, compared to its average volume of 2,287,013. The business has a 50 day moving average price of $76.65 and a 200 day moving average price of $61.09. Celestica Inc. has a 1 year low of $26.62 and a 1 year high of $99.34. The firm has a market cap of $11.54 billion, a price-to-earnings ratio of 31.49 and a beta of 2.27. The company has a quick ratio of 0.87, a current ratio of 1.47 and a debt-to-equity ratio of 0.49.

Celestica (NYSE:CLS - Get Free Report) TSE: CLS last posted its quarterly earnings data on Wednesday, October 23rd. The technology company reported $1.04 EPS for the quarter, beating analysts' consensus estimates of $0.93 by $0.11. Celestica had a net margin of 4.08% and a return on equity of 21.58%. The company had revenue of $2.50 billion during the quarter, compared to the consensus estimate of $2.41 billion. During the same quarter in the prior year, the company posted $0.65 EPS. The company's quarterly revenue was up 24.8% compared to the same quarter last year. Research analysts forecast that Celestica Inc. will post 3.44 EPS for the current year.

Analysts Set New Price Targets

CLS has been the subject of a number of research analyst reports. UBS Group started coverage on Celestica in a research report on Friday, November 22nd. They issued a "neutral" rating and a $95.00 price target for the company. Barclays assumed coverage on shares of Celestica in a research report on Tuesday, November 5th. They set an "overweight" rating and a $91.00 target price for the company. TD Securities increased their price target on shares of Celestica from $68.00 to $70.00 and gave the company a "buy" rating in a research report on Thursday, October 24th. BMO Capital Markets lifted their price objective on Celestica from $64.00 to $72.00 and gave the stock an "outperform" rating in a research report on Thursday, October 24th. Finally, Stifel Nicolaus increased their target price on Celestica from $70.00 to $100.00 and gave the company a "buy" rating in a report on Tuesday. Three equities research analysts have rated the stock with a hold rating and nine have issued a buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $74.18.

View Our Latest Research Report on CLS

Celestica Company Profile

(

Free Report)

Celestica Inc provides supply chain solutions in North America, Europe, and Asia. It operates through two segments: Advanced Technology Solutions, and Connectivity & Cloud Solutions. The company offers a range of product manufacturing and related supply chain services, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services.

Further Reading

Before you consider Celestica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celestica wasn't on the list.

While Celestica currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.