World Investment Advisors LLC acquired a new position in Sempra (NYSE:SRE - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 72,094 shares of the utilities provider's stock, valued at approximately $6,029,000.

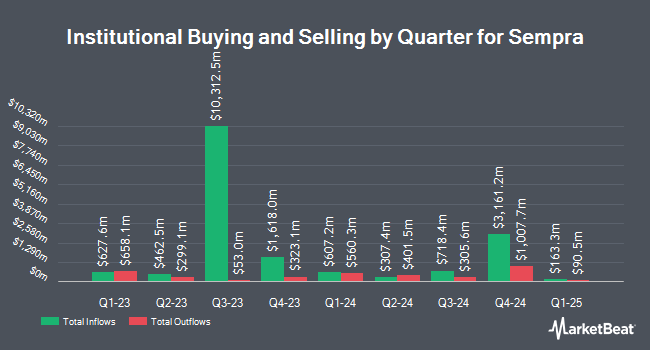

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Wellington Management Group LLP increased its stake in shares of Sempra by 0.4% during the 3rd quarter. Wellington Management Group LLP now owns 34,324,893 shares of the utilities provider's stock worth $2,870,591,000 after purchasing an additional 128,847 shares during the last quarter. State Street Corp lifted its stake in shares of Sempra by 4.9% in the 3rd quarter. State Street Corp now owns 32,940,620 shares of the utilities provider's stock valued at $2,774,974,000 after purchasing an additional 1,539,026 shares during the last quarter. FMR LLC boosted its holdings in Sempra by 9.1% in the third quarter. FMR LLC now owns 18,978,605 shares of the utilities provider's stock worth $1,587,181,000 after purchasing an additional 1,582,653 shares in the last quarter. Clearbridge Investments LLC increased its position in Sempra by 6.9% during the second quarter. Clearbridge Investments LLC now owns 13,452,912 shares of the utilities provider's stock worth $1,023,228,000 after buying an additional 874,133 shares during the last quarter. Finally, Geode Capital Management LLC raised its holdings in Sempra by 1.2% during the third quarter. Geode Capital Management LLC now owns 12,761,872 shares of the utilities provider's stock valued at $1,063,007,000 after buying an additional 145,873 shares in the last quarter. Institutional investors own 89.65% of the company's stock.

Insider Activity

In other Sempra news, VP Trevor I. Mihalik sold 23,713 shares of Sempra stock in a transaction that occurred on Wednesday, November 20th. The stock was sold at an average price of $93.09, for a total transaction of $2,207,443.17. Following the sale, the vice president now directly owns 11,190 shares of the company's stock, valued at approximately $1,041,677.10. The trade was a 67.94 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 0.24% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

Several analysts have recently issued reports on SRE shares. BMO Capital Markets upped their price target on Sempra from $93.00 to $96.00 and gave the stock an "outperform" rating in a research note on Monday, October 21st. Evercore ISI upped their target price on Sempra from $84.00 to $88.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Jefferies Financial Group assumed coverage on shares of Sempra in a research report on Thursday, October 24th. They issued a "buy" rating and a $98.00 price target on the stock. Barclays upped their price objective on shares of Sempra from $89.00 to $99.00 and gave the stock an "overweight" rating in a report on Monday, December 2nd. Finally, Wells Fargo & Company lifted their target price on shares of Sempra from $87.00 to $96.00 and gave the stock an "overweight" rating in a report on Thursday, November 7th. One research analyst has rated the stock with a sell rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat.com, Sempra presently has a consensus rating of "Moderate Buy" and a consensus target price of $91.60.

Check Out Our Latest Analysis on Sempra

Sempra Stock Performance

NYSE:SRE traded up $1.36 during trading hours on Friday, hitting $89.29. 936,172 shares of the company traded hands, compared to its average volume of 2,924,630. The company has a current ratio of 0.52, a quick ratio of 0.47 and a debt-to-equity ratio of 0.89. The stock has a market capitalization of $56.56 billion, a price-to-earnings ratio of 19.37, a P/E/G ratio of 2.40 and a beta of 0.77. The firm has a 50-day moving average of $87.95 and a 200 day moving average of $82.06. Sempra has a twelve month low of $66.40 and a twelve month high of $95.77.

Sempra (NYSE:SRE - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The utilities provider reported $0.89 EPS for the quarter, missing analysts' consensus estimates of $1.05 by ($0.16). Sempra had a net margin of 22.63% and a return on equity of 8.06%. The company had revenue of $2.78 billion for the quarter, compared to analyst estimates of $3.54 billion. During the same period in the prior year, the company posted $1.08 EPS. The firm's quarterly revenue was down 16.7% on a year-over-year basis. On average, analysts forecast that Sempra will post 4.76 EPS for the current year.

Sempra Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Thursday, December 5th will be issued a dividend of $0.62 per share. This represents a $2.48 annualized dividend and a dividend yield of 2.78%. The ex-dividend date of this dividend is Thursday, December 5th. Sempra's payout ratio is presently 54.63%.

About Sempra

(

Free Report)

Sempra operates as an energy infrastructure company in the United States and internationally. It operates through three segments: Sempra California, Sempra Texas Utilities, and Sempra Infrastructure. The Sempra California segment provides electric services; and natural gas services to San Diego County.

Read More

Before you consider Sempra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sempra wasn't on the list.

While Sempra currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.