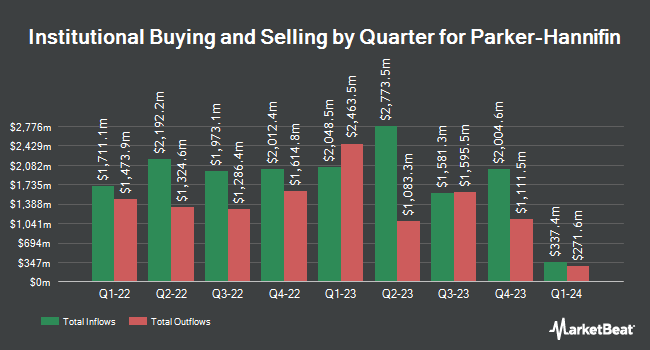

World Investment Advisors LLC bought a new position in shares of Parker-Hannifin Co. (NYSE:PH - Free Report) in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund bought 924 shares of the industrial products company's stock, valued at approximately $584,000.

Several other institutional investors also recently modified their holdings of the stock. Wilkinson Global Asset Management LLC increased its holdings in shares of Parker-Hannifin by 59.1% in the third quarter. Wilkinson Global Asset Management LLC now owns 39,093 shares of the industrial products company's stock worth $24,700,000 after acquiring an additional 14,526 shares in the last quarter. Banco Santander S.A. grew its position in shares of Parker-Hannifin by 11.9% in the 3rd quarter. Banco Santander S.A. now owns 14,478 shares of the industrial products company's stock valued at $9,147,000 after purchasing an additional 1,544 shares during the period. Ritholtz Wealth Management increased its stake in Parker-Hannifin by 88.4% during the 3rd quarter. Ritholtz Wealth Management now owns 1,473 shares of the industrial products company's stock worth $931,000 after purchasing an additional 691 shares in the last quarter. FMR LLC raised its holdings in Parker-Hannifin by 7.1% during the 3rd quarter. FMR LLC now owns 4,116,257 shares of the industrial products company's stock worth $2,600,733,000 after buying an additional 272,531 shares during the period. Finally, Hantz Financial Services Inc. lifted its stake in Parker-Hannifin by 3.2% in the third quarter. Hantz Financial Services Inc. now owns 40,332 shares of the industrial products company's stock valued at $25,483,000 after buying an additional 1,267 shares in the last quarter. 82.44% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on the stock. Argus raised their price objective on shares of Parker-Hannifin from $650.00 to $710.00 and gave the stock a "buy" rating in a report on Tuesday, November 5th. Truist Financial lifted their price target on Parker-Hannifin from $673.00 to $788.00 and gave the company a "buy" rating in a research note on Wednesday, October 9th. Barclays upped their price objective on Parker-Hannifin from $703.00 to $800.00 and gave the stock an "overweight" rating in a research report on Thursday, December 5th. Raymond James lifted their target price on Parker-Hannifin from $610.00 to $650.00 and gave the company an "outperform" rating in a research report on Wednesday, September 4th. Finally, Robert W. Baird raised their price target on shares of Parker-Hannifin from $695.00 to $710.00 and gave the stock an "outperform" rating in a research note on Friday, November 1st. Two equities research analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Parker-Hannifin currently has a consensus rating of "Moderate Buy" and an average target price of $709.65.

View Our Latest Stock Analysis on Parker-Hannifin

Parker-Hannifin Stock Performance

NYSE:PH traded down $7.75 during mid-day trading on Tuesday, hitting $665.99. The stock had a trading volume of 690,270 shares, compared to its average volume of 635,204. The company's 50 day simple moving average is $669.49 and its 200 day simple moving average is $597.76. The stock has a market cap of $85.73 billion, a price-to-earnings ratio of 30.43, a PEG ratio of 2.71 and a beta of 1.43. The company has a debt-to-equity ratio of 0.52, a quick ratio of 0.57 and a current ratio of 0.96. Parker-Hannifin Co. has a twelve month low of $440.00 and a twelve month high of $712.42.

Parker-Hannifin (NYSE:PH - Get Free Report) last issued its earnings results on Thursday, October 31st. The industrial products company reported $6.20 EPS for the quarter, topping the consensus estimate of $6.14 by $0.06. Parker-Hannifin had a return on equity of 27.95% and a net margin of 14.47%. The company had revenue of $4.90 billion during the quarter, compared to the consensus estimate of $4.90 billion. During the same period in the previous year, the company posted $5.96 EPS. The firm's revenue for the quarter was up 1.2% compared to the same quarter last year. On average, equities research analysts forecast that Parker-Hannifin Co. will post 26.75 earnings per share for the current year.

Parker-Hannifin Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, December 6th. Stockholders of record on Friday, November 8th were issued a dividend of $1.63 per share. This represents a $6.52 dividend on an annualized basis and a dividend yield of 0.98%. The ex-dividend date of this dividend was Friday, November 8th. Parker-Hannifin's dividend payout ratio is presently 29.45%.

Insider Activity

In related news, COO Andrew D. Ross sold 4,864 shares of the stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $706.04, for a total transaction of $3,434,178.56. Following the sale, the chief operating officer now owns 13,120 shares of the company's stock, valued at $9,263,244.80. This represents a 27.05 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, VP Joseph R. Leonti sold 5,877 shares of Parker-Hannifin stock in a transaction on Friday, November 1st. The shares were sold at an average price of $631.04, for a total value of $3,708,622.08. Following the completion of the transaction, the vice president now directly owns 15,350 shares of the company's stock, valued at $9,686,464. This represents a 27.69 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 18,077 shares of company stock valued at $12,303,829. 0.39% of the stock is owned by insiders.

Parker-Hannifin Profile

(

Free Report)

Parker-Hannifin Corporation manufactures and sells motion and control technologies and systems for various mobile, industrial, and aerospace markets worldwide. The company operates through two segments: Diversified Industrial and Aerospace Systems. The Diversified Industrial segment offers sealing, shielding, thermal products and systems, adhesives, coatings, and noise vibration and harshness solutions; filters, systems, and diagnostics solutions to ensure purity and remove contaminants from fuel, air, oil, water, and other liquids and gases; connectors used in fluid and gas handling; and hydraulic, pneumatic, and electromechanical components and systems for builders and users of mobile and industrial machinery and equipment.

See Also

Before you consider Parker-Hannifin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parker-Hannifin wasn't on the list.

While Parker-Hannifin currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report