Worldquant Millennium Advisors LLC lifted its position in shares of GitLab Inc. (NASDAQ:GTLB - Free Report) by 309.4% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 39,434 shares of the company's stock after purchasing an additional 29,803 shares during the quarter. Worldquant Millennium Advisors LLC's holdings in GitLab were worth $2,032,000 at the end of the most recent reporting period.

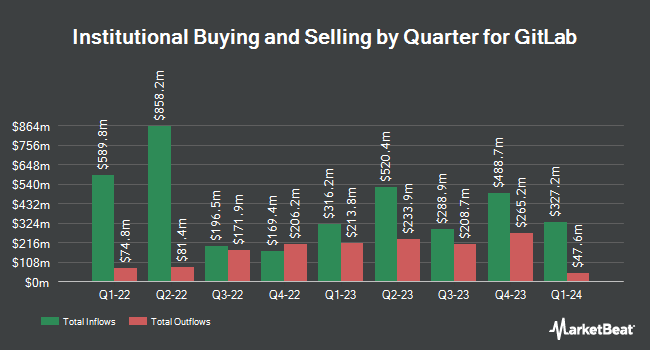

A number of other hedge funds and other institutional investors also recently made changes to their positions in the company. ARK Investment Management LLC bought a new stake in GitLab in the 3rd quarter valued at $13,435,000. Mission Creek Capital Partners Inc. lifted its position in GitLab by 113.9% in the 3rd quarter. Mission Creek Capital Partners Inc. now owns 79,917 shares of the company's stock valued at $4,119,000 after acquiring an additional 42,550 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. lifted its position in GitLab by 111.1% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 336,317 shares of the company's stock valued at $17,334,000 after acquiring an additional 176,967 shares in the last quarter. Victory Capital Management Inc. lifted its position in GitLab by 56.1% in the 3rd quarter. Victory Capital Management Inc. now owns 352,256 shares of the company's stock valued at $18,155,000 after acquiring an additional 126,578 shares in the last quarter. Finally, William Blair Investment Management LLC bought a new stake in GitLab in the 2nd quarter valued at $16,071,000. 95.04% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts have commented on GTLB shares. Baird R W raised shares of GitLab to a "strong-buy" rating in a research report on Tuesday, August 27th. BTIG Research boosted their price target on shares of GitLab from $58.00 to $63.00 and gave the stock a "buy" rating in a research report on Wednesday, September 4th. TD Cowen boosted their price target on shares of GitLab from $63.00 to $70.00 and gave the stock a "buy" rating in a research report on Thursday, November 21st. Needham & Company LLC boosted their price target on shares of GitLab from $70.00 to $85.00 and gave the stock a "buy" rating in a research report on Friday. Finally, Piper Sandler boosted their price target on shares of GitLab from $75.00 to $85.00 and gave the stock an "overweight" rating in a research report on Friday. Three research analysts have rated the stock with a hold rating, twenty-two have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $75.88.

Read Our Latest Report on GTLB

GitLab Stock Performance

Shares of GitLab stock traded down $0.46 on Monday, reaching $66.73. 4,682,635 shares of the stock were exchanged, compared to its average volume of 2,403,436. The firm's 50 day moving average is $58.22 and its 200-day moving average is $52.27. GitLab Inc. has a one year low of $40.72 and a one year high of $78.53. The firm has a market cap of $10.71 billion, a PE ratio of -208.53 and a beta of 0.54.

Insider Transactions at GitLab

In related news, CEO Sytse Sijbrandij sold 84,776 shares of the stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $59.64, for a total value of $5,056,040.64. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CFO Brian G. Robins sold 16,666 shares of the stock in a transaction that occurred on Friday, November 1st. The shares were sold at an average price of $56.74, for a total transaction of $945,628.84. Following the completion of the transaction, the chief financial officer now directly owns 242,803 shares of the company's stock, valued at approximately $13,776,642.22. The trade was a 6.42 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 168,365 shares of company stock valued at $9,674,784. Company insiders own 21.36% of the company's stock.

GitLab Profile

(

Free Report)

GitLab Inc, through its subsidiaries, develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific. It offers GitLab, a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

Featured Stories

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.