Worldquant Millennium Advisors LLC lessened its stake in shares of Pinterest, Inc. (NYSE:PINS - Free Report) by 97.6% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 16,438 shares of the company's stock after selling 668,727 shares during the quarter. Worldquant Millennium Advisors LLC's holdings in Pinterest were worth $532,000 at the end of the most recent reporting period.

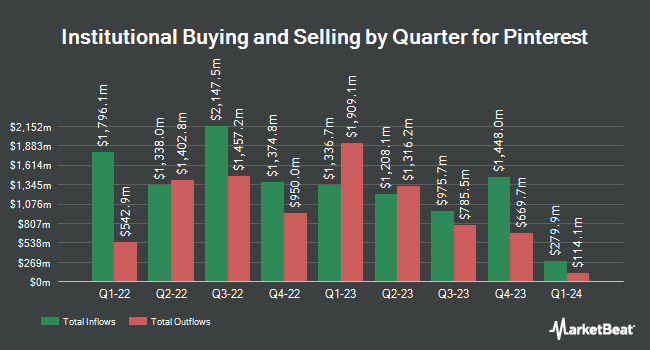

Other institutional investors have also modified their holdings of the company. State Street Corp lifted its holdings in Pinterest by 1.2% in the 3rd quarter. State Street Corp now owns 12,773,652 shares of the company's stock valued at $413,483,000 after purchasing an additional 156,748 shares in the last quarter. Baillie Gifford & Co. grew its position in Pinterest by 9.5% in the second quarter. Baillie Gifford & Co. now owns 10,116,139 shares of the company's stock valued at $445,818,000 after acquiring an additional 880,398 shares in the last quarter. Ontario Teachers Pension Plan Board boosted its stake in shares of Pinterest by 51.5% during the 3rd quarter. Ontario Teachers Pension Plan Board now owns 8,812,117 shares of the company's stock valued at $285,248,000 after buying an additional 2,996,750 shares during the last quarter. Bank of New York Mellon Corp boosted its stake in shares of Pinterest by 6.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 5,960,861 shares of the company's stock valued at $262,695,000 after buying an additional 380,431 shares during the last quarter. Finally, Sumitomo Mitsui Trust Group Inc. lifted its stake in Pinterest by 8.4% during the third quarter. Sumitomo Mitsui Trust Group Inc. now owns 5,944,489 shares of the company's stock worth $192,423,000 after purchasing an additional 460,708 shares during the last quarter. 88.81% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research firms recently weighed in on PINS. KeyCorp decreased their price target on Pinterest from $45.00 to $39.00 and set an "overweight" rating for the company in a research report on Monday, November 11th. Robert W. Baird reduced their price target on Pinterest from $41.00 to $36.00 and set an "outperform" rating for the company in a report on Friday, November 8th. Cantor Fitzgerald reissued an "overweight" rating and issued a $41.00 price objective on shares of Pinterest in a research note on Monday, October 7th. Royal Bank of Canada reissued an "outperform" rating and issued a $48.00 price objective on shares of Pinterest in a research note on Thursday, September 12th. Finally, Raymond James dropped their price target on Pinterest from $40.00 to $34.00 and set an "outperform" rating on the stock in a research report on Friday, November 8th. Seven investment analysts have rated the stock with a hold rating, twenty have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, Pinterest presently has an average rating of "Moderate Buy" and an average target price of $41.65.

Read Our Latest Analysis on PINS

Insider Activity

In related news, CAO Andrea Acosta sold 3,845 shares of Pinterest stock in a transaction that occurred on Wednesday, November 27th. The stock was sold at an average price of $30.88, for a total transaction of $118,733.60. Following the transaction, the chief accounting officer now owns 158,468 shares of the company's stock, valued at $4,893,491.84. The trade was a 2.37 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, insider Wanjiku Juanita Walcott sold 11,862 shares of the business's stock in a transaction on Wednesday, November 27th. The stock was sold at an average price of $30.82, for a total value of $365,586.84. Following the completion of the transaction, the insider now directly owns 246,921 shares in the company, valued at approximately $7,610,105.22. This represents a 4.58 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 48,287 shares of company stock valued at $1,547,820. 7.11% of the stock is currently owned by corporate insiders.

Pinterest Stock Up 2.4 %

Shares of PINS traded up $0.79 during trading hours on Monday, hitting $33.07. 11,962,250 shares of the company were exchanged, compared to its average volume of 9,638,189. The company has a market cap of $22.35 billion, a price-to-earnings ratio of 107.60, a P/E/G ratio of 2.28 and a beta of 1.02. Pinterest, Inc. has a fifty-two week low of $27.00 and a fifty-two week high of $45.19. The firm's fifty day moving average is $31.77 and its 200 day moving average is $34.97.

Pinterest Company Profile

(

Free Report)

Pinterest, Inc operates as a visual search and discovery platform in the United States and internationally. Its platform allows people to find ideas, such as recipes, home and style inspiration, and others; and to search, save, and shop the ideas. The company was formerly known as Cold Brew Labs Inc and changed its name to Pinterest, Inc in April 2012.

Read More

Before you consider Pinterest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinterest wasn't on the list.

While Pinterest currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.