Worldquant Millennium Advisors LLC acquired a new stake in International Paper (NYSE:IP - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor acquired 228,982 shares of the basic materials company's stock, valued at approximately $11,186,000. Worldquant Millennium Advisors LLC owned 0.07% of International Paper at the end of the most recent quarter.

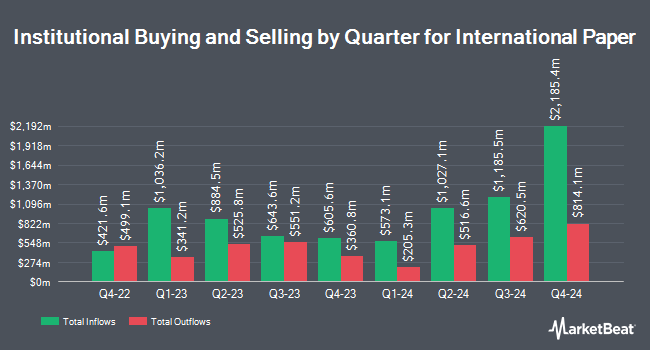

Other hedge funds have also modified their holdings of the company. FMR LLC raised its position in International Paper by 88.4% in the 3rd quarter. FMR LLC now owns 17,839,237 shares of the basic materials company's stock valued at $871,447,000 after purchasing an additional 8,370,273 shares during the last quarter. Bank of New York Mellon Corp raised its holdings in shares of International Paper by 133.7% in the second quarter. Bank of New York Mellon Corp now owns 14,214,754 shares of the basic materials company's stock valued at $613,367,000 after buying an additional 8,132,332 shares during the last quarter. Massachusetts Financial Services Co. MA acquired a new stake in shares of International Paper during the second quarter worth about $119,012,000. Point72 Asset Management L.P. grew its holdings in shares of International Paper by 511.1% during the third quarter. Point72 Asset Management L.P. now owns 2,970,432 shares of the basic materials company's stock worth $145,106,000 after buying an additional 2,484,386 shares during the last quarter. Finally, Diamond Hill Capital Management Inc. increased its position in International Paper by 125.1% in the 3rd quarter. Diamond Hill Capital Management Inc. now owns 4,235,846 shares of the basic materials company's stock valued at $206,921,000 after acquiring an additional 2,354,341 shares during the period. 81.95% of the stock is currently owned by hedge funds and other institutional investors.

International Paper Price Performance

Shares of NYSE IP traded up $0.07 during trading on Friday, hitting $56.78. 2,204,679 shares of the company were exchanged, compared to its average volume of 3,890,151. The firm's fifty day moving average price is $53.29 and its 200 day moving average price is $48.62. The company has a debt-to-equity ratio of 0.62, a current ratio of 1.53 and a quick ratio of 1.11. The company has a market cap of $19.73 billion, a price-to-earnings ratio of 48.53 and a beta of 1.02. International Paper has a 1 year low of $32.70 and a 1 year high of $60.36.

International Paper (NYSE:IP - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The basic materials company reported $0.44 EPS for the quarter, topping analysts' consensus estimates of $0.24 by $0.20. International Paper had a net margin of 2.25% and a return on equity of 6.49%. The firm had revenue of $4.69 billion for the quarter, compared to the consensus estimate of $4.70 billion. During the same quarter in the previous year, the firm earned $0.64 earnings per share. The firm's revenue was up 1.6% on a year-over-year basis. On average, sell-side analysts expect that International Paper will post 1.22 earnings per share for the current fiscal year.

International Paper Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 15th will be issued a dividend of $0.4625 per share. The ex-dividend date of this dividend is Friday, November 15th. This represents a $1.85 annualized dividend and a yield of 3.26%. International Paper's dividend payout ratio is presently 158.12%.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on IP shares. Truist Financial reaffirmed a "buy" rating and set a $61.00 price objective (up from $57.00) on shares of International Paper in a research report on Friday, November 1st. Argus raised International Paper from a "hold" rating to a "buy" rating and set a $52.00 price target for the company in a report on Wednesday, August 14th. Royal Bank of Canada boosted their price objective on shares of International Paper from $56.00 to $64.00 and gave the company an "outperform" rating in a research note on Friday, November 1st. Finally, BNP Paribas cut shares of International Paper from a "neutral" rating to an "underperform" rating and set a $48.20 target price for the company. in a research note on Wednesday, November 13th. One analyst has rated the stock with a sell rating, three have issued a hold rating, six have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $51.54.

View Our Latest Stock Report on IP

Insiders Place Their Bets

In other news, Director Kathryn D. Sullivan sold 600 shares of the firm's stock in a transaction that occurred on Friday, November 29th. The shares were sold at an average price of $58.39, for a total transaction of $35,034.00. Following the completion of the transaction, the director now directly owns 37,145 shares of the company's stock, valued at $2,168,896.55. This trade represents a 1.59 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, SVP Joseph R. Saab sold 2,440 shares of International Paper stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $47.30, for a total value of $115,412.00. Following the transaction, the senior vice president now owns 18,668 shares of the company's stock, valued at $882,996.40. This represents a 11.56 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 6,040 shares of company stock worth $304,004. 0.55% of the stock is owned by corporate insiders.

International Paper Company Profile

(

Free Report)

International Paper Company produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa. It operates through two segments, Industrial Packaging and Global Cellulose Fibers. The company offers linerboard, medium, whitetop, recycled linerboard, recycled medium and saturating kraft; and pulp for a range of applications, such as diapers, towel and tissue products, feminine care, incontinence, and other personal care products, as well as specialty pulps for use in textiles, construction materials, paints, coatings, and others.

Further Reading

Before you consider International Paper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Paper wasn't on the list.

While International Paper currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report