Worldquant Millennium Advisors LLC decreased its holdings in IQVIA Holdings Inc. (NYSE:IQV - Free Report) by 88.6% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 14,380 shares of the medical research company's stock after selling 111,332 shares during the quarter. Worldquant Millennium Advisors LLC's holdings in IQVIA were worth $3,408,000 as of its most recent filing with the SEC.

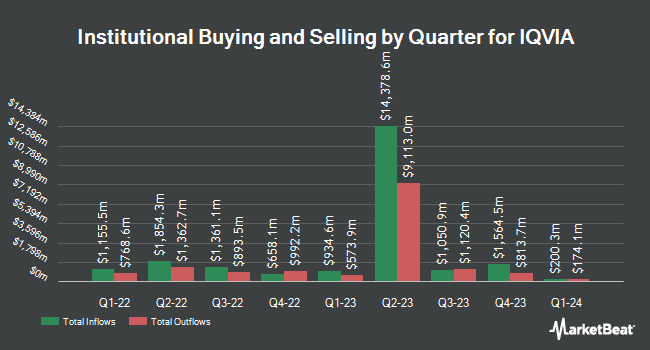

Other institutional investors and hedge funds have also recently bought and sold shares of the company. First Foundation Advisors boosted its stake in shares of IQVIA by 3.8% during the 2nd quarter. First Foundation Advisors now owns 1,161 shares of the medical research company's stock valued at $245,000 after buying an additional 43 shares during the last quarter. Invera Wealth Advisors LLC grew its holdings in IQVIA by 0.3% during the 2nd quarter. Invera Wealth Advisors LLC now owns 14,506 shares of the medical research company's stock worth $3,183,000 after acquiring an additional 46 shares in the last quarter. Private Trust Co. NA increased its position in shares of IQVIA by 10.7% in the 3rd quarter. Private Trust Co. NA now owns 485 shares of the medical research company's stock worth $115,000 after purchasing an additional 47 shares during the last quarter. Oregon Public Employees Retirement Fund raised its stake in shares of IQVIA by 0.3% in the 2nd quarter. Oregon Public Employees Retirement Fund now owns 15,668 shares of the medical research company's stock valued at $3,313,000 after purchasing an additional 48 shares in the last quarter. Finally, Continuum Advisory LLC lifted its position in shares of IQVIA by 3.3% during the second quarter. Continuum Advisory LLC now owns 1,538 shares of the medical research company's stock worth $325,000 after purchasing an additional 49 shares during the last quarter. Hedge funds and other institutional investors own 89.62% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have issued reports on IQV shares. Truist Financial cut their price objective on IQVIA from $286.00 to $265.00 and set a "buy" rating on the stock in a research note on Monday, November 4th. Evercore ISI reduced their price objective on IQVIA from $270.00 to $265.00 and set an "outperform" rating on the stock in a research note on Tuesday, October 8th. JPMorgan Chase & Co. decreased their price objective on shares of IQVIA from $279.00 to $240.00 and set an "overweight" rating for the company in a report on Tuesday, November 5th. Deutsche Bank Aktiengesellschaft dropped their target price on shares of IQVIA from $270.00 to $265.00 and set a "buy" rating on the stock in a report on Friday, November 1st. Finally, BTIG Research decreased their price target on shares of IQVIA from $290.00 to $260.00 and set a "buy" rating for the company in a report on Friday, November 1st. Five equities research analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, IQVIA presently has an average rating of "Moderate Buy" and an average price target of $256.50.

Read Our Latest Stock Analysis on IQVIA

IQVIA Stock Performance

IQVIA stock traded up $2.70 during mid-day trading on Friday, hitting $202.63. 1,388,125 shares of the company's stock traded hands, compared to its average volume of 2,002,141. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 1.76. IQVIA Holdings Inc. has a one year low of $187.62 and a one year high of $261.73. The firm has a 50 day moving average price of $215.18 and a 200 day moving average price of $225.11. The company has a market cap of $36.78 billion, a PE ratio of 26.59, a price-to-earnings-growth ratio of 2.09 and a beta of 1.49.

IQVIA Profile

(

Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Further Reading

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.