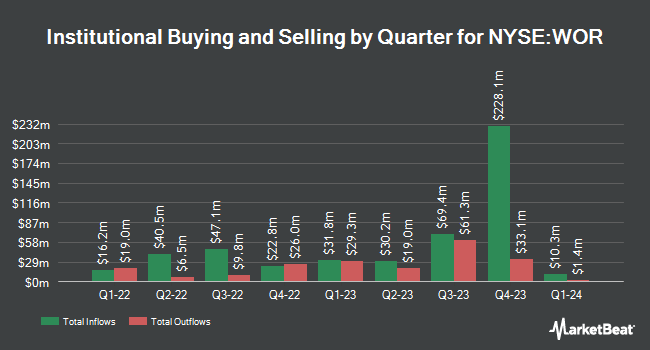

Jane Street Group LLC raised its holdings in Worthington Enterprises, Inc. (NYSE:WOR - Free Report) by 98.9% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 79,464 shares of the industrial products company's stock after buying an additional 39,507 shares during the quarter. Jane Street Group LLC owned 0.16% of Worthington Enterprises worth $3,294,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently modified their holdings of the business. American Century Companies Inc. increased its position in Worthington Enterprises by 43.7% in the 2nd quarter. American Century Companies Inc. now owns 568,678 shares of the industrial products company's stock valued at $26,916,000 after buying an additional 172,850 shares in the last quarter. Private Wealth Strategies L.L.C. bought a new stake in shares of Worthington Enterprises during the second quarter valued at approximately $3,913,000. Edgestream Partners L.P. acquired a new position in shares of Worthington Enterprises during the second quarter worth approximately $3,060,000. Panagora Asset Management Inc. bought a new position in shares of Worthington Enterprises in the 2nd quarter worth $2,044,000. Finally, Connor Clark & Lunn Investment Management Ltd. acquired a new stake in Worthington Enterprises in the 3rd quarter valued at $1,764,000. 51.59% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on WOR. StockNews.com upgraded shares of Worthington Enterprises from a "sell" rating to a "hold" rating in a report on Wednesday, September 25th. Canaccord Genuity Group dropped their price target on shares of Worthington Enterprises from $52.00 to $46.00 and set a "hold" rating on the stock in a research report on Thursday, September 26th. Finally, Canaccord Genuity Group boosted their price objective on Worthington Enterprises from $46.00 to $49.00 and gave the stock a "hold" rating in a report on Thursday.

Get Our Latest Analysis on WOR

Worthington Enterprises Stock Down 1.1 %

Shares of WOR traded down $0.44 during trading hours on Friday, reaching $40.78. 1,459,291 shares of the stock traded hands, compared to its average volume of 281,503. Worthington Enterprises, Inc. has a 52 week low of $37.88 and a 52 week high of $69.96. The company has a current ratio of 3.47, a quick ratio of 2.34 and a debt-to-equity ratio of 0.33. The stock has a fifty day simple moving average of $40.38 and a 200 day simple moving average of $44.23. The company has a market cap of $2.05 billion, a price-to-earnings ratio of 53.66 and a beta of 1.26.

Worthington Enterprises (NYSE:WOR - Get Free Report) last announced its earnings results on Tuesday, December 17th. The industrial products company reported $0.60 earnings per share for the quarter, topping analysts' consensus estimates of $0.52 by $0.08. The firm had revenue of $274.05 million for the quarter, compared to the consensus estimate of $273.77 million. Worthington Enterprises had a return on equity of 12.23% and a net margin of 1.96%. The company's revenue was down 8.1% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.78 EPS.

Worthington Enterprises Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, March 28th. Investors of record on Friday, March 14th will be given a dividend of $0.17 per share. This represents a $0.68 annualized dividend and a yield of 1.67%. Worthington Enterprises's payout ratio is currently 81.93%.

Insider Buying and Selling

In other news, CFO Joseph B. Hayek acquired 2,500 shares of the firm's stock in a transaction that occurred on Friday, October 11th. The stock was bought at an average price of $40.21 per share, with a total value of $100,525.00. Following the acquisition, the chief financial officer now owns 168,875 shares in the company, valued at $6,790,463.75. The trade was a 1.50 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which is accessible through the SEC website. 37.50% of the stock is currently owned by corporate insiders.

About Worthington Enterprises

(

Free Report)

Worthington Enterprises, Inc operates as an industrial manufacturing company. It operates through three segments: Building Products, Consumer Products, and Sustainable Energy Solutions. The Building Products segment sells refrigerant and LPG cylinders, well water and expansion tanks, fire suppression tanks, chemical tanks, and foam and adhesive tanks for gas producers, and distributors.

Read More

Before you consider Worthington Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Worthington Enterprises wasn't on the list.

While Worthington Enterprises currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.