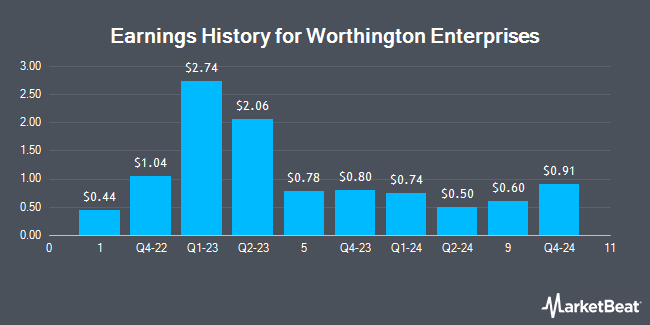

Worthington Enterprises (NYSE:WOR - Get Free Report) released its quarterly earnings data on Tuesday. The industrial products company reported $0.60 earnings per share for the quarter, beating analysts' consensus estimates of $0.52 by $0.08, Briefing.com reports. Worthington Enterprises had a net margin of 1.96% and a return on equity of 12.23%. The company had revenue of $274.05 million during the quarter, compared to analysts' expectations of $273.77 million. During the same quarter in the previous year, the company earned $0.78 earnings per share. The firm's revenue for the quarter was down 8.1% on a year-over-year basis.

Worthington Enterprises Price Performance

Shares of WOR stock traded down $0.55 on Tuesday, reaching $38.13. 416,129 shares of the company were exchanged, compared to its average volume of 272,827. The company has a market cap of $1.92 billion, a price-to-earnings ratio of 50.89 and a beta of 1.26. The business has a 50-day moving average price of $40.35 and a 200 day moving average price of $44.51. The company has a debt-to-equity ratio of 0.33, a quick ratio of 2.34 and a current ratio of 3.47. Worthington Enterprises has a 1 year low of $37.88 and a 1 year high of $69.96.

Worthington Enterprises Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, March 28th. Stockholders of record on Friday, March 14th will be paid a dividend of $0.17 per share. This represents a $0.68 dividend on an annualized basis and a dividend yield of 1.78%. Worthington Enterprises's dividend payout ratio is currently 89.47%.

Insider Transactions at Worthington Enterprises

In other Worthington Enterprises news, CFO Joseph B. Hayek acquired 2,500 shares of the company's stock in a transaction that occurred on Friday, October 11th. The stock was bought at an average price of $40.21 per share, with a total value of $100,525.00. Following the purchase, the chief financial officer now owns 168,875 shares in the company, valued at approximately $6,790,463.75. The trade was a 1.50 % increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 37.50% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts have weighed in on WOR shares. StockNews.com raised shares of Worthington Enterprises from a "sell" rating to a "hold" rating in a report on Wednesday, September 25th. Canaccord Genuity Group cut their price objective on shares of Worthington Enterprises from $52.00 to $46.00 and set a "hold" rating for the company in a report on Thursday, September 26th. Finally, Canaccord Genuity Group reaffirmed a "hold" rating and issued a $46.00 price objective on shares of Worthington Enterprises in a report on Friday, October 4th.

Read Our Latest Report on WOR

Worthington Enterprises Company Profile

(

Get Free Report)

Worthington Enterprises, Inc operates as an industrial manufacturing company. It operates through three segments: Building Products, Consumer Products, and Sustainable Energy Solutions. The Building Products segment sells refrigerant and LPG cylinders, well water and expansion tanks, fire suppression tanks, chemical tanks, and foam and adhesive tanks for gas producers, and distributors.

Featured Articles

Before you consider Worthington Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Worthington Enterprises wasn't on the list.

While Worthington Enterprises currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.