WW International (NASDAQ:WW - Get Free Report) was upgraded by equities research analysts at StockNews.com from a "sell" rating to a "hold" rating in a report released on Friday.

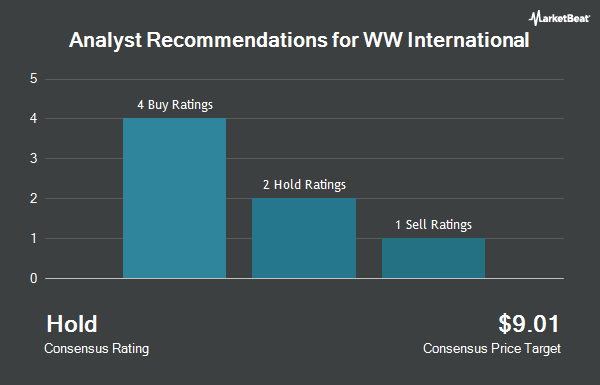

A number of other research firms have also recently commented on WW. UBS Group dropped their target price on shares of WW International from $2.10 to $1.00 and set a "neutral" rating for the company in a report on Friday, August 2nd. Guggenheim dropped their price objective on shares of WW International from $12.00 to $6.00 and set a "buy" rating for the company in a research note on Friday, August 2nd. Morgan Stanley cut shares of WW International from an "overweight" rating to an "equal weight" rating and decreased their target price for the stock from $6.50 to $1.25 in a research note on Friday, July 26th. Finally, Barclays reiterated an "underweight" rating and issued a $0.75 price target on shares of WW International in a research note on Thursday, October 10th. One analyst has rated the stock with a sell rating, three have issued a hold rating and three have given a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $4.50.

Check Out Our Latest Report on WW International

WW International Stock Performance

Shares of WW stock traded down $0.17 during trading on Friday, hitting $0.86. The company had a trading volume of 9,585,503 shares, compared to its average volume of 5,664,278. The firm has a market capitalization of $68.34 million, a P/E ratio of -0.15 and a beta of 1.69. WW International has a one year low of $0.67 and a one year high of $9.77. The stock's 50-day moving average price is $1.01 and its 200 day moving average price is $1.24.

WW International (NASDAQ:WW - Get Free Report) last issued its earnings results on Wednesday, November 6th. The company reported $0.24 EPS for the quarter, beating the consensus estimate of $0.05 by $0.19. The firm had revenue of $192.89 million during the quarter, compared to analyst estimates of $188.49 million. On average, research analysts anticipate that WW International will post -0.12 earnings per share for the current fiscal year.

Hedge Funds Weigh In On WW International

Hedge funds have recently made changes to their positions in the stock. SG Americas Securities LLC grew its stake in WW International by 52.1% during the first quarter. SG Americas Securities LLC now owns 47,409 shares of the company's stock worth $88,000 after purchasing an additional 16,244 shares during the period. BNP Paribas Financial Markets boosted its holdings in shares of WW International by 229.7% during the 1st quarter. BNP Paribas Financial Markets now owns 113,427 shares of the company's stock worth $210,000 after buying an additional 79,026 shares in the last quarter. Prism Advisors Inc. grew its position in shares of WW International by 110.0% during the 3rd quarter. Prism Advisors Inc. now owns 42,000 shares of the company's stock worth $37,000 after buying an additional 22,000 shares during the period. Marshall Wace LLP increased its stake in shares of WW International by 159.9% in the 2nd quarter. Marshall Wace LLP now owns 260,400 shares of the company's stock valued at $305,000 after acquiring an additional 160,200 shares in the last quarter. Finally, Empirical Capital Management LLC acquired a new position in shares of WW International during the 1st quarter valued at $185,000. 86.18% of the stock is currently owned by institutional investors.

WW International Company Profile

(

Get Free Report)

WW International, Inc provides weight management products and services worldwide. It offers a range of nutritional, activity, behavioral, and lifestyle tools and approaches products and services. The company also provides various digital subscription products to wellness and weight management business, which provide interactive and personalized resources that allow users to follow its weight management program through its app and web-based platform; and allows members to inspire and support each other by sharing their experiences with other people on weight health journeys.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider WW International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WW International wasn't on the list.

While WW International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.