Jane Street Group LLC reduced its position in Wyndham Hotels & Resorts, Inc. (NYSE:WH - Free Report) by 58.4% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 85,844 shares of the company's stock after selling 120,386 shares during the period. Jane Street Group LLC owned 0.11% of Wyndham Hotels & Resorts worth $6,708,000 at the end of the most recent quarter.

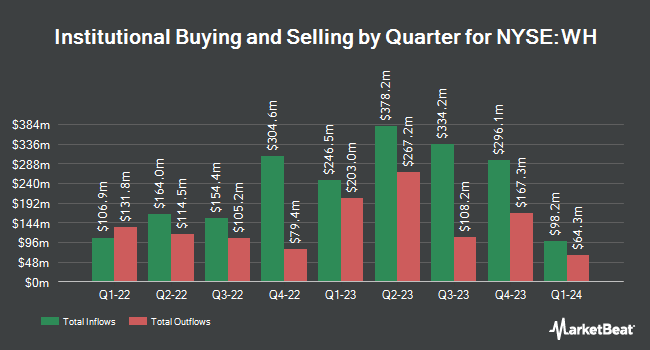

Other institutional investors have also modified their holdings of the company. Burgundy Asset Management Ltd. lifted its position in Wyndham Hotels & Resorts by 70.9% during the second quarter. Burgundy Asset Management Ltd. now owns 2,210,658 shares of the company's stock valued at $163,589,000 after acquiring an additional 916,742 shares during the last quarter. Thrivent Financial for Lutherans lifted its holdings in shares of Wyndham Hotels & Resorts by 40.8% during the 3rd quarter. Thrivent Financial for Lutherans now owns 1,747,295 shares of the company's stock valued at $136,533,000 after purchasing an additional 506,593 shares during the last quarter. Dimensional Fund Advisors LP boosted its position in shares of Wyndham Hotels & Resorts by 18.9% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,237,944 shares of the company's stock worth $91,609,000 after purchasing an additional 196,982 shares in the last quarter. Millennium Management LLC grew its stake in Wyndham Hotels & Resorts by 12.6% during the 2nd quarter. Millennium Management LLC now owns 1,174,404 shares of the company's stock worth $86,906,000 after buying an additional 131,848 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. increased its position in Wyndham Hotels & Resorts by 1.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 722,082 shares of the company's stock valued at $56,423,000 after buying an additional 7,241 shares in the last quarter. 93.46% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, Director Stephen P. Holmes sold 80,000 shares of the firm's stock in a transaction dated Friday, October 25th. The stock was sold at an average price of $91.01, for a total transaction of $7,280,800.00. Following the sale, the director now directly owns 366,371 shares in the company, valued at $33,343,424.71. This trade represents a 17.92 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Scott R. Strickland sold 2,850 shares of the company's stock in a transaction dated Tuesday, November 5th. The stock was sold at an average price of $88.14, for a total value of $251,199.00. Following the completion of the transaction, the insider now directly owns 26,062 shares of the company's stock, valued at $2,297,104.68. The trade was a 9.86 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 97,850 shares of company stock worth $8,881,849. Corporate insiders own 2.79% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts have weighed in on WH shares. Truist Financial raised their price target on Wyndham Hotels & Resorts from $103.00 to $105.00 and gave the stock a "buy" rating in a report on Friday, October 25th. JPMorgan Chase & Co. lifted their target price on shares of Wyndham Hotels & Resorts from $99.00 to $113.00 and gave the stock an "overweight" rating in a research note on Friday. StockNews.com upgraded shares of Wyndham Hotels & Resorts from a "sell" rating to a "hold" rating in a research note on Friday, November 1st. Barclays raised their price target on shares of Wyndham Hotels & Resorts from $100.00 to $115.00 and gave the stock an "overweight" rating in a report on Friday. Finally, Stifel Nicolaus boosted their price objective on shares of Wyndham Hotels & Resorts from $92.00 to $107.00 and gave the company a "buy" rating in a report on Tuesday, November 26th. Three investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. Based on data from MarketBeat, Wyndham Hotels & Resorts currently has an average rating of "Moderate Buy" and a consensus price target of $105.56.

Get Our Latest Stock Report on WH

Wyndham Hotels & Resorts Stock Performance

Shares of Wyndham Hotels & Resorts stock traded down $0.30 during trading on Friday, hitting $103.33. 762,722 shares of the company's stock were exchanged, compared to its average volume of 642,318. The stock has a market capitalization of $8.04 billion, a price-to-earnings ratio of 32.80, a PEG ratio of 2.42 and a beta of 1.32. The business has a 50-day simple moving average of $92.21 and a 200-day simple moving average of $81.12. Wyndham Hotels & Resorts, Inc. has a 52-week low of $67.67 and a 52-week high of $105.12. The company has a debt-to-equity ratio of 4.19, a quick ratio of 0.97 and a current ratio of 0.97.

Wyndham Hotels & Resorts (NYSE:WH - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The company reported $1.39 earnings per share for the quarter, beating analysts' consensus estimates of $1.38 by $0.01. The business had revenue of $396.00 million during the quarter, compared to analyst estimates of $408.32 million. Wyndham Hotels & Resorts had a return on equity of 51.79% and a net margin of 18.29%. The company's revenue was down 1.5% on a year-over-year basis. During the same quarter last year, the business posted $1.31 EPS. On average, research analysts forecast that Wyndham Hotels & Resorts, Inc. will post 4.29 EPS for the current year.

Wyndham Hotels & Resorts Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Friday, December 13th will be issued a $0.38 dividend. This represents a $1.52 dividend on an annualized basis and a yield of 1.47%. The ex-dividend date of this dividend is Friday, December 13th. Wyndham Hotels & Resorts's payout ratio is presently 48.25%.

About Wyndham Hotels & Resorts

(

Free Report)

Wyndham Hotels & Resorts, Inc operates as a hotel franchisor in the United States and internationally. It operates through Hotel Franchising and Hotel Management segments. The Hotel Franchising segment licenses its lodging brands and provides related services to third-party hotel owners and others.

Featured Stories

Before you consider Wyndham Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wyndham Hotels & Resorts wasn't on the list.

While Wyndham Hotels & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.