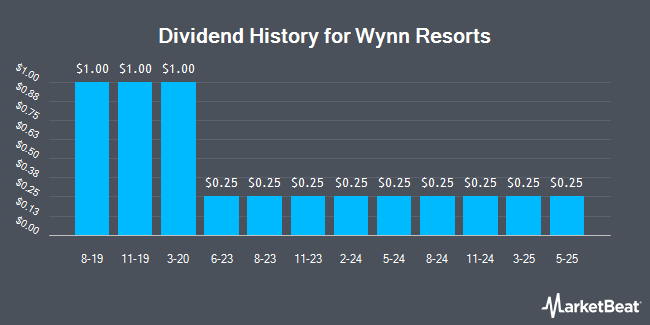

Wynn Resorts, Limited (NASDAQ:WYNN - Get Free Report) announced a quarterly dividend on Monday, November 4th, Zacks reports. Stockholders of record on Friday, November 15th will be paid a dividend of 0.25 per share by the casino operator on Wednesday, November 27th. This represents a $1.00 annualized dividend and a dividend yield of 1.17%. The ex-dividend date of this dividend is Friday, November 15th.

Wynn Resorts has decreased its dividend payment by an average of 9.1% per year over the last three years. Wynn Resorts has a dividend payout ratio of 18.9% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect Wynn Resorts to earn $5.48 per share next year, which means the company should continue to be able to cover its $1.00 annual dividend with an expected future payout ratio of 18.2%.

Wynn Resorts Trading Down 1.6 %

Shares of Wynn Resorts stock traded down $1.40 during trading on Wednesday, reaching $85.32. The company's stock had a trading volume of 4,783,465 shares, compared to its average volume of 2,167,544. Wynn Resorts has a one year low of $71.63 and a one year high of $110.38. The stock has a 50-day moving average price of $90.38 and a two-hundred day moving average price of $88.69. The stock has a market capitalization of $9.47 billion, a P/E ratio of 10.54, a price-to-earnings-growth ratio of 2.48 and a beta of 1.80.

Wynn Resorts (NASDAQ:WYNN - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The casino operator reported $0.90 earnings per share for the quarter, missing analysts' consensus estimates of $1.01 by ($0.11). The company had revenue of $1.69 billion during the quarter, compared to analyst estimates of $1.73 billion. Wynn Resorts had a net margin of 13.37% and a negative return on equity of 62.44%. The business's revenue for the quarter was up 1.3% on a year-over-year basis. During the same period in the prior year, the business earned $0.99 EPS. As a group, sell-side analysts anticipate that Wynn Resorts will post 5.42 EPS for the current fiscal year.

Insiders Place Their Bets

In related news, Director Patricia Mulroy sold 2,650 shares of the stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $78.73, for a total transaction of $208,634.50. Following the transaction, the director now owns 5,689 shares in the company, valued at $447,894.97. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Corporate insiders own 0.52% of the company's stock.

Wall Street Analyst Weigh In

WYNN has been the topic of several recent analyst reports. UBS Group raised shares of Wynn Resorts to a "hold" rating in a research note on Friday, August 23rd. Wells Fargo & Company decreased their price target on Wynn Resorts from $125.00 to $122.00 and set an "overweight" rating for the company in a research note on Tuesday. Deutsche Bank Aktiengesellschaft decreased their target price on Wynn Resorts from $122.00 to $118.00 and set a "buy" rating on the stock in a research report on Tuesday. Stifel Nicolaus cut their price target on Wynn Resorts from $121.00 to $103.00 and set a "buy" rating for the company in a research note on Friday, September 13th. Finally, Macquarie restated an "outperform" rating and set a $120.00 price objective on shares of Wynn Resorts in a research report on Tuesday. Four investment analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, Wynn Resorts currently has a consensus rating of "Moderate Buy" and a consensus target price of $115.71.

Read Our Latest Report on WYNN

Wynn Resorts Company Profile

(

Get Free Report)

Wynn Resorts, Limited designs, develops, and operates integrated resorts. The company operates through four segments: Wynn Palace, Wynn Macau, Las Vegas Operations, and Encore Boston Harbor. The Wynn Palace segment operates private gaming salons and sky casinos; a luxury hotel tower with suites, and villas, including a health club, spa, salon, and pool; food and beverage outlets; retail space; meeting and convention space; and performance lake and floral art displays.

Read More

Before you consider Wynn Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wynn Resorts wasn't on the list.

While Wynn Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.