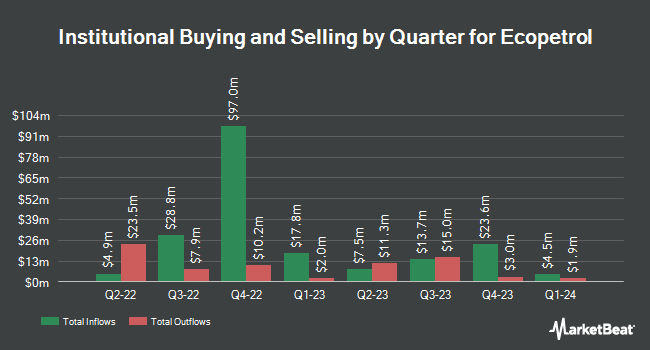

X Square Capital LLC acquired a new stake in Ecopetrol S.A. (NYSE:EC - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 52,000 shares of the oil and gas company's stock, valued at approximately $412,000.

A number of other institutional investors have also recently added to or reduced their stakes in EC. Charles Schwab Investment Management Inc. lifted its holdings in Ecopetrol by 81.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 425,116 shares of the oil and gas company's stock worth $3,796,000 after buying an additional 190,293 shares during the last quarter. Robeco Institutional Asset Management B.V. acquired a new position in Ecopetrol in the fourth quarter worth $790,000. SBI Securities Co. Ltd. bought a new stake in Ecopetrol during the fourth quarter valued at $2,060,000. Strategic Financial Concepts LLC acquired a new stake in shares of Ecopetrol during the fourth quarter worth $179,000. Finally, BNP Paribas Financial Markets boosted its stake in Ecopetrol by 61.9% in the third quarter. BNP Paribas Financial Markets now owns 56,783 shares of the oil and gas company's stock valued at $507,000 after acquiring an additional 21,703 shares during the period.

Ecopetrol Price Performance

NYSE:EC traded up $0.23 during midday trading on Monday, hitting $10.45. 2,993,866 shares of the stock were exchanged, compared to its average volume of 2,293,348. The company has a market capitalization of $21.47 billion, a price-to-earnings ratio of 5.01 and a beta of 1.22. The company has a current ratio of 1.68, a quick ratio of 1.38 and a debt-to-equity ratio of 1.00. Ecopetrol S.A. has a one year low of $7.21 and a one year high of $12.90. The business has a 50-day moving average price of $9.76 and a two-hundred day moving average price of $8.78.

Ecopetrol Increases Dividend

The company also recently announced a -- dividend, which will be paid on Friday, April 11th. Investors of record on Thursday, April 3rd will be paid a dividend of $0.5202 per share. The ex-dividend date of this dividend is Thursday, April 3rd. This represents a yield of 30%. This is a boost from Ecopetrol's previous -- dividend of $0.49. Ecopetrol's dividend payout ratio (DPR) is currently 91.87%.

Wall Street Analyst Weigh In

Several equities research analysts have weighed in on the company. Citigroup raised Ecopetrol from a "neutral" rating to a "buy" rating and increased their target price for the stock from $9.00 to $14.00 in a research report on Tuesday, February 18th. JPMorgan Chase & Co. upgraded shares of Ecopetrol from an "underweight" rating to a "neutral" rating and upped their target price for the stock from $7.50 to $9.50 in a research report on Thursday, February 13th. Finally, StockNews.com cut Ecopetrol from a "buy" rating to a "hold" rating in a report on Monday, March 17th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and one has issued a buy rating to the company. According to data from MarketBeat, Ecopetrol currently has a consensus rating of "Hold" and an average target price of $11.00.

View Our Latest Research Report on Ecopetrol

Ecopetrol Company Profile

(

Free Report)

Ecopetrol SA operates as an integrated energy company. The company operates through four segments: Exploration and Production; Transport and Logistics; Refining, Petrochemical and Biofuels; and Electric Power Transmission and Toll Roads Concessions. It engages in the exploration and production of oil and gas; transportation of crude oil, motor fuels, fuel oil, and other refined products, including diesel, jet, and biofuels; processing and refining crude oil; distribution of natural gas and LPG; sale of refined and petrochemical products; supplying of electric power transmission services; design, development, construction, operation, and maintenance of road and energy infrastructure projects; and supplying of information technology and telecommunications services.

Read More

Before you consider Ecopetrol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ecopetrol wasn't on the list.

While Ecopetrol currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.