Braidwell LP boosted its stake in shares of Xenon Pharmaceuticals Inc. (NASDAQ:XENE - Free Report) by 5.7% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 2,707,255 shares of the biopharmaceutical company's stock after acquiring an additional 146,682 shares during the quarter. Xenon Pharmaceuticals comprises about 3.0% of Braidwell LP's investment portfolio, making the stock its 7th biggest position. Braidwell LP owned 3.57% of Xenon Pharmaceuticals worth $106,585,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

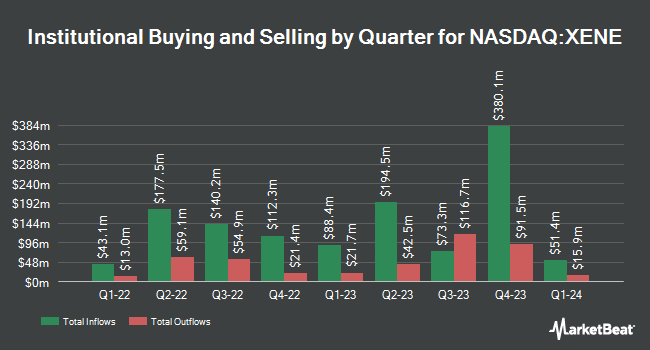

Several other hedge funds and other institutional investors also recently bought and sold shares of XENE. Mirae Asset Global Investments Co. Ltd. grew its position in Xenon Pharmaceuticals by 21.6% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,740 shares of the biopharmaceutical company's stock valued at $106,000 after acquiring an additional 487 shares during the last quarter. California State Teachers Retirement System grew its holdings in shares of Xenon Pharmaceuticals by 0.9% in the first quarter. California State Teachers Retirement System now owns 56,477 shares of the biopharmaceutical company's stock worth $2,431,000 after purchasing an additional 490 shares during the last quarter. Advisors Asset Management Inc. increased its stake in Xenon Pharmaceuticals by 3.8% in the 3rd quarter. Advisors Asset Management Inc. now owns 13,592 shares of the biopharmaceutical company's stock worth $535,000 after buying an additional 493 shares during the period. Blue Trust Inc. lifted its holdings in Xenon Pharmaceuticals by 174.7% during the 3rd quarter. Blue Trust Inc. now owns 1,008 shares of the biopharmaceutical company's stock valued at $39,000 after buying an additional 641 shares in the last quarter. Finally, Arizona State Retirement System boosted its position in Xenon Pharmaceuticals by 4.0% in the 2nd quarter. Arizona State Retirement System now owns 17,949 shares of the biopharmaceutical company's stock valued at $700,000 after buying an additional 688 shares during the period. Hedge funds and other institutional investors own 95.45% of the company's stock.

Xenon Pharmaceuticals Stock Down 1.2 %

Shares of NASDAQ XENE traded down $0.52 during trading hours on Friday, hitting $42.63. 240,694 shares of the stock were exchanged, compared to its average volume of 404,296. Xenon Pharmaceuticals Inc. has a 12 month low of $35.18 and a 12 month high of $50.99. The firm has a fifty day moving average price of $41.47 and a 200-day moving average price of $40.25. The company has a market cap of $3.25 billion, a PE ratio of -15.12 and a beta of 1.25.

Xenon Pharmaceuticals (NASDAQ:XENE - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The biopharmaceutical company reported ($0.81) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.82) by $0.01. During the same period last year, the company earned ($0.73) EPS. As a group, equities analysts anticipate that Xenon Pharmaceuticals Inc. will post -3.1 earnings per share for the current fiscal year.

Insider Activity at Xenon Pharmaceuticals

In other Xenon Pharmaceuticals news, Director Gary Patou sold 4,891 shares of the firm's stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $41.08, for a total value of $200,922.28. Following the completion of the transaction, the director now owns 23,573 shares of the company's stock, valued at approximately $968,378.84. This trade represents a 17.18 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. 5.52% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

Several research firms have recently weighed in on XENE. Wedbush decreased their price target on shares of Xenon Pharmaceuticals from $50.00 to $49.00 and set an "outperform" rating for the company in a research note on Friday, August 9th. HC Wainwright reaffirmed a "buy" rating and set a $53.00 target price on shares of Xenon Pharmaceuticals in a research report on Wednesday, November 13th. Raymond James reissued an "outperform" rating and set a $50.00 price target on shares of Xenon Pharmaceuticals in a research report on Thursday, October 10th. Needham & Company LLC restated a "buy" rating and issued a $60.00 price objective on shares of Xenon Pharmaceuticals in a report on Wednesday, November 13th. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and issued a $55.00 price objective on shares of Xenon Pharmaceuticals in a research note on Tuesday, September 3rd. Eleven research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, Xenon Pharmaceuticals currently has an average rating of "Buy" and an average target price of $57.45.

Get Our Latest Analysis on XENE

Xenon Pharmaceuticals Company Profile

(

Free Report)

Xenon Pharmaceuticals Inc, a neuroscience-focused biopharmaceutical company, engages in the development of therapeutics to treat patients with neurological disorders in Canada. Its clinical development pipeline includes XEN1101, a novel and potent Kv7 potassium channel opener, which is in Phase 3 clinical trials for the treatment of epilepsy and other neurological disorders.

Featured Articles

Before you consider Xenon Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xenon Pharmaceuticals wasn't on the list.

While Xenon Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.