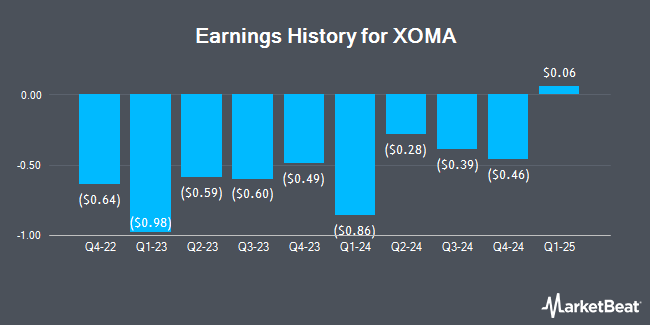

XOMA (NASDAQ:XOMA - Get Free Report) posted its quarterly earnings data on Monday. The biotechnology company reported ($0.46) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.29) by ($0.17), Zacks reports. XOMA had a negative return on equity of 24.95% and a negative net margin of 151.34%. The firm had revenue of $8.70 million for the quarter, compared to analyst estimates of $8.75 million.

XOMA Trading Up 0.7 %

Shares of XOMA stock traded up $0.16 during trading hours on Friday, reaching $21.22. The company had a trading volume of 41,994 shares, compared to its average volume of 26,349. The firm has a market cap of $249.99 million, a price-to-earnings ratio of -6.13 and a beta of 1.00. XOMA has a 1-year low of $19.92 and a 1-year high of $35.00. The company has a debt-to-equity ratio of 1.28, a current ratio of 7.52 and a quick ratio of 7.52. The company has a 50 day moving average of $24.45 and a 200 day moving average of $27.20.

Insider Buying and Selling

In related news, major shareholder Bvf Partners L. P/Il sold 500,742 shares of the firm's stock in a transaction on Friday, January 24th. The stock was sold at an average price of $26.10, for a total transaction of $13,069,366.20. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. 7.20% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

Several research analysts have issued reports on XOMA shares. HC Wainwright reaffirmed a "buy" rating and set a $104.00 price objective on shares of XOMA in a report on Wednesday. StockNews.com downgraded XOMA from a "hold" rating to a "sell" rating in a research note on Tuesday, February 25th.

Get Our Latest Analysis on XOMA

About XOMA

(

Get Free Report)

XOMA Corporation operates as a biotech royalty aggregator in the United States and the Asia Pacific. It has a portfolio of economic rights to future potential milestone and royalty payments associated with partnered commercial and pre-commercial therapeutic candidates. The company also focuses on early to mid-stage clinical assets primarily in Phase 1 and 2 with commercial sales potential that are licensed to partners; and acquires milestone and royalty revenue streams on late-stage clinical or commercial assets.

See Also

Before you consider XOMA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XOMA wasn't on the list.

While XOMA currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.