XPeng (NYSE:XPEV - Get Free Report) was upgraded by stock analysts at UBS Group from a "sell" rating to a "neutral" rating in a report issued on Monday. The brokerage currently has a $18.00 target price on the stock, up from their previous target price of $8.80. UBS Group's price target would suggest a potential downside of 2.20% from the company's previous close.

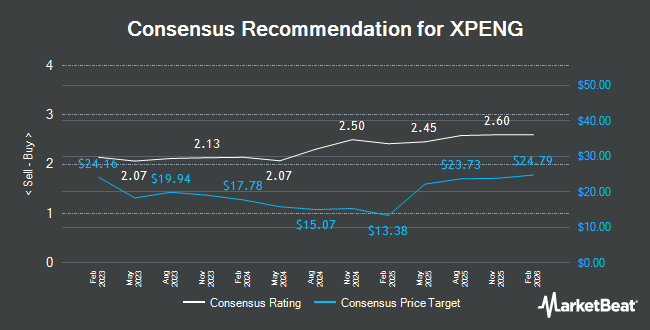

A number of other brokerages have also recently issued reports on XPEV. Macquarie reiterated a "neutral" rating and set a $18.00 price objective on shares of XPeng in a research note on Friday, February 7th. The Goldman Sachs Group cut XPeng from a "buy" rating to a "neutral" rating and set a $12.50 price objective for the company. in a research note on Thursday, November 21st. Sanford C. Bernstein lifted their price objective on XPeng from $9.00 to $14.00 and gave the company a "market perform" rating in a research note on Wednesday, November 20th. Citigroup lowered their price objective on XPeng from $14.60 to $13.70 and set a "neutral" rating for the company in a research note on Wednesday, November 20th. Finally, China Renaissance upgraded XPeng from a "hold" rating to a "buy" rating and set a $16.70 price objective for the company in a research note on Friday, November 22nd. Five investment analysts have rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, XPeng presently has a consensus rating of "Moderate Buy" and a consensus target price of $13.93.

Read Our Latest Analysis on XPEV

XPeng Trading Up 4.0 %

XPEV opened at $18.41 on Monday. The stock has a market cap of $17.34 billion, a PE ratio of -21.15 and a beta of 2.77. The company has a quick ratio of 1.18, a current ratio of 1.37 and a debt-to-equity ratio of 0.22. The business has a 50 day moving average of $14.27 and a 200-day moving average of $11.97. XPeng has a 52 week low of $6.55 and a 52 week high of $19.36.

Institutional Trading of XPeng

Large investors have recently modified their holdings of the company. EverSource Wealth Advisors LLC grew its holdings in shares of XPeng by 55.8% in the fourth quarter. EverSource Wealth Advisors LLC now owns 2,508 shares of the company's stock worth $30,000 after acquiring an additional 898 shares during the period. Avior Wealth Management LLC grew its holdings in shares of XPeng by 1,215.2% in the fourth quarter. Avior Wealth Management LLC now owns 2,775 shares of the company's stock worth $33,000 after acquiring an additional 2,564 shares during the period. Lindbrook Capital LLC grew its holdings in shares of XPeng by 50.7% in the fourth quarter. Lindbrook Capital LLC now owns 3,382 shares of the company's stock worth $40,000 after acquiring an additional 1,138 shares during the period. Golden State Wealth Management LLC bought a new stake in shares of XPeng in the fourth quarter worth $41,000. Finally, Natixis bought a new stake in shares of XPeng in the fourth quarter worth $43,000. Institutional investors own 21.09% of the company's stock.

About XPeng

(

Get Free Report)

XPeng Inc designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People's Republic of China. It offers SUVs under the G3, G3i, and G9 names; four-door sports sedans under the P7 and P7i names; and family sedans under the P5 name. The company also provides sales contracts, super charging, maintenance, technical support, auto financing, insurance, technology support, ride-hailing, automotive loan referral, and other services, as well as vehicle leasing and insurance agency services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider XPeng, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XPeng wasn't on the list.

While XPeng currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.