XPO (NYSE:XPO - Free Report) had its price target trimmed by Barclays from $165.00 to $150.00 in a research note published on Monday,Benzinga reports. The firm currently has an overweight rating on the transportation company's stock.

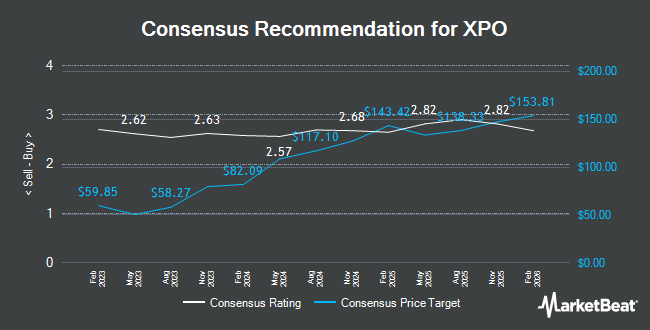

Several other equities research analysts have also commented on the stock. Deutsche Bank Aktiengesellschaft started coverage on shares of XPO in a research report on Friday, March 7th. They set a "buy" rating and a $156.00 target price on the stock. Vertical Research upgraded shares of XPO from a "hold" rating to a "buy" rating and set a $140.00 target price on the stock in a research report on Thursday, March 6th. Wells Fargo & Company dropped their target price on shares of XPO from $175.00 to $170.00 and set an "overweight" rating for the company in a report on Tuesday, January 7th. Susquehanna raised XPO from a "neutral" rating to a "positive" rating and boosted their price target for the stock from $155.00 to $180.00 in a research note on Friday, February 7th. Finally, Oppenheimer raised their price objective on XPO from $148.00 to $176.00 and gave the company an "outperform" rating in a research note on Thursday, December 12th. Eighteen research analysts have rated the stock with a buy rating, Based on data from MarketBeat, XPO currently has a consensus rating of "Buy" and an average price target of $160.06.

Get Our Latest Report on XPO

XPO Stock Performance

Shares of XPO stock traded up $1.79 on Monday, reaching $108.95. 1,810,662 shares of the stock were exchanged, compared to its average volume of 1,484,166. The firm has a market capitalization of $12.77 billion, a PE ratio of 33.73, a PEG ratio of 1.79 and a beta of 2.13. XPO has a 1-year low of $97.03 and a 1-year high of $161.00. The business has a fifty day moving average price of $132.87 and a two-hundred day moving average price of $130.06. The company has a current ratio of 1.06, a quick ratio of 1.06 and a debt-to-equity ratio of 2.08.

XPO (NYSE:XPO - Get Free Report) last released its earnings results on Thursday, February 6th. The transportation company reported $0.89 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.68 by $0.21. XPO had a return on equity of 30.36% and a net margin of 4.81%. As a group, research analysts anticipate that XPO will post 4.15 earnings per share for the current fiscal year.

Institutional Investors Weigh In On XPO

A number of hedge funds and other institutional investors have recently modified their holdings of XPO. Versant Capital Management Inc purchased a new position in shares of XPO during the fourth quarter valued at approximately $29,000. Halbert Hargrove Global Advisors LLC purchased a new position in shares of XPO during the 4th quarter worth $42,000. Cullen Frost Bankers Inc. lifted its stake in shares of XPO by 69.1% during the 4th quarter. Cullen Frost Bankers Inc. now owns 318 shares of the transportation company's stock worth $42,000 after purchasing an additional 130 shares during the period. Larson Financial Group LLC boosted its holdings in shares of XPO by 25.6% during the fourth quarter. Larson Financial Group LLC now owns 373 shares of the transportation company's stock worth $49,000 after purchasing an additional 76 shares during the last quarter. Finally, Brooklyn Investment Group purchased a new stake in shares of XPO in the third quarter valued at $57,000. 97.73% of the stock is currently owned by hedge funds and other institutional investors.

About XPO

(

Get Free Report)

XPO, Inc provides freight transportation services in the United States, rest of North America, France, the United Kingdom, rest of Europe, and internationally. The company operates in two segments, North American LTL and European Transportation. The North American LTL segment provides customers with less-than-truckload (LTL) services, such as geographic density and day-definite domestic services.

Read More

Before you consider XPO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XPO wasn't on the list.

While XPO currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.