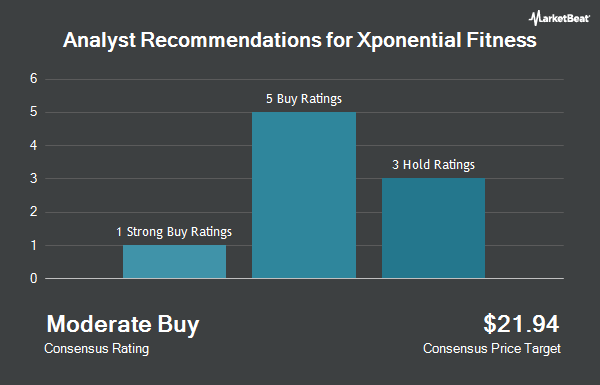

Xponential Fitness, Inc. (NYSE:XPOF - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the ten ratings firms that are presently covering the stock, Marketbeat reports. Four analysts have rated the stock with a hold recommendation, four have given a buy recommendation and two have assigned a strong buy recommendation to the company. The average 12-month target price among analysts that have covered the stock in the last year is $17.17.

XPOF has been the subject of several research analyst reports. B. Riley raised their price target on Xponential Fitness from $9.00 to $12.00 and gave the company a "neutral" rating in a report on Monday, August 5th. Piper Sandler decreased their price target on Xponential Fitness from $13.00 to $12.00 and set a "neutral" rating for the company in a research note on Friday, November 8th. Finally, Stifel Nicolaus boosted their target price on Xponential Fitness from $18.00 to $20.00 and gave the stock a "buy" rating in a research note on Monday, November 11th.

Get Our Latest Report on XPOF

Xponential Fitness Trading Down 0.3 %

XPOF stock traded down $0.04 during trading on Tuesday, reaching $15.46. The stock had a trading volume of 282,433 shares, compared to its average volume of 667,412. Xponential Fitness has a 52 week low of $7.40 and a 52 week high of $18.95. The stock's 50 day moving average is $13.41 and its two-hundred day moving average is $13.67. The firm has a market cap of $746.72 million, a PE ratio of -13.33 and a beta of 1.26.

Insider Buying and Selling at Xponential Fitness

In other news, President Sarah Luna sold 14,400 shares of the stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $13.85, for a total value of $199,440.00. Following the transaction, the president now directly owns 290,297 shares of the company's stock, valued at $4,020,613.45. This represents a 4.73 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Mark Grabowski sold 2,595,598 shares of the firm's stock in a transaction dated Thursday, November 21st. The stock was sold at an average price of $15.35, for a total transaction of $39,842,429.30. Following the transaction, the director now directly owns 30,546 shares in the company, valued at approximately $468,881.10. This represents a 98.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 2,636,738 shares of company stock worth $40,367,563 over the last ninety days. Corporate insiders own 47.83% of the company's stock.

Institutional Investors Weigh In On Xponential Fitness

A number of hedge funds have recently made changes to their positions in the stock. SkyView Investment Advisors LLC raised its holdings in Xponential Fitness by 23.3% during the 3rd quarter. SkyView Investment Advisors LLC now owns 18,500 shares of the company's stock worth $229,000 after purchasing an additional 3,500 shares during the last quarter. Barclays PLC increased its stake in shares of Xponential Fitness by 366.5% in the 3rd quarter. Barclays PLC now owns 39,621 shares of the company's stock valued at $491,000 after acquiring an additional 31,127 shares in the last quarter. Geode Capital Management LLC increased its stake in Xponential Fitness by 0.7% during the 3rd quarter. Geode Capital Management LLC now owns 538,436 shares of the company's stock valued at $6,678,000 after purchasing an additional 3,658 shares in the last quarter. ABS Direct Equity Fund LLC increased its stake in Xponential Fitness by 5.9% during the 3rd quarter. ABS Direct Equity Fund LLC now owns 180,000 shares of the company's stock valued at $2,232,000 after purchasing an additional 10,000 shares in the last quarter. Finally, State Street Corp boosted its holdings in Xponential Fitness by 0.4% during the 3rd quarter. State Street Corp now owns 541,092 shares of the company's stock worth $6,710,000 after acquiring an additional 1,977 shares during the last quarter. 58.55% of the stock is currently owned by institutional investors and hedge funds.

Xponential Fitness Company Profile

(

Get Free ReportXponential Fitness, Inc, through its subsidiaries, operates as a boutique fitness franchisor in North America. It offers pilates, indoor cycling, barre, stretching, rowing, dancing, boxing, running, functional training, and yoga services under the Club Pilates, Pure Barre, CycleBar, StretchLab, Row House, YogaSix, Rumble, AKT, Stride, and BFT brands.

Further Reading

Before you consider Xponential Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xponential Fitness wasn't on the list.

While Xponential Fitness currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.