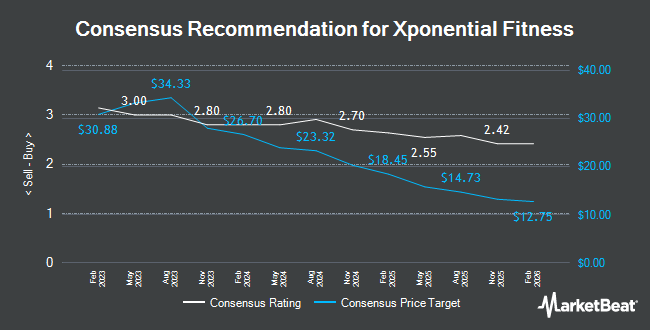

Xponential Fitness (NYSE:XPOF - Get Free Report) had its target price lowered by equities research analysts at Piper Sandler from $13.00 to $12.00 in a report released on Friday,Benzinga reports. The firm presently has a "neutral" rating on the stock. Piper Sandler's price target would suggest a potential downside of 26.83% from the stock's current price.

Several other analysts have also recently commented on the company. Raymond James lowered their price target on Xponential Fitness from $30.00 to $20.00 and set a "strong-buy" rating for the company in a report on Friday, August 2nd. B. Riley lifted their price target on shares of Xponential Fitness from $9.00 to $12.00 and gave the stock a "neutral" rating in a research note on Monday, August 5th. Roth Mkm decreased their target price on Xponential Fitness from $22.00 to $19.00 and set a "buy" rating for the company in a research report on Friday, August 2nd. Finally, Robert W. Baird decreased their target price on Xponential Fitness from $16.00 to $15.00 and set a "neutral" rating for the company in a research note on Friday, August 2nd. Four analysts have rated the stock with a hold rating, four have issued a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $17.17.

Read Our Latest Research Report on Xponential Fitness

Xponential Fitness Stock Performance

NYSE XPOF traded up $3.70 during trading hours on Friday, hitting $16.40. The company had a trading volume of 2,013,459 shares, compared to its average volume of 674,994. The company has a market cap of $789.99 million, a PE ratio of -16.46 and a beta of 1.18. Xponential Fitness has a 1-year low of $7.40 and a 1-year high of $18.95. The business has a 50 day moving average of $12.65 and a 200-day moving average of $13.19.

Insider Buying and Selling

In related news, President Sarah Luna sold 14,400 shares of the business's stock in a transaction on Friday, September 13th. The shares were sold at an average price of $13.85, for a total value of $199,440.00. Following the sale, the president now directly owns 290,297 shares of the company's stock, valued at approximately $4,020,613.45. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In other news, insider Andrew Hagopian sold 26,740 shares of the stock in a transaction that occurred on Thursday, October 10th. The stock was sold at an average price of $12.18, for a total transaction of $325,693.20. Following the transaction, the insider now owns 255,764 shares in the company, valued at approximately $3,115,205.52. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, President Sarah Luna sold 14,400 shares of the business's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $13.85, for a total transaction of $199,440.00. Following the completion of the sale, the president now directly owns 290,297 shares of the company's stock, valued at $4,020,613.45. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 47.83% of the stock is owned by insiders.

Institutional Investors Weigh In On Xponential Fitness

Several institutional investors and hedge funds have recently added to or reduced their stakes in the business. Kent Lake Capital LLC increased its holdings in Xponential Fitness by 276.0% in the first quarter. Kent Lake Capital LLC now owns 882,443 shares of the company's stock worth $14,596,000 after purchasing an additional 647,743 shares in the last quarter. Nut Tree Capital Management LP grew its position in Xponential Fitness by 74.3% during the first quarter. Nut Tree Capital Management LP now owns 250,000 shares of the company's stock valued at $4,135,000 after acquiring an additional 106,587 shares during the last quarter. Dnca Finance bought a new stake in shares of Xponential Fitness in the 2nd quarter valued at about $107,000. Bank of New York Mellon Corp grew its holdings in shares of Xponential Fitness by 12.4% in the second quarter. Bank of New York Mellon Corp now owns 82,419 shares of the company's stock worth $1,286,000 after purchasing an additional 9,079 shares during the last quarter. Finally, Principal Financial Group Inc. raised its stake in shares of Xponential Fitness by 13.1% during the second quarter. Principal Financial Group Inc. now owns 19,021 shares of the company's stock valued at $297,000 after acquiring an additional 2,203 shares during the last quarter. 58.55% of the stock is currently owned by institutional investors.

About Xponential Fitness

(

Get Free Report)

Xponential Fitness, Inc, through its subsidiaries, operates as a boutique fitness franchisor in North America. It offers pilates, indoor cycling, barre, stretching, rowing, dancing, boxing, running, functional training, and yoga services under the Club Pilates, Pure Barre, CycleBar, StretchLab, Row House, YogaSix, Rumble, AKT, Stride, and BFT brands.

Recommended Stories

Before you consider Xponential Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xponential Fitness wasn't on the list.

While Xponential Fitness currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.