XTX Topco Ltd acquired a new stake in shares of Aspen Technology, Inc. (NASDAQ:AZPN - Free Report) during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund acquired 6,505 shares of the technology company's stock, valued at approximately $1,554,000.

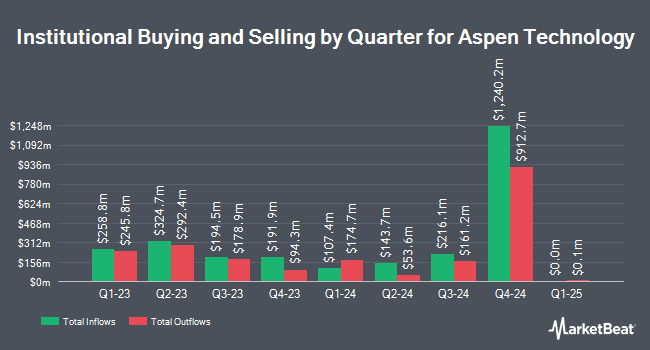

Other hedge funds have also modified their holdings of the company. Commerce Bank increased its holdings in shares of Aspen Technology by 3.1% during the third quarter. Commerce Bank now owns 1,550 shares of the technology company's stock worth $370,000 after buying an additional 47 shares in the last quarter. US Bancorp DE increased its holdings in Aspen Technology by 0.4% during the 3rd quarter. US Bancorp DE now owns 13,695 shares of the technology company's stock valued at $3,271,000 after purchasing an additional 50 shares in the last quarter. LRI Investments LLC raised its position in Aspen Technology by 6.7% in the 2nd quarter. LRI Investments LLC now owns 862 shares of the technology company's stock valued at $171,000 after purchasing an additional 54 shares during the last quarter. State of Alaska Department of Revenue boosted its stake in Aspen Technology by 1.8% in the third quarter. State of Alaska Department of Revenue now owns 3,084 shares of the technology company's stock worth $736,000 after purchasing an additional 55 shares in the last quarter. Finally, Tortoise Investment Management LLC grew its holdings in shares of Aspen Technology by 77.8% during the second quarter. Tortoise Investment Management LLC now owns 128 shares of the technology company's stock worth $25,000 after purchasing an additional 56 shares during the last quarter. 45.66% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several brokerages recently issued reports on AZPN. Berenberg Bank downgraded shares of Aspen Technology from a "strong-buy" rating to a "hold" rating in a research report on Thursday, November 7th. Bank of America upped their target price on shares of Aspen Technology from $225.00 to $260.00 and gave the stock a "buy" rating in a research report on Wednesday, September 18th. StockNews.com assumed coverage on shares of Aspen Technology in a report on Sunday. They issued a "hold" rating for the company. Piper Sandler upped their price objective on Aspen Technology from $217.00 to $240.00 and gave the stock a "neutral" rating in a report on Tuesday, November 5th. Finally, Loop Capital increased their price objective on Aspen Technology from $204.00 to $260.00 and gave the company a "buy" rating in a research report on Thursday, September 19th. Four investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat, Aspen Technology presently has a consensus rating of "Hold" and a consensus target price of $253.00.

Check Out Our Latest Analysis on Aspen Technology

Aspen Technology Stock Up 0.6 %

NASDAQ AZPN traded up $1.47 during trading hours on Monday, hitting $252.90. The company's stock had a trading volume of 481,170 shares, compared to its average volume of 246,431. Aspen Technology, Inc. has a twelve month low of $171.25 and a twelve month high of $254.44. The firm has a market capitalization of $16.00 billion, a P/E ratio of -436.03, a PEG ratio of 2.87 and a beta of 0.76. The stock has a fifty day moving average of $242.28 and a 200 day moving average of $220.43.

Aspen Technology (NASDAQ:AZPN - Get Free Report) last issued its earnings results on Monday, November 4th. The technology company reported $0.85 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.39 by ($0.54). The company had revenue of $215.90 million for the quarter, compared to the consensus estimate of $265.04 million. Aspen Technology had a positive return on equity of 2.81% and a negative net margin of 3.26%. Aspen Technology's quarterly revenue was down 13.4% on a year-over-year basis. During the same quarter last year, the business posted $0.96 EPS. On average, analysts predict that Aspen Technology, Inc. will post 6.68 earnings per share for the current year.

About Aspen Technology

(

Free Report)

Aspen Technology, Inc provides industrial software that focuses on helping customers in asset-intensive industries worldwide. The company's solutions address complex environments where it is critical to optimize the asset design, operation, and maintenance lifecycle. Its software is used in performance engineering, modeling and design, supply chain management, predictive and prescriptive maintenance, digital grid management, and industrial data management.

Further Reading

Before you consider Aspen Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aspen Technology wasn't on the list.

While Aspen Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.