XTX Topco Ltd bought a new position in shares of MGM Resorts International (NYSE:MGM - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the SEC. The institutional investor bought 24,232 shares of the company's stock, valued at approximately $840,000.

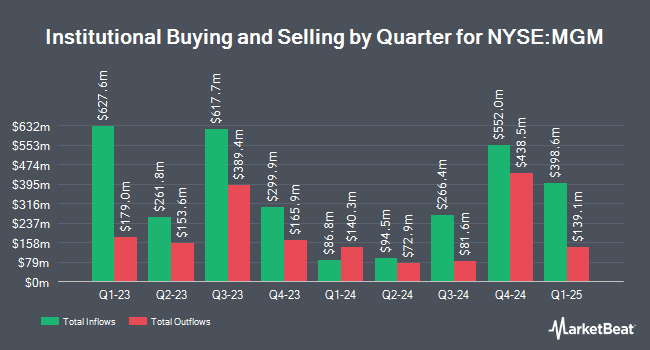

A number of other hedge funds also recently modified their holdings of MGM. Assetmark Inc. grew its stake in MGM Resorts International by 104.1% during the fourth quarter. Assetmark Inc. now owns 806 shares of the company's stock worth $28,000 after buying an additional 411 shares in the last quarter. Global Trust Asset Management LLC bought a new stake in shares of MGM Resorts International during the 4th quarter worth approximately $28,000. Global Retirement Partners LLC boosted its position in shares of MGM Resorts International by 47.8% during the 4th quarter. Global Retirement Partners LLC now owns 1,250 shares of the company's stock worth $43,000 after acquiring an additional 404 shares in the last quarter. Modus Advisors LLC bought a new position in MGM Resorts International in the fourth quarter valued at approximately $46,000. Finally, Wilmington Savings Fund Society FSB acquired a new position in MGM Resorts International during the third quarter valued at approximately $55,000. Institutional investors own 68.11% of the company's stock.

MGM Resorts International Price Performance

Shares of NYSE MGM opened at $28.51 on Thursday. The company has a quick ratio of 1.26, a current ratio of 1.30 and a debt-to-equity ratio of 1.73. The company has a market capitalization of $8.07 billion, a PE ratio of 11.88, a P/E/G ratio of 0.98 and a beta of 1.96. The firm has a fifty day simple moving average of $32.34 and a 200 day simple moving average of $35.07. MGM Resorts International has a twelve month low of $25.30 and a twelve month high of $47.26.

MGM Resorts International (NYSE:MGM - Get Free Report) last announced its earnings results on Wednesday, February 12th. The company reported $0.45 EPS for the quarter, beating the consensus estimate of $0.37 by $0.08. MGM Resorts International had a return on equity of 21.08% and a net margin of 4.33%. On average, sell-side analysts forecast that MGM Resorts International will post 2.21 EPS for the current year.

Insider Transactions at MGM Resorts International

In other news, CFO Jonathan S. Halkyard acquired 10,000 shares of MGM Resorts International stock in a transaction on Thursday, March 6th. The stock was purchased at an average price of $32.17 per share, with a total value of $321,700.00. Following the completion of the purchase, the chief financial officer now owns 75,648 shares of the company's stock, valued at approximately $2,433,596.16. The trade was a 15.23 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CAO Todd Meinert sold 6,000 shares of the company's stock in a transaction that occurred on Wednesday, February 19th. The stock was sold at an average price of $37.84, for a total value of $227,040.00. Following the transaction, the chief accounting officer now directly owns 18,301 shares in the company, valued at $692,509.84. The trade was a 24.69 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 2.13% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on the company. JMP Securities reaffirmed a "market outperform" rating and issued a $50.00 target price on shares of MGM Resorts International in a report on Thursday, February 13th. Jefferies Financial Group decreased their target price on MGM Resorts International from $52.00 to $50.00 and set a "buy" rating on the stock in a research report on Friday, January 3rd. Wells Fargo & Company raised their price target on shares of MGM Resorts International from $44.00 to $46.00 and gave the company an "overweight" rating in a research note on Thursday, February 13th. Truist Financial lowered their price objective on shares of MGM Resorts International from $54.00 to $50.00 and set a "buy" rating for the company in a research report on Tuesday, January 14th. Finally, Wedbush restated an "outperform" rating on shares of MGM Resorts International in a research report on Thursday, February 13th. Six investment analysts have rated the stock with a hold rating and sixteen have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $51.00.

Check Out Our Latest Stock Analysis on MGM Resorts International

MGM Resorts International Company Profile

(

Free Report)

MGM Resorts International, through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and internationally. The company operates through three segments: Las Vegas Strip Resorts, Regional Operations, and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MGM Resorts International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGM Resorts International wasn't on the list.

While MGM Resorts International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.