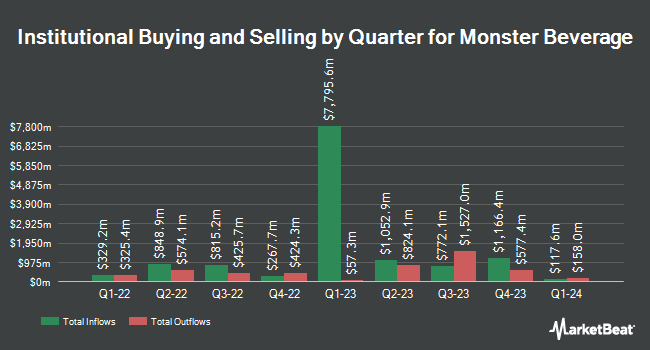

XTX Topco Ltd cut its holdings in Monster Beverage Co. (NASDAQ:MNST - Free Report) by 75.5% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 13,232 shares of the company's stock after selling 40,777 shares during the quarter. XTX Topco Ltd's holdings in Monster Beverage were worth $690,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also recently bought and sold shares of the business. Stephens Consulting LLC acquired a new stake in Monster Beverage during the second quarter valued at approximately $26,000. Kings Path Partners LLC acquired a new stake in Monster Beverage during the 2nd quarter worth about $30,000. University of Texas Texas AM Investment Management Co. purchased a new stake in Monster Beverage during the second quarter valued at about $30,000. Quarry LP boosted its holdings in shares of Monster Beverage by 152.0% in the second quarter. Quarry LP now owns 824 shares of the company's stock worth $41,000 after buying an additional 497 shares during the period. Finally, Crewe Advisors LLC increased its position in shares of Monster Beverage by 37.5% in the second quarter. Crewe Advisors LLC now owns 850 shares of the company's stock worth $42,000 after acquiring an additional 232 shares in the last quarter. 72.36% of the stock is currently owned by institutional investors.

Monster Beverage Stock Performance

Monster Beverage stock traded up $0.82 on Thursday, reaching $52.92. 4,259,616 shares of the stock were exchanged, compared to its average volume of 6,805,972. The company has a current ratio of 3.13, a quick ratio of 2.51 and a debt-to-equity ratio of 0.13. The firm has a fifty day moving average price of $53.33 and a two-hundred day moving average price of $51.05. The stock has a market cap of $51.47 billion, a PE ratio of 33.77, a PEG ratio of 2.50 and a beta of 0.74. Monster Beverage Co. has a twelve month low of $43.32 and a twelve month high of $61.22.

Analyst Upgrades and Downgrades

MNST has been the subject of a number of recent analyst reports. Wells Fargo & Company raised their price objective on shares of Monster Beverage from $57.00 to $60.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 5th. Argus upped their price target on Monster Beverage from $55.00 to $65.00 and gave the company a "buy" rating in a research report on Tuesday, November 12th. JPMorgan Chase & Co. lowered their target price on Monster Beverage from $50.00 to $49.00 and set a "neutral" rating on the stock in a research note on Monday, November 4th. TD Cowen increased their price target on shares of Monster Beverage from $50.00 to $55.00 and gave the stock a "hold" rating in a research report on Monday, November 11th. Finally, Stifel Nicolaus boosted their price objective on shares of Monster Beverage from $57.00 to $59.00 and gave the company a "buy" rating in a research report on Friday, November 8th. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating and thirteen have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $56.45.

Get Our Latest Report on Monster Beverage

Monster Beverage Company Profile

(

Free Report)

Monster Beverage Corporation, through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. The company operates through three segments: Monster Energy Drinks, Strategic Brands, Alcohol Brands, and Other.

Featured Stories

Before you consider Monster Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monster Beverage wasn't on the list.

While Monster Beverage currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.