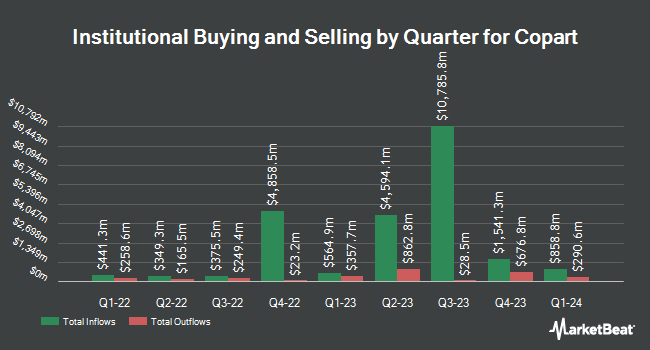

XTX Topco Ltd trimmed its holdings in Copart, Inc. (NASDAQ:CPRT - Free Report) by 38.7% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 28,328 shares of the business services provider's stock after selling 17,881 shares during the period. XTX Topco Ltd's holdings in Copart were worth $1,484,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds and other institutional investors have also bought and sold shares of CPRT. DF Dent & Co. Inc. purchased a new stake in shares of Copart in the third quarter worth about $27,122,000. National Bank of Canada FI grew its position in Copart by 90.4% during the third quarter. National Bank of Canada FI now owns 665,634 shares of the business services provider's stock worth $34,879,000 after buying an additional 316,120 shares in the last quarter. Kovitz Investment Group Partners LLC grew its holdings in shares of Copart by 2.6% during the third quarter. Kovitz Investment Group Partners LLC now owns 509,913 shares of the business services provider's stock worth $25,985,000 after purchasing an additional 12,770 shares in the last quarter. Worldquant Millennium Advisors LLC bought a new position in shares of Copart in the third quarter worth approximately $5,455,000. Finally, State Street Corp raised its stake in Copart by 0.4% in the third quarter. State Street Corp now owns 34,157,967 shares of the business services provider's stock valued at $1,789,877,000 after purchasing an additional 120,939 shares in the last quarter. Institutional investors own 85.78% of the company's stock.

Insiders Place Their Bets

In related news, Chairman A Jayson Adair sold 251,423 shares of the business's stock in a transaction dated Tuesday, November 26th. The stock was sold at an average price of $63.79, for a total transaction of $16,038,273.17. Following the transaction, the chairman now owns 14,436,557 shares in the company, valued at $920,907,971.03. The trade was a 1.71 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Thomas N. Tryforos sold 83,310 shares of the company's stock in a transaction that occurred on Thursday, December 5th. The shares were sold at an average price of $61.86, for a total value of $5,153,556.60. Following the transaction, the director now directly owns 7,850 shares of the company's stock, valued at $485,601. The trade was a 91.39 % decrease in their position. The disclosure for this sale can be found here. 9.68% of the stock is currently owned by insiders.

Analyst Ratings Changes

CPRT has been the topic of a number of research analyst reports. JPMorgan Chase & Co. increased their price target on shares of Copart from $55.00 to $60.00 and gave the stock a "neutral" rating in a report on Tuesday, November 19th. Robert W. Baird reduced their target price on Copart from $58.00 to $56.00 and set an "outperform" rating on the stock in a research note on Thursday, September 5th.

Read Our Latest Stock Analysis on Copart

Copart Stock Performance

NASDAQ:CPRT traded down $0.31 during mid-day trading on Monday, reaching $61.77. The stock had a trading volume of 4,251,873 shares, compared to its average volume of 4,452,637. The stock has a market capitalization of $59.52 billion, a P/E ratio of 43.50 and a beta of 1.31. The firm has a 50 day moving average price of $56.26 and a two-hundred day moving average price of $53.81. Copart, Inc. has a one year low of $46.21 and a one year high of $64.38.

Copart (NASDAQ:CPRT - Get Free Report) last announced its quarterly earnings data on Thursday, November 21st. The business services provider reported $0.37 earnings per share for the quarter, hitting analysts' consensus estimates of $0.37. Copart had a net margin of 31.92% and a return on equity of 18.96%. The firm had revenue of $1.15 billion during the quarter, compared to analyst estimates of $1.10 billion. During the same period in the previous year, the business posted $0.34 EPS. The business's quarterly revenue was up 12.4% on a year-over-year basis. Research analysts forecast that Copart, Inc. will post 1.57 earnings per share for the current year.

Copart Profile

(

Free Report)

Copart, Inc provides online auctions and vehicle remarketing services. It offers a range of services for processing and selling vehicles over the Internet through its Virtual Bidding Third Generation Internet auction-style sales technology on behalf of vehicle sellers, insurance companies, banks and finance companies, charities, and fleet operators and dealers, as well as individual owners.

Recommended Stories

Before you consider Copart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Copart wasn't on the list.

While Copart currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.