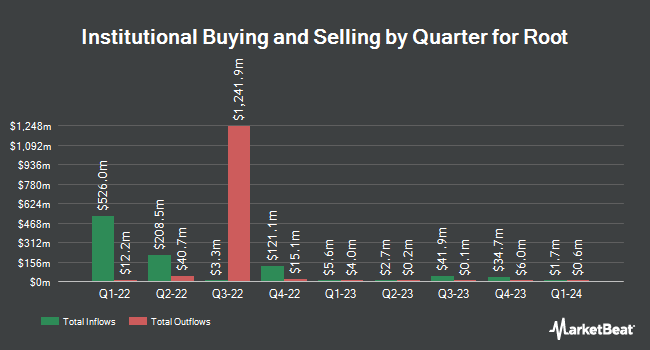

XTX Topco Ltd acquired a new stake in shares of Root, Inc. (NASDAQ:ROOT - Free Report) in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 17,082 shares of the company's stock, valued at approximately $645,000. XTX Topco Ltd owned approximately 0.11% of Root as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also bought and sold shares of ROOT. Hood River Capital Management LLC bought a new stake in shares of Root in the second quarter worth approximately $9,547,000. Driehaus Capital Management LLC bought a new stake in shares of Root in the second quarter worth approximately $9,154,000. Bank of New York Mellon Corp bought a new stake in shares of Root in the second quarter worth approximately $1,280,000. FMR LLC grew its stake in shares of Root by 966.2% in the third quarter. FMR LLC now owns 18,040 shares of the company's stock worth $682,000 after acquiring an additional 16,348 shares during the period. Finally, Dynamic Technology Lab Private Ltd bought a new stake in shares of Root in the third quarter worth approximately $539,000. 59.82% of the stock is currently owned by institutional investors.

Root Price Performance

ROOT traded up $0.03 during trading hours on Friday, hitting $76.29. The company's stock had a trading volume of 316,181 shares, compared to its average volume of 545,077. The business's 50-day moving average price is $70.32 and its 200-day moving average price is $57.21. Root, Inc. has a 12 month low of $7.22 and a 12 month high of $118.15. The stock has a market cap of $1.15 billion, a price-to-earnings ratio of -61.89 and a beta of 2.47. The company has a current ratio of 1.39, a quick ratio of 1.39 and a debt-to-equity ratio of 1.65.

Root (NASDAQ:ROOT - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The company reported $1.35 earnings per share for the quarter, topping the consensus estimate of ($0.61) by $1.96. Root had a negative net margin of 1.56% and a negative return on equity of 9.81%. The company had revenue of $305.70 million for the quarter, compared to analysts' expectations of $272.77 million. During the same quarter in the previous year, the business posted ($3.16) earnings per share. Root's quarterly revenue was up 165.1% on a year-over-year basis. Sell-side analysts expect that Root, Inc. will post -1.2 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, major shareholder Meyer Malka sold 75,839 shares of the firm's stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $81.21, for a total value of $6,158,885.19. Following the transaction, the insider now owns 43,107 shares of the company's stock, valued at $3,500,719.47. This trade represents a 63.76 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Julie Szudarek sold 2,000 shares of the firm's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $96.33, for a total transaction of $192,660.00. Following the completion of the transaction, the director now directly owns 15,003 shares in the company, valued at $1,445,238.99. This represents a 11.76 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 246,905 shares of company stock worth $20,440,479. Insiders own 11.71% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have recently commented on ROOT shares. UBS Group lifted their price target on shares of Root from $61.00 to $67.00 and gave the stock a "neutral" rating in a research note on Monday, November 4th. Cantor Fitzgerald upgraded shares of Root to a "strong-buy" rating in a research note on Thursday, October 3rd. JMP Securities downgraded shares of Root from an "outperform" rating to a "market perform" rating in a report on Friday, November 22nd. Wells Fargo & Company raised their price objective on shares of Root from $64.00 to $78.00 and gave the stock an "equal weight" rating in a report on Friday, November 1st. Finally, Citizens Jmp downgraded shares of Root from a "strong-buy" rating to a "hold" rating in a report on Friday, November 22nd. Six equities research analysts have rated the stock with a hold rating, two have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $59.13.

View Our Latest Analysis on Root

Root Company Profile

(

Free Report)

Root, Inc provides insurance products and services in the United States. The company offers automobile, homeowners, and renters insurance products. It operates a direct-to-consumer model; and serves customers primarily through mobile applications, as well as through its website. The company's direct distribution channels also cover digital, media, and referral channels, as well as distribution partners and agencies.

See Also

Before you consider Root, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Root wasn't on the list.

While Root currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.