XTX Topco Ltd purchased a new stake in Braze, Inc. (NASDAQ:BRZE - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm purchased 28,562 shares of the company's stock, valued at approximately $924,000.

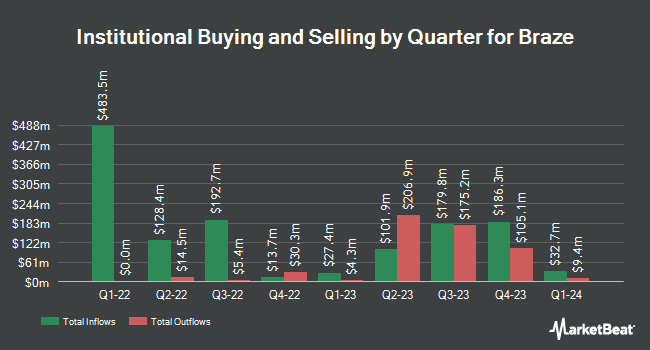

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Stephens Investment Management Group LLC bought a new stake in shares of Braze during the third quarter worth approximately $20,794,000. Healthcare of Ontario Pension Plan Trust Fund raised its position in shares of Braze by 69.5% in the third quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 1,494,100 shares of the company's stock valued at $48,319,000 after purchasing an additional 612,400 shares during the period. Granite Investment Partners LLC bought a new position in shares of Braze in the second quarter valued at about $12,925,000. State Street Corp increased its position in Braze by 21.5% during the third quarter. State Street Corp now owns 1,575,701 shares of the company's stock worth $50,958,000 after acquiring an additional 279,050 shares during the period. Finally, Point72 Asset Management L.P. bought a new position in Braze during the second quarter worth about $10,166,000. 90.47% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity at Braze

In other news, CEO William Magnuson sold 17,933 shares of the company's stock in a transaction that occurred on Monday, November 18th. The stock was sold at an average price of $34.45, for a total transaction of $617,791.85. Following the sale, the chief executive officer now directly owns 582,816 shares of the company's stock, valued at $20,078,011.20. This represents a 2.99 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CAO Pankaj Malik sold 3,432 shares of the stock in a transaction on Monday, November 18th. The shares were sold at an average price of $34.45, for a total value of $118,232.40. Following the sale, the chief accounting officer now owns 67,095 shares in the company, valued at $2,311,422.75. The trade was a 4.87 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 113,979 shares of company stock worth $3,688,914. 24.03% of the stock is owned by company insiders.

Braze Price Performance

Shares of NASDAQ:BRZE traded up $1.43 during mid-day trading on Wednesday, reaching $42.38. 1,375,654 shares of the company traded hands, compared to its average volume of 1,080,317. The company's 50 day moving average price is $34.46 and its 200-day moving average price is $37.25. The firm has a market cap of $4.35 billion, a PE ratio of -37.18 and a beta of 1.15. Braze, Inc. has a 52 week low of $29.18 and a 52 week high of $61.53.

Analysts Set New Price Targets

Several research analysts have issued reports on the stock. Macquarie raised their price target on shares of Braze from $30.00 to $39.00 and gave the stock a "neutral" rating in a report on Wednesday. Oppenheimer reiterated an "outperform" rating and set a $51.00 price target on shares of Braze in a research report on Tuesday. TD Cowen decreased their price objective on shares of Braze from $52.00 to $45.00 and set a "buy" rating on the stock in a research report on Tuesday, September 24th. The Goldman Sachs Group decreased their price objective on shares of Braze from $65.00 to $47.00 and set a "buy" rating on the stock in a research report on Tuesday, November 12th. Finally, Wells Fargo & Company decreased their price objective on shares of Braze from $65.00 to $55.00 and set an "overweight" rating on the stock in a research report on Tuesday, November 26th. One research analyst has rated the stock with a hold rating and nineteen have given a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $53.74.

Get Our Latest Stock Analysis on BRZE

Braze Profile

(

Free Report)

Braze, Inc operates a customer engagement platform that provides interactions between consumers and brands worldwide. The company offers Braze software development kits that automatically manage data ingestion and deliver mobile and web notifications, in-application/in-browser interstitial messages, and content cards; REST API that can be used to import or export data or to trigger workflows between Braze and brands' existing technology stacks; Partner Data Integrations, which allow brands to sync user cohorts from partners; Data Transformation, in which brands can programmatically sync and transform user data; and Braze Cloud Data Ingestion that enables brands to harness their customer data.

Featured Articles

Before you consider Braze, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Braze wasn't on the list.

While Braze currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.