XTX Topco Ltd bought a new stake in shares of Core & Main, Inc. (NYSE:CNM - Free Report) during the 3rd quarter, according to its most recent filing with the SEC. The fund bought 31,322 shares of the company's stock, valued at approximately $1,391,000.

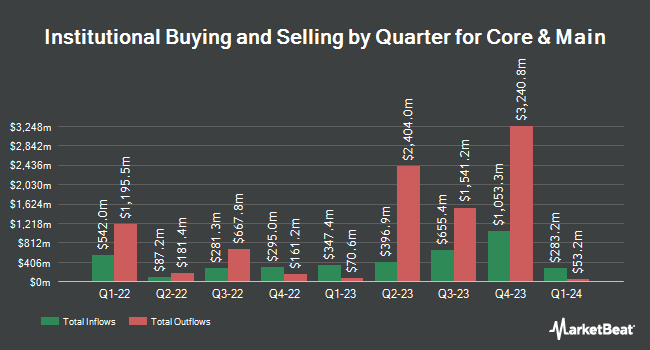

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. CWM LLC boosted its holdings in Core & Main by 25.6% during the second quarter. CWM LLC now owns 1,638 shares of the company's stock valued at $80,000 after purchasing an additional 334 shares in the last quarter. QRG Capital Management Inc. boosted its stake in Core & Main by 1.9% in the 2nd quarter. QRG Capital Management Inc. now owns 12,153 shares of the company's stock valued at $595,000 after buying an additional 228 shares in the last quarter. SG Americas Securities LLC grew its position in Core & Main by 542.1% in the second quarter. SG Americas Securities LLC now owns 39,415 shares of the company's stock valued at $1,929,000 after acquiring an additional 33,277 shares during the period. Andina Capital Management LLC raised its stake in Core & Main by 12.4% during the second quarter. Andina Capital Management LLC now owns 8,413 shares of the company's stock worth $412,000 after acquiring an additional 929 shares in the last quarter. Finally, Border to Coast Pensions Partnership Ltd bought a new position in shares of Core & Main during the second quarter valued at $16,760,000. Institutional investors own 94.19% of the company's stock.

Insider Buying and Selling at Core & Main

In other news, President Bradford A. Cowles sold 50,000 shares of Core & Main stock in a transaction on Tuesday, December 3rd. The shares were sold at an average price of $55.07, for a total transaction of $2,753,500.00. Following the transaction, the president now directly owns 18,423 shares of the company's stock, valued at $1,014,554.61. This trade represents a 73.07 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, EVP Jeffrey D. Giles sold 25,000 shares of the business's stock in a transaction on Tuesday, December 3rd. The shares were sold at an average price of $54.71, for a total transaction of $1,367,750.00. Following the completion of the transaction, the executive vice president now directly owns 11,615 shares of the company's stock, valued at $635,456.65. This trade represents a 68.28 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 290,000 shares of company stock worth $15,926,000. Insiders own 3.49% of the company's stock.

Core & Main Trading Down 0.0 %

Shares of CNM traded down $0.02 during trading hours on Monday, hitting $53.84. 1,852,574 shares of the stock traded hands, compared to its average volume of 2,599,702. The business has a fifty day moving average of $45.60 and a 200-day moving average of $47.94. The firm has a market capitalization of $10.83 billion, a PE ratio of 25.28, a price-to-earnings-growth ratio of 2.97 and a beta of 1.04. Core & Main, Inc. has a 1-year low of $37.22 and a 1-year high of $62.15. The company has a current ratio of 2.14, a quick ratio of 1.28 and a debt-to-equity ratio of 1.36.

Core & Main (NYSE:CNM - Get Free Report) last issued its earnings results on Tuesday, December 3rd. The company reported $0.69 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.65 by $0.04. Core & Main had a net margin of 5.71% and a return on equity of 24.71%. The company had revenue of $2.04 billion for the quarter, compared to analyst estimates of $1.99 billion. During the same quarter last year, the firm earned $0.65 EPS. The company's revenue for the quarter was up 11.5% on a year-over-year basis. Analysts expect that Core & Main, Inc. will post 2.16 EPS for the current year.

Analyst Upgrades and Downgrades

CNM has been the topic of several analyst reports. Truist Financial upped their target price on shares of Core & Main from $38.00 to $56.00 and gave the stock a "hold" rating in a report on Wednesday, December 4th. Loop Capital raised their price objective on shares of Core & Main from $52.00 to $63.00 and gave the stock a "buy" rating in a report on Wednesday, December 4th. Bank of America cut their target price on shares of Core & Main from $38.00 to $34.00 and set an "underperform" rating for the company in a research note on Thursday, September 5th. Royal Bank of Canada restated an "outperform" rating and set a $62.00 price target (up from $53.00) on shares of Core & Main in a research report on Wednesday, December 4th. Finally, Barclays lifted their price objective on Core & Main from $57.00 to $65.00 and gave the company an "overweight" rating in a research report on Wednesday, December 4th. One analyst has rated the stock with a sell rating, three have given a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $58.10.

Check Out Our Latest Analysis on CNM

About Core & Main

(

Free Report)

Core & Main, Inc distributes water, wastewater, storm drainage, and fire protection products and related services to municipalities, private water companies, and professional contractors in the municipal, non-residential, and residential end markets in the United States. Its products portfolio include pipes, valves, hydrants, fittings, and other products and services; storm drainage products, such as corrugated piping systems, retention basins, inline drains, manholes, grates, geosynthetics, erosion control, and other related products; fire protection products, including fire protection pipes, and sprinkler heads and devices, as well as fabrication services; and meter products, such as smart meter products, meter sets, meter accessories, installation, software, and other services.

Featured Articles

Before you consider Core & Main, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core & Main wasn't on the list.

While Core & Main currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here