XTX Topco Ltd lifted its position in Butterfly Network, Inc. (NYSE:BFLY - Free Report) by 169.7% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 360,392 shares of the company's stock after acquiring an additional 226,781 shares during the quarter. XTX Topco Ltd owned 0.17% of Butterfly Network worth $638,000 as of its most recent SEC filing.

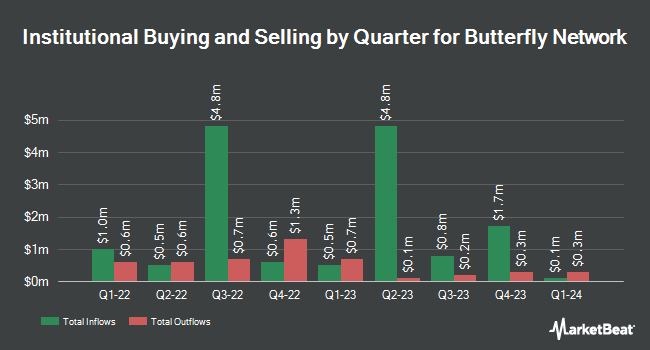

Several other hedge funds also recently made changes to their positions in BFLY. Vanguard Group Inc. grew its position in shares of Butterfly Network by 2.9% in the 1st quarter. Vanguard Group Inc. now owns 7,885,238 shares of the company's stock worth $8,516,000 after acquiring an additional 218,720 shares in the last quarter. Renaissance Technologies LLC grew its position in shares of Butterfly Network by 46.5% in the 2nd quarter. Renaissance Technologies LLC now owns 343,100 shares of the company's stock worth $288,000 after acquiring an additional 108,944 shares in the last quarter. Marshall Wace LLP grew its position in shares of Butterfly Network by 353.7% in the 2nd quarter. Marshall Wace LLP now owns 318,383 shares of the company's stock worth $267,000 after acquiring an additional 248,201 shares in the last quarter. Point72 DIFC Ltd boosted its position in Butterfly Network by 1,271.4% during the 2nd quarter. Point72 DIFC Ltd now owns 77,418 shares of the company's stock valued at $65,000 after purchasing an additional 71,773 shares during the period. Finally, Cubist Systematic Strategies LLC acquired a new position in Butterfly Network during the 2nd quarter valued at approximately $90,000. Institutional investors and hedge funds own 37.85% of the company's stock.

Butterfly Network Price Performance

NYSE:BFLY traded down $0.15 during midday trading on Friday, reaching $3.39. 2,334,851 shares of the company traded hands, compared to its average volume of 2,080,793. Butterfly Network, Inc. has a twelve month low of $0.67 and a twelve month high of $3.78. The firm has a market capitalization of $722.27 million, a price-to-earnings ratio of -7.41 and a beta of 2.46. The company has a fifty day moving average price of $2.51 and a 200 day moving average price of $1.64.

Butterfly Network (NYSE:BFLY - Get Free Report) last released its quarterly earnings data on Friday, November 1st. The company reported ($0.08) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.09) by $0.01. Butterfly Network had a negative return on equity of 42.68% and a negative net margin of 129.25%. The business had revenue of $20.56 million during the quarter, compared to analyst estimates of $19.12 million. During the same quarter in the previous year, the firm posted ($0.13) EPS. On average, equities research analysts forecast that Butterfly Network, Inc. will post -0.34 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Separately, Lake Street Capital began coverage on Butterfly Network in a research report on Tuesday, September 10th. They set a "buy" rating and a $3.00 price objective for the company.

Get Our Latest Research Report on Butterfly Network

Butterfly Network Company Profile

(

Free Report)

Butterfly Network, Inc develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally. It offers Butterfly iQ, a handheld and single-probe whole body ultrasound system; Butterfly iQ+ and iQ3 ultrasound devices that can perform whole-body imaging in a single handheld probe integrated with the clinical workflow, and accessible on a user's smartphone, tablet, and almost any hospital computer system; and Butterfly iQ+ Vet, a handheld ultrasound system designed for veterinarians.

See Also

Before you consider Butterfly Network, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Butterfly Network wasn't on the list.

While Butterfly Network currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.