XTX Topco Ltd bought a new stake in Avis Budget Group, Inc. (NASDAQ:CAR - Free Report) during the third quarter, according to the company in its most recent disclosure with the SEC. The firm bought 7,815 shares of the business services provider's stock, valued at approximately $685,000.

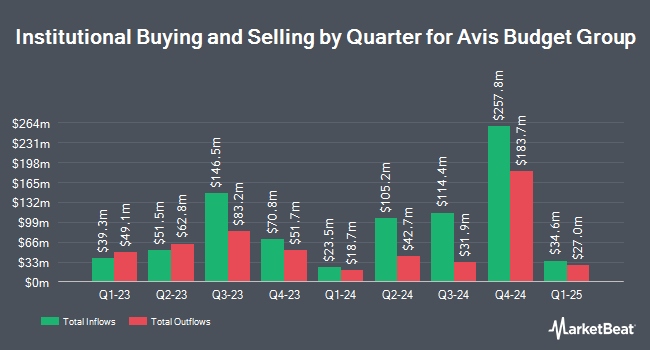

Several other hedge funds and other institutional investors also recently modified their holdings of the business. Strategic Investment Solutions Inc. IL increased its holdings in shares of Avis Budget Group by 198.3% during the third quarter. Strategic Investment Solutions Inc. IL now owns 361 shares of the business services provider's stock worth $32,000 after buying an additional 240 shares in the last quarter. Nisa Investment Advisors LLC increased its holdings in Avis Budget Group by 293.3% in the 3rd quarter. Nisa Investment Advisors LLC now owns 409 shares of the business services provider's stock worth $36,000 after purchasing an additional 305 shares in the last quarter. Signaturefd LLC raised its position in Avis Budget Group by 180.0% in the second quarter. Signaturefd LLC now owns 714 shares of the business services provider's stock valued at $75,000 after purchasing an additional 459 shares during the last quarter. Point72 Asia Singapore Pte. Ltd. acquired a new stake in shares of Avis Budget Group during the second quarter valued at about $75,000. Finally, Headlands Technologies LLC bought a new stake in shares of Avis Budget Group during the second quarter worth about $116,000. Institutional investors own 96.35% of the company's stock.

Avis Budget Group Price Performance

Shares of CAR traded down $3.05 during trading hours on Thursday, hitting $96.09. The stock had a trading volume of 465,481 shares, compared to its average volume of 710,588. Avis Budget Group, Inc. has a 1-year low of $65.73 and a 1-year high of $204.77. The firm has a market capitalization of $3.38 billion, a P/E ratio of 8.74 and a beta of 2.20. The firm has a 50 day simple moving average of $93.46 and a 200-day simple moving average of $94.62.

Avis Budget Group (NASDAQ:CAR - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The business services provider reported $6.65 EPS for the quarter, missing analysts' consensus estimates of $8.55 by ($1.90). The company had revenue of $3.48 billion for the quarter, compared to the consensus estimate of $3.53 billion. Avis Budget Group had a negative return on equity of 101.41% and a net margin of 3.34%. The business's revenue for the quarter was down 2.4% on a year-over-year basis. During the same period in the prior year, the firm posted $16.78 earnings per share. Equities analysts predict that Avis Budget Group, Inc. will post 3.59 EPS for the current fiscal year.

Analyst Ratings Changes

A number of research analysts recently issued reports on CAR shares. Northcoast Research lowered shares of Avis Budget Group from a "buy" rating to a "neutral" rating in a report on Monday, November 18th. Deutsche Bank Aktiengesellschaft cut their price target on shares of Avis Budget Group from $145.00 to $143.00 and set a "buy" rating on the stock in a report on Tuesday, November 5th. JPMorgan Chase & Co. dropped their target price on shares of Avis Budget Group from $175.00 to $150.00 and set an "overweight" rating on the stock in a report on Monday, November 4th. The Goldman Sachs Group lifted their price objective on Avis Budget Group from $85.00 to $95.00 and gave the stock a "neutral" rating in a research report on Tuesday. Finally, StockNews.com upgraded Avis Budget Group from a "sell" rating to a "hold" rating in a research report on Monday, November 4th. Five research analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $133.75.

Read Our Latest Analysis on CAR

About Avis Budget Group

(

Free Report)

Avis Budget Group, Inc, together with its subsidiaries, provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia. It operates the Avis brand, that offers vehicle rental and other mobility solutions to the premium commercial and leisure segments of the travel industry; and the Zipcar brand, a car sharing network, as well as the Budget brand, a supplier of vehicle rental and other mobility solutions focused primarily on more value-conscious customers comprising Budget car rental, and Budget Truck, a local, and one-way truck and cargo van rental businesses with a fleet of approximately 19,000 vehicles, which are rented through a network of dealer-operated and company-operated locations that serve the light commercial and consumer sectors in the continental United States.

Featured Stories

Before you consider Avis Budget Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avis Budget Group wasn't on the list.

While Avis Budget Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.