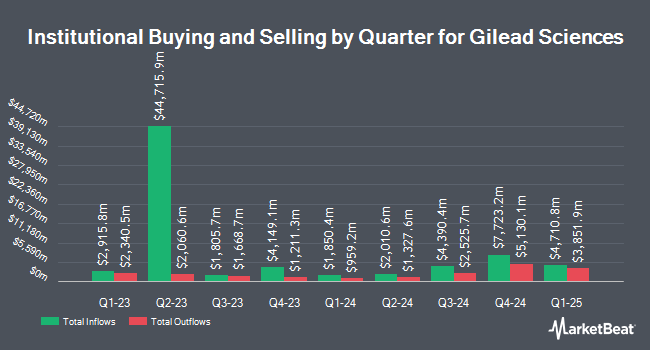

XTX Topco Ltd bought a new stake in Gilead Sciences, Inc. (NASDAQ:GILD - Free Report) in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor bought 6,924 shares of the biopharmaceutical company's stock, valued at approximately $581,000.

Several other institutional investors have also recently added to or reduced their stakes in the business. Zacks Investment Management grew its stake in shares of Gilead Sciences by 9.8% in the third quarter. Zacks Investment Management now owns 369,358 shares of the biopharmaceutical company's stock valued at $30,967,000 after buying an additional 33,099 shares in the last quarter. Zega Financial LLC acquired a new stake in shares of Gilead Sciences in the third quarter valued at about $507,000. Zurich Insurance Group Ltd FI grew its stake in shares of Gilead Sciences by 791.5% in the third quarter. Zurich Insurance Group Ltd FI now owns 273,685 shares of the biopharmaceutical company's stock valued at $22,946,000 after buying an additional 242,985 shares in the last quarter. Goldstream Capital Management Ltd acquired a new stake in shares of Gilead Sciences in the third quarter valued at about $104,000. Finally, iA Global Asset Management Inc. grew its stake in shares of Gilead Sciences by 14.5% in the third quarter. iA Global Asset Management Inc. now owns 175,067 shares of the biopharmaceutical company's stock valued at $14,678,000 after buying an additional 22,228 shares in the last quarter. 83.67% of the stock is currently owned by institutional investors and hedge funds.

Gilead Sciences Trading Down 0.6 %

Shares of GILD stock traded down $0.52 during trading hours on Friday, reaching $91.86. The company had a trading volume of 7,514,582 shares, compared to its average volume of 7,068,425. The firm has a market cap of $114.48 billion, a price-to-earnings ratio of 1,026.44, a P/E/G ratio of 2.38 and a beta of 0.18. Gilead Sciences, Inc. has a 1-year low of $62.07 and a 1-year high of $98.90. The company has a debt-to-equity ratio of 1.24, a current ratio of 1.26 and a quick ratio of 1.10. The company has a 50 day moving average of $89.82 and a 200 day moving average of $79.26.

Gilead Sciences (NASDAQ:GILD - Get Free Report) last released its earnings results on Wednesday, November 6th. The biopharmaceutical company reported $2.02 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.58 by $0.44. The firm had revenue of $7.55 billion during the quarter, compared to analysts' expectations of $7.01 billion. Gilead Sciences had a return on equity of 29.00% and a net margin of 0.45%. The company's revenue was up 7.0% on a year-over-year basis. During the same quarter in the prior year, the company earned $2.29 EPS. On average, equities research analysts anticipate that Gilead Sciences, Inc. will post 4.35 EPS for the current year.

Gilead Sciences Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 30th. Stockholders of record on Friday, December 13th will be issued a $0.77 dividend. This represents a $3.08 annualized dividend and a dividend yield of 3.35%. The ex-dividend date of this dividend is Friday, December 13th. Gilead Sciences's payout ratio is 3,422.22%.

Analysts Set New Price Targets

A number of research analysts recently commented on the company. Robert W. Baird increased their price target on Gilead Sciences from $80.00 to $95.00 and gave the company a "neutral" rating in a report on Thursday, November 7th. Piper Sandler raised their target price on Gilead Sciences from $95.00 to $105.00 and gave the company an "overweight" rating in a research report on Thursday, November 7th. Sanford C. Bernstein initiated coverage on Gilead Sciences in a research report on Thursday, October 17th. They set an "outperform" rating and a $105.00 price target on the stock. Mizuho raised their target price on Gilead Sciences from $90.00 to $100.00 and gave the stock an "outperform" rating in a research report on Thursday, November 21st. Finally, Citigroup began coverage on Gilead Sciences in a report on Thursday, November 14th. They set a "buy" rating and a $125.00 target price on the stock. Twelve analysts have rated the stock with a hold rating, twelve have assigned a buy rating and four have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $96.43.

Get Our Latest Analysis on GILD

Insider Activity

In related news, CFO Andrew D. Dickinson sold 248,645 shares of Gilead Sciences stock in a transaction dated Friday, November 29th. The stock was sold at an average price of $92.76, for a total transaction of $23,064,310.20. Following the completion of the transaction, the chief financial officer now owns 138,919 shares in the company, valued at approximately $12,886,126.44. This trade represents a 64.16 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Merdad Parsey sold 2,000 shares of Gilead Sciences stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $83.83, for a total value of $167,660.00. Following the transaction, the insider now owns 100,189 shares of the company's stock, valued at $8,398,843.87. The trade was a 1.96 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 447,234 shares of company stock worth $41,288,086 in the last quarter. Corporate insiders own 0.16% of the company's stock.

Gilead Sciences Company Profile

(

Free Report)

Gilead Sciences, Inc, a biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally. The company provides Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/ Eviplera, Stribild, Sunlencs, and Atripla products for the treatment of HIV/AIDS; Veklury, an injection for intravenous use, for the treatment of COVID-19; and Epclusa, Harvoni, Vemlidy, and Viread for the treatment of viral hepatitis.

See Also

Before you consider Gilead Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gilead Sciences wasn't on the list.

While Gilead Sciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report