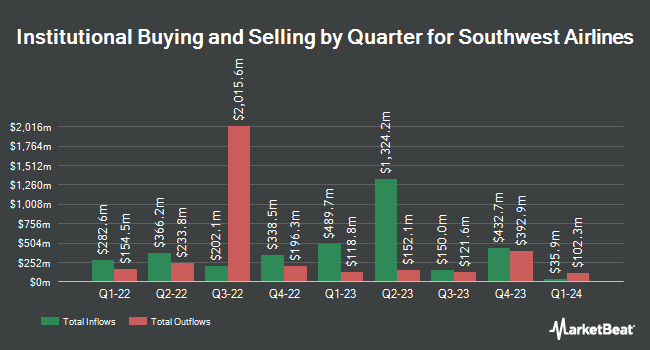

XTX Topco Ltd reduced its stake in Southwest Airlines Co. (NYSE:LUV - Free Report) by 53.9% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 14,379 shares of the airline's stock after selling 16,801 shares during the period. XTX Topco Ltd's holdings in Southwest Airlines were worth $426,000 as of its most recent filing with the Securities and Exchange Commission.

Several other institutional investors and hedge funds have also made changes to their positions in LUV. Blue Trust Inc. boosted its holdings in Southwest Airlines by 13.4% during the second quarter. Blue Trust Inc. now owns 8,246 shares of the airline's stock worth $241,000 after buying an additional 977 shares in the last quarter. Raymond James & Associates boosted its position in shares of Southwest Airlines by 31.6% in the second quarter. Raymond James & Associates now owns 629,872 shares of the airline's stock worth $18,021,000 after buying an additional 151,314 shares during the period. Lecap Asset Management Ltd. purchased a new stake in Southwest Airlines in the 2nd quarter worth about $695,000. Cambridge Investment Research Advisors Inc. grew its stake in Southwest Airlines by 14.1% during the 2nd quarter. Cambridge Investment Research Advisors Inc. now owns 147,863 shares of the airline's stock valued at $4,230,000 after acquiring an additional 18,281 shares in the last quarter. Finally, Migdal Insurance & Financial Holdings Ltd. purchased a new stake in shares of Southwest Airlines in the second quarter worth approximately $95,000. 80.82% of the stock is currently owned by institutional investors.

Southwest Airlines Stock Down 0.6 %

Shares of NYSE:LUV traded down $0.21 during midday trading on Friday, hitting $33.02. The company had a trading volume of 5,863,951 shares, compared to its average volume of 6,572,636. The firm has a fifty day simple moving average of $31.71 and a 200 day simple moving average of $29.24. The company has a quick ratio of 0.83, a current ratio of 0.88 and a debt-to-equity ratio of 0.49. Southwest Airlines Co. has a 12 month low of $23.58 and a 12 month high of $36.12.

Southwest Airlines (NYSE:LUV - Get Free Report) last posted its earnings results on Thursday, October 24th. The airline reported $0.15 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.05 by $0.10. The firm had revenue of $6.87 billion during the quarter, compared to analysts' expectations of $6.77 billion. Southwest Airlines had a positive return on equity of 4.56% and a negative net margin of 0.06%. The company's revenue was up 5.3% on a year-over-year basis. During the same period in the previous year, the firm earned $0.38 earnings per share. As a group, equities research analysts expect that Southwest Airlines Co. will post 0.78 earnings per share for the current year.

Southwest Airlines Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, January 16th. Stockholders of record on Thursday, December 26th will be issued a $0.18 dividend. This represents a $0.72 annualized dividend and a dividend yield of 2.18%. The ex-dividend date of this dividend is Thursday, December 26th. Southwest Airlines's payout ratio is -1,028.57%.

Wall Street Analysts Forecast Growth

A number of research analysts have commented on LUV shares. Evercore ISI upgraded Southwest Airlines from an "in-line" rating to an "outperform" rating and boosted their target price for the company from $30.00 to $35.00 in a research note on Tuesday, September 3rd. Barclays lifted their target price on shares of Southwest Airlines from $32.00 to $35.00 and gave the company an "equal weight" rating in a research note on Friday, December 6th. TD Cowen lifted their price objective on shares of Southwest Airlines from $25.00 to $28.00 and gave the company a "hold" rating in a research note on Friday, December 6th. StockNews.com upgraded Southwest Airlines from a "sell" rating to a "hold" rating in a report on Monday, October 28th. Finally, Citigroup upped their target price on Southwest Airlines from $28.25 to $31.50 and gave the stock a "neutral" rating in a research report on Thursday, October 3rd. Four analysts have rated the stock with a sell rating, twelve have assigned a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $31.37.

Get Our Latest Analysis on LUV

Insider Activity at Southwest Airlines

In related news, Director Rakesh Gangwal bought 643,788 shares of Southwest Airlines stock in a transaction that occurred on Tuesday, October 1st. The stock was acquired at an average price of $29.98 per share, with a total value of $19,300,764.24. Following the acquisition, the director now owns 3,606,311 shares of the company's stock, valued at approximately $108,117,203.78. This represents a 21.73 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, major shareholder Elliott Investment Management sold 1,203,920 shares of the business's stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $29.83, for a total value of $35,912,933.60. Following the sale, the insider now owns 59,912,580 shares of the company's stock, valued at approximately $1,787,192,261.40. This represents a 1.97 % decrease in their position. The disclosure for this sale can be found here. Insiders own 0.33% of the company's stock.

Southwest Airlines Profile

(

Free Report)

Southwest Airlines Co operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets. As of December 31, 2023, the company operated a total fleet of 817 Boeing 737 aircraft; and served 121 destinations in 42 states, the District of Columbia, and the Commonwealth of Puerto Rico, as well as ten near-international countries, including Mexico, Jamaica, the Bahamas, Aruba, the Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands, and Turks and Caicos.

Read More

Before you consider Southwest Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southwest Airlines wasn't on the list.

While Southwest Airlines currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report