XXEC Inc. trimmed its position in Gentex Co. (NASDAQ:GNTX - Free Report) by 7.2% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 159,883 shares of the auto parts company's stock after selling 12,423 shares during the quarter. Gentex accounts for approximately 3.8% of XXEC Inc.'s holdings, making the stock its 12th biggest holding. XXEC Inc. owned about 0.07% of Gentex worth $4,593,000 at the end of the most recent reporting period.

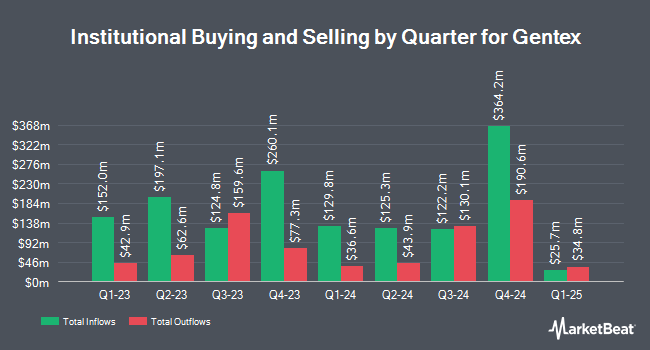

Several other hedge funds also recently made changes to their positions in the company. Midwest Capital Advisors LLC bought a new stake in Gentex in the fourth quarter valued at $26,000. Synergy Asset Management LLC bought a new stake in Gentex in the fourth quarter valued at $34,000. Thurston Springer Miller Herd & Titak Inc. boosted its holdings in Gentex by 32.5% in the fourth quarter. Thurston Springer Miller Herd & Titak Inc. now owns 2,419 shares of the auto parts company's stock valued at $70,000 after acquiring an additional 593 shares in the last quarter. Wilmington Savings Fund Society FSB bought a new stake in Gentex in the third quarter valued at $125,000. Finally, GAMMA Investing LLC boosted its holdings in Gentex by 159.1% in the fourth quarter. GAMMA Investing LLC now owns 5,133 shares of the auto parts company's stock valued at $147,000 after acquiring an additional 3,152 shares in the last quarter. 86.76% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

GNTX has been the topic of several recent analyst reports. UBS Group cut their price target on shares of Gentex from $30.00 to $29.00 and set a "neutral" rating on the stock in a report on Monday, February 3rd. B. Riley reiterated a "buy" rating and issued a $32.50 price target (down previously from $37.00) on shares of Gentex in a report on Monday, February 3rd. Robert W. Baird set a $31.00 price target on shares of Gentex in a report on Monday, February 3rd. JPMorgan Chase & Co. dropped their target price on shares of Gentex from $34.00 to $32.00 and set a "neutral" rating on the stock in a report on Monday, February 3rd. Finally, Guggenheim dropped their target price on shares of Gentex from $35.00 to $34.00 and set a "buy" rating on the stock in a report on Thursday, November 21st. Six investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to MarketBeat.com, Gentex presently has an average rating of "Hold" and an average price target of $32.31.

Read Our Latest Stock Analysis on GNTX

Gentex Stock Up 1.2 %

Shares of GNTX stock traded up $0.31 during mid-day trading on Friday, reaching $25.39. 2,411,297 shares of the company's stock traded hands, compared to its average volume of 1,494,248. The company has a market cap of $5.77 billion, a P/E ratio of 14.43, a P/E/G ratio of 0.84 and a beta of 0.90. The company's 50-day moving average price is $26.25 and its 200-day moving average price is $28.73. Gentex Co. has a 12 month low of $23.63 and a 12 month high of $37.48.

Gentex (NASDAQ:GNTX - Get Free Report) last announced its quarterly earnings results on Friday, January 31st. The auto parts company reported $0.39 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.49 by ($0.10). Gentex had a return on equity of 16.74% and a net margin of 17.49%. During the same quarter in the prior year, the firm posted $0.50 earnings per share. Equities analysts predict that Gentex Co. will post 2.04 earnings per share for the current year.

Gentex Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, April 23rd. Investors of record on Wednesday, April 9th will be paid a $0.12 dividend. This represents a $0.48 dividend on an annualized basis and a yield of 1.89%. The ex-dividend date is Wednesday, April 9th. Gentex's payout ratio is 27.27%.

Gentex Profile

(

Free Report)

Gentex Corporation designs, develops, manufactures, markets, and supplies digital vision, connected car, dimmable glass, and fire protection products in the United States, Germany, Japan, Mexico, Republic of Korea, and internationally. It operates through Automotive Products and Other segments. The company offers automotive products, including interior and exterior electrochromic automatic-dimming rearview mirrors, automotive electronics, and non-automatic-dimming rearview mirrors for automotive passenger cars, light trucks, pick-up trucks, sport utility vehicles, and vans for original equipment manufacturers, automotive suppliers, and various aftermarket and accessory customers.

Read More

Before you consider Gentex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gentex wasn't on the list.

While Gentex currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.