Y Intercept Hong Kong Ltd lifted its stake in shares of On Holding AG (NYSE:ONON - Free Report) by 584.8% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 83,651 shares of the company's stock after purchasing an additional 71,436 shares during the quarter. Y Intercept Hong Kong Ltd's holdings in ON were worth $4,195,000 at the end of the most recent reporting period.

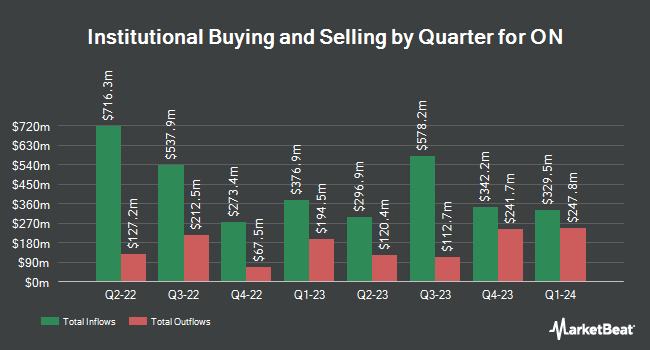

Several other large investors also recently made changes to their positions in the company. MML Investors Services LLC grew its position in ON by 54.9% in the 3rd quarter. MML Investors Services LLC now owns 43,200 shares of the company's stock valued at $2,166,000 after purchasing an additional 15,313 shares during the period. Orion Portfolio Solutions LLC acquired a new position in shares of ON during the third quarter valued at about $1,499,000. Zurich Insurance Group Ltd FI acquired a new position in shares of ON during the third quarter valued at about $10,263,000. National Bank of Canada FI increased its position in shares of ON by 5,339.1% during the third quarter. National Bank of Canada FI now owns 140,601 shares of the company's stock worth $7,051,000 after acquiring an additional 138,016 shares in the last quarter. Finally, EP Wealth Advisors LLC acquired a new stake in shares of ON in the 3rd quarter worth about $258,000. 36.39% of the stock is currently owned by institutional investors and hedge funds.

ON Stock Performance

ON stock traded down $2.62 during mid-day trading on Monday, hitting $55.02. 5,245,053 shares of the company traded hands, compared to its average volume of 4,869,012. The stock has a fifty day moving average price of $52.06 and a 200-day moving average price of $45.83. The stock has a market cap of $34.64 billion, a price-to-earnings ratio of 127.96 and a beta of 2.30. On Holding AG has a one year low of $25.78 and a one year high of $60.12.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on ONON shares. UBS Group lifted their price target on ON from $61.00 to $63.00 and gave the company a "buy" rating in a research note on Wednesday, November 13th. Needham & Company LLC began coverage on ON in a research note on Friday, November 22nd. They set a "buy" rating and a $64.00 target price on the stock. HSBC started coverage on ON in a research note on Thursday, September 5th. They issued a "hold" rating and a $52.00 price objective on the stock. Piper Sandler increased their target price on shares of ON from $52.00 to $56.00 and gave the stock an "overweight" rating in a research report on Thursday, October 3rd. Finally, The Goldman Sachs Group boosted their price target on shares of ON from $50.00 to $57.00 and gave the company a "buy" rating in a research report on Wednesday, November 13th. Four research analysts have rated the stock with a hold rating, eighteen have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $56.05.

View Our Latest Stock Analysis on ON

ON Company Profile

(

Free Report)

On Holding AG engages in the development and distribution of sports products worldwide. The company offers athletic footwear, apparel, and accessories for high-performance running, outdoor, training, all-day activities, and tennis. It offers its products through independent retailers and distributors, online, and stores.

See Also

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.