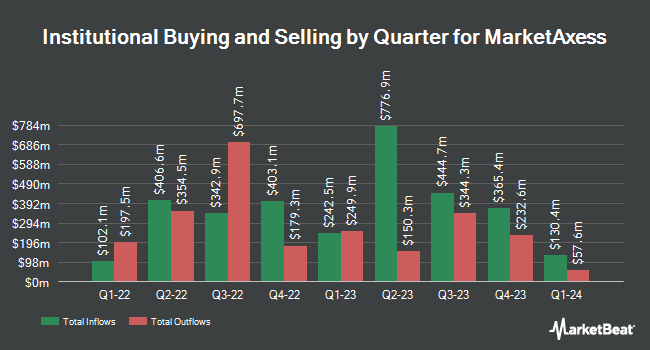

Y Intercept Hong Kong Ltd lifted its stake in shares of MarketAxess Holdings Inc. (NASDAQ:MKTX - Free Report) by 390.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 7,866 shares of the financial services provider's stock after acquiring an additional 6,263 shares during the quarter. Y Intercept Hong Kong Ltd's holdings in MarketAxess were worth $2,015,000 at the end of the most recent reporting period.

Several other large investors have also modified their holdings of MKTX. Czech National Bank boosted its stake in shares of MarketAxess by 8.3% during the 2nd quarter. Czech National Bank now owns 7,221 shares of the financial services provider's stock worth $1,448,000 after acquiring an additional 553 shares in the last quarter. V Square Quantitative Management LLC boosted its stake in shares of MarketAxess by 7.5% during the 2nd quarter. V Square Quantitative Management LLC now owns 1,453 shares of the financial services provider's stock worth $291,000 after acquiring an additional 101 shares in the last quarter. Blue Trust Inc. boosted its stake in shares of MarketAxess by 405.1% during the 2nd quarter. Blue Trust Inc. now owns 197 shares of the financial services provider's stock worth $43,000 after acquiring an additional 158 shares in the last quarter. Rovin Capital UT ADV boosted its position in shares of MarketAxess by 20.4% in the second quarter. Rovin Capital UT ADV now owns 2,748 shares of the financial services provider's stock worth $551,000 after buying an additional 465 shares during the period. Finally, Raymond James & Associates boosted its position in shares of MarketAxess by 0.4% in the second quarter. Raymond James & Associates now owns 202,201 shares of the financial services provider's stock worth $40,547,000 after buying an additional 789 shares during the period. 99.01% of the stock is owned by institutional investors.

Insiders Place Their Bets

In related news, General Counsel Scott Pintoff sold 300 shares of the business's stock in a transaction dated Monday, December 9th. The stock was sold at an average price of $240.57, for a total transaction of $72,171.00. Following the completion of the transaction, the general counsel now owns 8,302 shares of the company's stock, valued at approximately $1,997,212.14. The trade was a 3.49 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Chairman Richard M. Mcvey sold 10,000 shares of the business's stock in a transaction dated Thursday, November 14th. The stock was sold at an average price of $267.67, for a total value of $2,676,700.00. Following the transaction, the chairman now directly owns 562,029 shares of the company's stock, valued at $150,438,302.43. This represents a 1.75 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 30,300 shares of company stock valued at $8,183,871 over the last quarter. Insiders own 2.66% of the company's stock.

MarketAxess Stock Performance

Shares of NASDAQ:MKTX traded down $5.21 during midday trading on Wednesday, hitting $234.86. 566,877 shares of the stock were exchanged, compared to its average volume of 410,615. MarketAxess Holdings Inc. has a 52-week low of $192.42 and a 52-week high of $297.97. The business's fifty day simple moving average is $272.00 and its two-hundred day simple moving average is $241.52. The company has a market capitalization of $8.86 billion, a PE ratio of 31.82, a P/E/G ratio of 10.78 and a beta of 1.00.

MarketAxess (NASDAQ:MKTX - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The financial services provider reported $1.90 earnings per share for the quarter, topping analysts' consensus estimates of $1.85 by $0.05. MarketAxess had a return on equity of 20.93% and a net margin of 34.32%. The company had revenue of $206.70 million during the quarter, compared to analysts' expectations of $207.17 million. During the same quarter in the previous year, the firm earned $1.46 earnings per share. The business's quarterly revenue was up 20.0% compared to the same quarter last year. As a group, equities analysts anticipate that MarketAxess Holdings Inc. will post 7.37 EPS for the current year.

MarketAxess Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, December 4th. Shareholders of record on Wednesday, November 20th were given a $0.74 dividend. The ex-dividend date of this dividend was Wednesday, November 20th. This represents a $2.96 dividend on an annualized basis and a dividend yield of 1.26%. MarketAxess's dividend payout ratio is currently 40.11%.

Wall Street Analysts Forecast Growth

Several analysts have recently commented on MKTX shares. Citigroup raised their target price on MarketAxess from $310.00 to $325.00 and gave the stock a "buy" rating in a research report on Friday, October 4th. Barclays decreased their target price on MarketAxess from $289.00 to $260.00 and set an "equal weight" rating for the company in a research report on Monday. UBS Group raised their target price on MarketAxess from $330.00 to $335.00 and gave the stock a "buy" rating in a research report on Thursday, November 7th. Bank of America decreased their target price on MarketAxess from $193.00 to $185.00 and set an "underperform" rating for the company in a research report on Thursday, October 3rd. Finally, The Goldman Sachs Group raised their target price on MarketAxess from $204.00 to $233.00 and gave the stock a "neutral" rating in a research report on Monday, September 30th. Two equities research analysts have rated the stock with a sell rating, seven have assigned a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and an average price target of $266.70.

Read Our Latest Research Report on MKTX

About MarketAxess

(

Free Report)

MarketAxess Holdings Inc, together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. The company offers trading technology that provides liquidity access in U.S. high-grade bonds, U.S. high-yield bonds, emerging market debt, eurobonds, municipal bonds, U.S.

See Also

Before you consider MarketAxess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarketAxess wasn't on the list.

While MarketAxess currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.